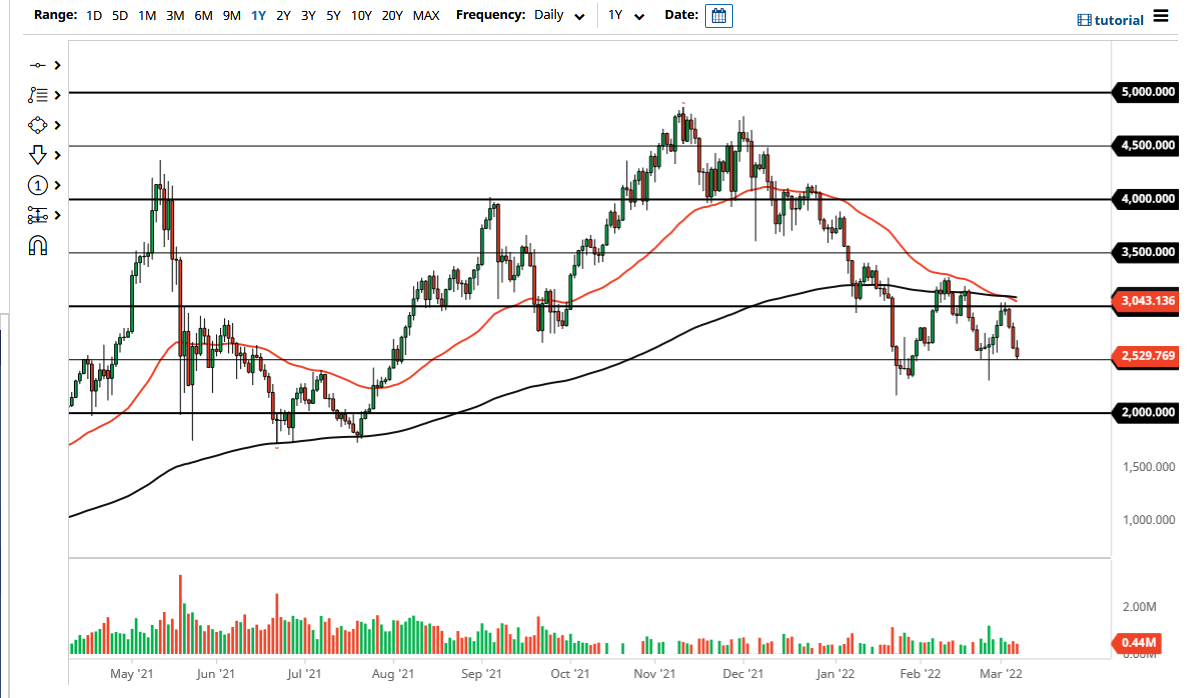

Ethereum initially tried to rally on Monday but gave back gains to crash into the $2500 level. The $2500 level is an area that has been important multiple times, so it does make sense that we could see this area become where we have a big fight. The 50-day EMA breaks down below the 200-day EMA just a few days ago, kicking off the “death cross.”

Regardless, Ethereum looks likely to continue to see a lot of volatility, so I think you need to be very cautious about the overall market in general. After all, the Bitcoin market has been very negative, so it is almost impossible for Ethereum to rally. Rallies at this point in time will continue to be sold into, especially if we get some type of exhaustion.

On the upside, we have the $3000 level that comes into the picture right below those moving averages, so it is likely that we will see a massive amount of resistance that the market simply will not be able to get above without some type of major fundamental shift in attitude and momentum. Because of this, I think that rallies will continue to be sold into, and we have a range that we will continue to bounce around then.

We could be heading into “crypto winter”, which is when crypto markets drop drastically and then do nothing for a while. It is possible that we could see that happen and Ethereum will fall right along with everything else. If we start to get that situation, I will be buying Ethereum hand over fist in little increments in order to build up a bigger position for the next time we rally.

Ethereum is the second biggest market out there when it comes to cryptocurrencies, so it will be one of the first markets to recover when crypto comes back into vogue. With that being the case, if you are a longer-term trader, you may be looking at an opportunity coming. If you are a shorter-term trader, you need to be able to go back and forth, looking at the $2400 level as a bit of a floor, while the 3000 level could be resistance.