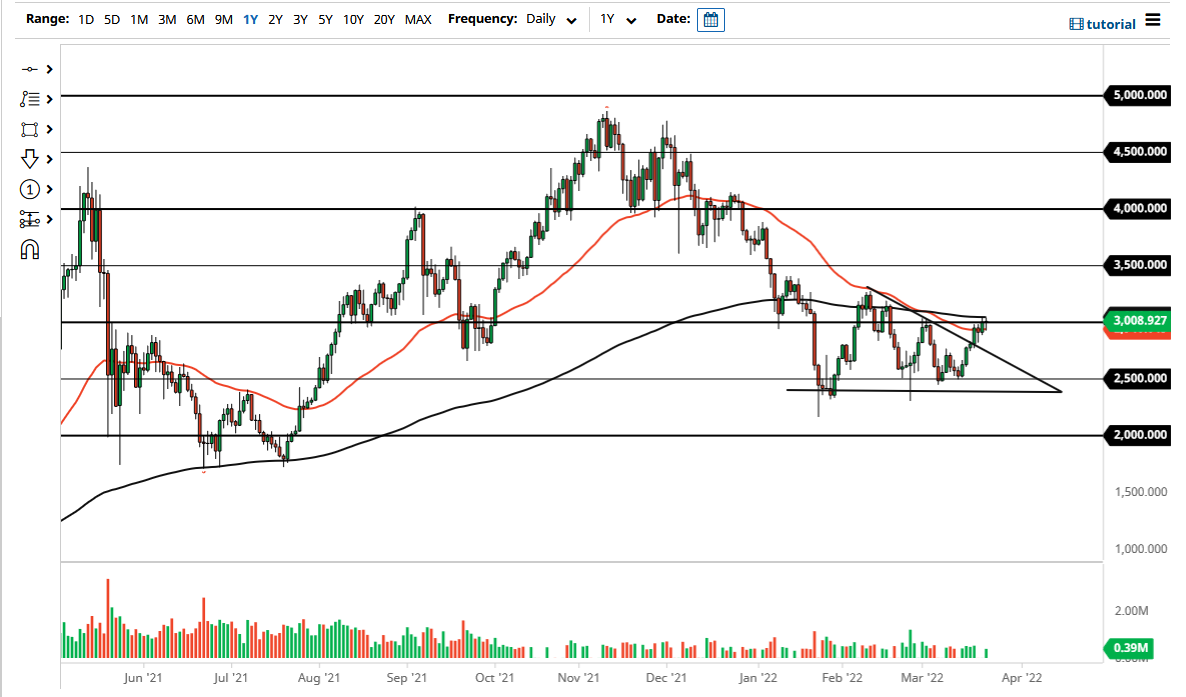

Ethereum went back and forth on Wednesday as we are dancing around the $3000 level. This is a market that continues to be very noisy, and the fact that we are hanging about the 200-day EMA, which of course attracts quite a bit of attention. With that being said, the market is more than likely going to be very noisy.

If we get a daily close above the 200-day EMA, then it is a buying signal and people will more than likely go running back into Ethereum. It is worth noting that the market has been rather bullish as of late, but whether or not we can break out is a completely different question. It is worth noting that this is a market that has been choppy, to say the least, and it is also very likely that it will continue to focus on the recent gains towards “Ethereum 2.0” implementation. That being said, the market is more likely than not going to continue to be short-term bullish, but a breakout is not necessarily a given at this point.

If we do pull back, I would anticipate a bit of support near the $2800 level, which is an area that has seen both support and resistance on short-term charts over the last several months. The market will almost certainly have to take into account whether or not people are willing to go that far out on the risk spectrum, but most Ethereum investors are just that, investors. They are of the longer-term variety, and therefore it would not be a huge surprise to see traders willing to just hang on to this position.

The 30% drop that we have seen recently suggests that we are getting close to a bottom, as these are typical moves in the crypto markets. Ultimately, this is a market that continues to be erratic and volatile, but if you build up your position slowly it can be profitable. I think eventually we do break out to the upside based upon what we have seen as of late, but I do not necessarily think it happens right now. In general, this is a market that I think could be building up momentum in order to make that bigger move, but we may have some work to do still.