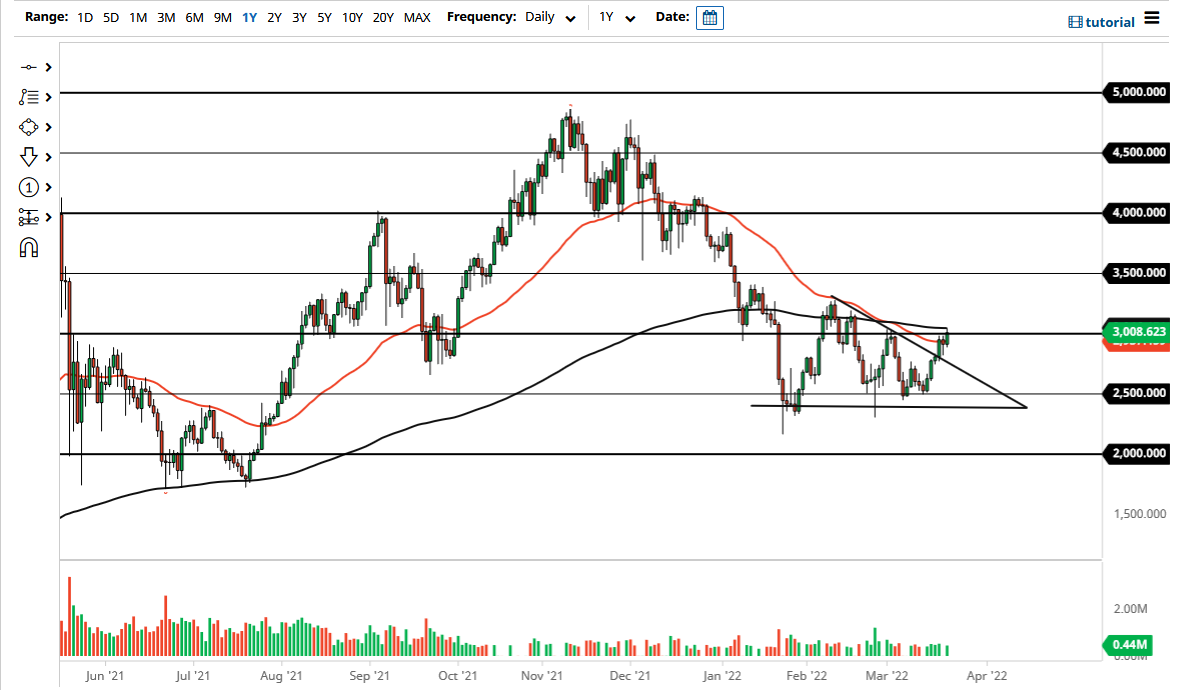

Ethereum rallied again on Tuesday to reach the $3000 level. This is an area that has been important more than once, and has quite a bit of psychology attached to it. The $3000 level will attract a lot of headlines, so it will be interesting to see whether or not traders react to it. Because of this, I think a little bit of caution is probably needed at the moment.

The 50-day EMA sits at the bottom of the candlestick, while the 200-day EMA sits at the top of the candlestick for the session. This sets up for a very interesting situation because if we can break out above the top of the range for the day on Tuesday, that could open up the possibility of a bigger move, perhaps to the $3250 level, and then the $3500 level.

On the downside, if we were to break down below the hammer from the Monday session, that could have a certain amount of negative pressure put on this market, drifting lower at that point. While we did break out of the descending triangle, if we pull back from here could just simply be an extension of the triangle with a different trendline. Furthermore, you can also say that perhaps we are trying to trade in some type of range as we have seen in Bitcoin.

Ethereum is a little bit different in the sense that we have seen some leaps forward when it comes to “Ethereum 2.0”, so that is a little bit of good fundamental news. Regardless, it is still considered to be a risk asset and you need to be cautious about jumping “all in” when it comes to this type of market. The market continues to be very noisy, but it looks as if, at this time, Ethereum is probably going to be the leader in the crypto world. It generally ends up being either Bitcoin or Ethereum, so this is a sign of the times as it were.

It is worth noting that we are still very much in a “risk-off environment”, at least for the short term. Yes, we have had a little bit of a relief rally when it comes to risk assets, but it is still world full of problems. You need to slowly build up a position in Ethereum, not get reckless.