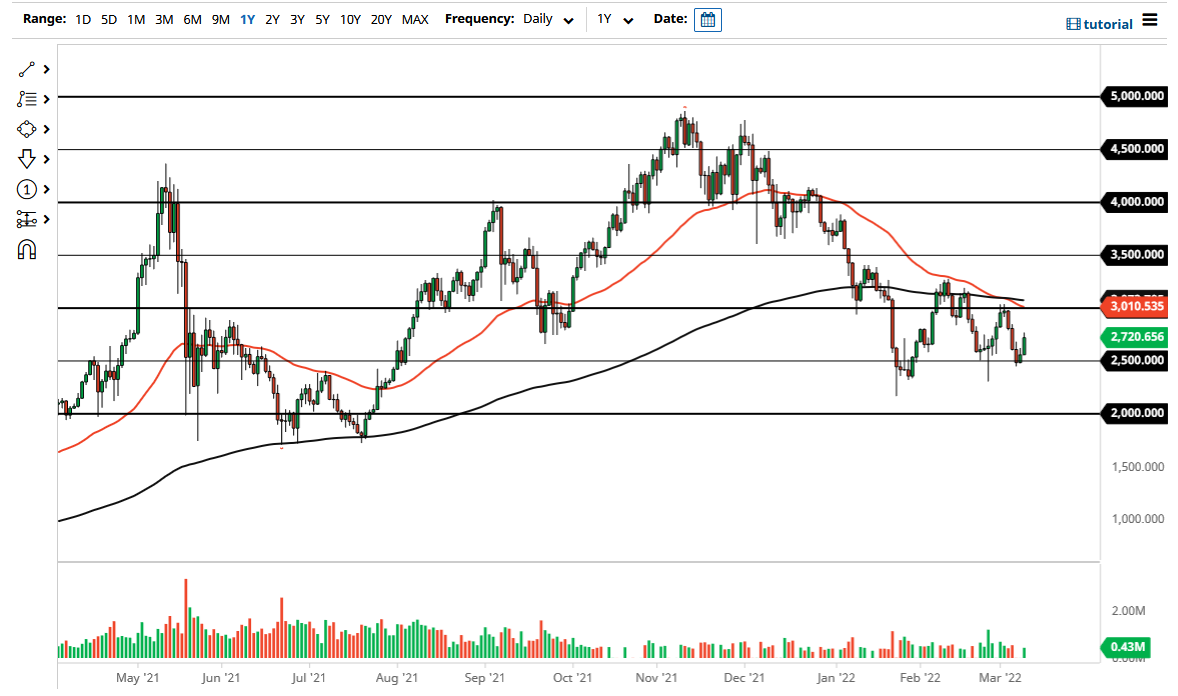

Ethereum rallied a bit on Wednesday, just as we have seen many other risk assets do. The $2500 level looks as if it is trying to offer a little bit of a base, and it is worth noting that we have bounced from there three different times. It does suggest that there are a lot of buyers in that general vicinity, so I would not be surprised at all to see it continue to be difficult to break below.

However, it is worth noting that the highs continue to get lower, and it is potentially making a descending triangle. The Federal Reserve has a meeting next week that will have a massive influence on what happens next with crypto, mainly due to the fact that they are expected to raise interest rates. If they are not as hawkish and the statement as once feared, it is possible that money will go looking into riskier assets such as Ethereum, and therefore drive prices higher. We would need to break above the $3000 level to truly get impressive, but that being said it is still a long way from there.

The support level at the $2500 level extends down to the $2400 level, so a move below there could open up the possibility of a drop to the $2000 level. The $2000 level is a large, round, psychologically significant figure that would attract a lot of attention, and I think there would be a bit of a natural bid in that general vicinity. If we were to break down below that level, then it is possible that the market could really start to sell off and head towards a “crypto winter.”

The market is currently in the process of trying to figure out whether or not we can find our footing, but we are still struggling overall. I think volatility is here to stay, at least for the foreseeable future. I do believe in buying dips, and would certainly be adding if we broke down, but I think you have plenty of time to build up a larger position. To think that crypto is suddenly going to turn around and take off to the upside is a bit of a stretch in the best case, so caution is advised.