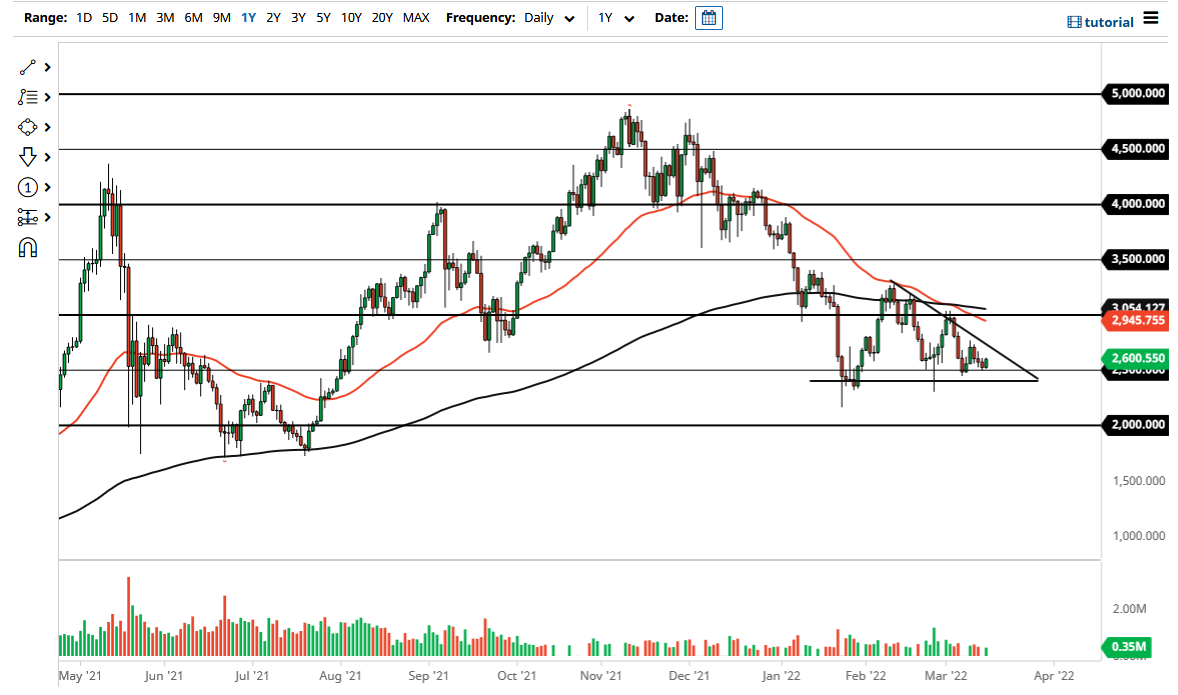

The Ethereum market rallied ever so slightly on Tuesday as we continue to respect the $2500 level. That being said, this is a market that I think will continue to struggle going forward, as we have decidedly gone bearish in not only in Ethereum, but all crypto it seems. The $2500 level is a large, round, psychologically significant figure, and has offered support all the way down to the $2400 level, so keep that in mind.

Ethereum is the second-largest cryptocurrency out there, so if Ethereum continues to fail, so will other coins. Bitcoin has been struggling as well, so nothing looks good in the crypto space at the moment. Ethereum is a project that I believe in the longer term, but right now price action is suggesting that we probably go lower.

It is interesting that we are at the 80% range of the descending triangle currently because we have the Federal Reserve meeting and announcement on Wednesday. While a 25 basis rate hike is anticipated, the real question is going to be how will the statement sound afterward? Will it sound like they are going to be hawkish or dovish? Remember, crypto is a very speculative asset and it needs cheap and easy money to get moving. This will be true after the announcement, so if the Federal Reserve is extraordinarily hawkish, that might be exactly what sends Ethereum lower.

On the upside, if we can break above the $2750 level, we may go looking towards the 50-day EMA which is currently sitting at the $2945 level. The $3000 level after that, of course, will be psychologically important and could cause a little bit of hesitation, but all of that remains to be seen. As things stand right now, this is a market that looks like it would have an easier time going lower than going higher. The momentum is most certainly to the selling side, with what little momentum there actually is. Ethereum breaking down below this region could open up a move towards the $2000 level, where we will more than likely reset and try to figure it out again. As things stand right now, I do not have a lot of hope in the short term for Ethereum going higher.