Ethereum sold off on Thursday to go below the $2700 level. This is a market that is going to be highly sensitive to Bitcoin, which is also suffering at the hands of selling pressure. It is worth noting that the market is going to continue to suffer as monetary policy tightening has driven money away from risk assets such as crypto overall. While Ethereum is considered to be one of the important coins, the reality is that the entire sector is in significant trouble.

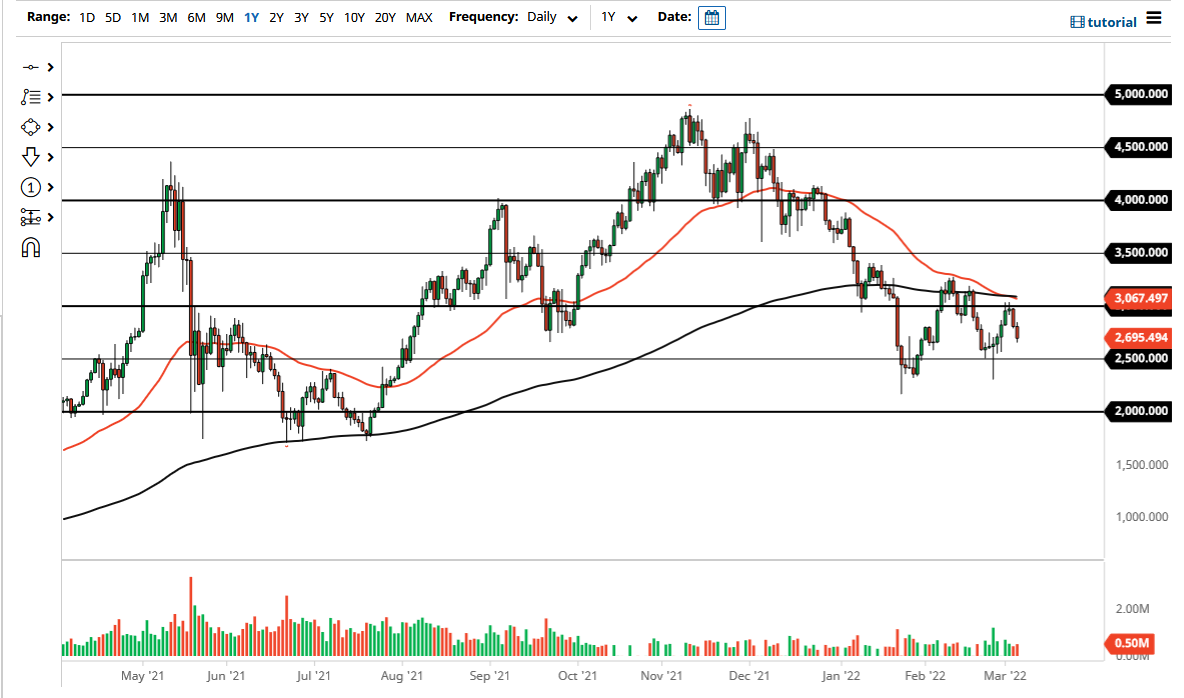

This is not a call for the end of crypto. However, “crypto winter” is a very real possibility at this point. When you look at this chart, you can see that we are forming a little bit of a descending triangle, and if we were to break down through the bottom of the recent consolidation, that could send this market well below $2000. I do not know if that is going to happen yet, but I do know that buying Ethereum right now is a very difficult proposition unless you are willing to hang onto it for years.

The biggest thing affecting this market right now is the Federal Reserve. I know it is ironic to think about that, considering that crypto is supposed to be a way to get away from the typical finance markets. Having said that, as monetary policy tightens, the big institutional money simply does not participate. Beyond that, it seems as if “Ethereum 2.0” is taking forever, and that is not helping the situation either.

I do believe that Ethereum is going to continue to be a very strong ecosystem over the longer term, and I do believe that eventually once they get gas fees down it is going to be one of the better investments. However, it is obvious that we have some time to go before we turn back around so I do not feel any need to start picking up anymore at this point. Longer term, I am a holder, and I will probably buy Ethereum hand over fist if we break down even further. As far as trading is concerned, you need to be thinking along the lines of shorting this market, not going long. On top of that, we are forming the so-called “death cross.”