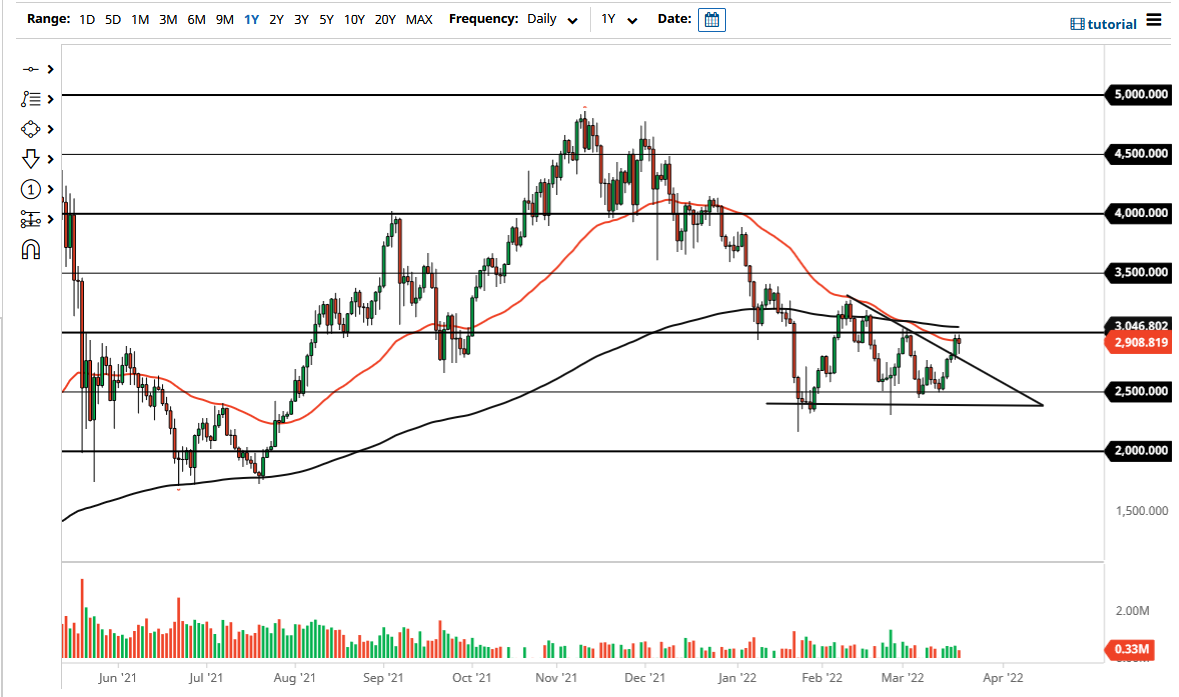

Ethereum pulled back just a bit on Monday to retest the downtrend line that I have drawn from the descending triangle. We are currently hanging around the 50-day EMA, and the fact that we recovered the way we did on Monday does suggest that there is a lot of buying pressure underneath. The $3000 level is an area where you would expect to see a certain amount of psychological resistance anyway, and the fact that we have pulled back from there a couple of times previously does suggest that we are facing an uphill battle at this point.

Ethereum recently got a little bit of momentum due to good headlines coming out about the gains made in the implementation of upgrades, but at the end of the day, we still have a lot of concerns when it comes to risk assets. The 200-day EMA sits just above, and that is something that a lot of people will be paying attention to. It is interesting to see that we have ended up forming a bit of a hammer-shaped candlestick, so it certainly looks as if there are buyers willing to push. If we can break above the 200-day EMA, then I might be convinced of an impending breakout. It certainly looks healthy at the moment, but you can also make an argument for a bit of a failed breakout. A little bit of confirmation will go a long way in an asset that has dropped over 30% from the highs.

If we break down below the bottom of the candlestick for the trading session on Monday, then I think it is very likely we go looking towards the $2500 level. That is an area where we have seen a lot of support, and I do expect that to continue to be the case. Ethereum has a bit of a boost due to the network being upgraded, and it is a bit of an outlier in the crypto markets right now. That being said though, it is still a risk asset and has to be looked at through that prism. Right now, risk assets are not doing that well, so I think it is possible that Ethereum will remain somewhat range-bound. While I do like Ethereum longer term, right now I think we still have a lot of work to do.