The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

The world is in the grip of a major geopolitical crisis which is producing a few strong trends in the Forex market, so it is an interesting time to be trading the market.

Big Picture 13th March 2022

I wrote in my previous piece last week that the best trade for the week was likely to be short of the EUR/USD currency pair, and long of WTI Crude Oil, Gold, Wheat, and Corn. Unfortunately, about half of these made significant retracements as the week went on, but use of a trailing stop as I recommended should have kept averaged losses relatively small.

The news today is dominated by the Russian invasion of Ukraine which is now in its third week. The invasion, fighting, and resultant political and economic crisis boosted certain commodities, notably crude oil, European natural gas, and wheat, which dramatically increased in value, while the Euro had dropped quite heavily relative to almost all major currencies. However, all these trends saw significant retracements over the week as even this crisis was unable to push these trends any further. The price of Crude Oil came down especially hard after the UAE gave in to American pressure and announced it would seek an increase in output from within OPEC.

Clearly, the Ukrainian defense has been far more effective than the Russian leadership or anyone else anticipated, and that Russian losses may already be exceeding 10,000 dead troops – nearly two thirds the Soviet Union’s total losses in the 10-year war in Afghanistan in the 1980s.

NATO, the European Union, and associated allies have responded by making it clear they will not become involved militarily or send aircraft, reducing the chance of a full-scale wider European war breaking out, but they are sending quite sophisticated weaponry plus a stream of volunteer soldiers, which seems to be helping to slow the Russian advance. The Russian government has just threatened to target NATO weapons shipments, which could potentially lead to a clash with NATO at the Polish/Ukrainian border.

On the economic front, strong sanctions have been placed on Russia and the Russian economy, with more and more companies pulling out of Russia or shutting down operations and sales there, while several Russian banks have been cut off from SWIFT. Russian assets abroad are also being seized and frozen. This is going to cause a great deal of economic pain in a country where a lot of people are already barely getting by paycheck to paycheck. The USA has banned Russian oil imports, but EU and other nations are refusing to do so.

In other news last week, US CPI (inflation) reached a new 40-year annualized high rate of 7.9%, which had been the consensus forecast so the news had little impact. However, the rises in commodity prices seen since the compilation of this data point indicate a further increase next month.

Another news item which may add to risk-off sentiment is the ballistic missile attack from Iranian territory which struck the US Consulate in Kurdistan a few hours ago.

In its monthly policy release, the European Central Bank last week left its interest rate unchanged but took a hawkish step of speeding up the end of its monetary stimulus beyond what had been expected. This had the effect of boosting the Euro off its multi-month lows to which it had been falling hard.

Last week saw the global number of confirmed new coronavirus cases rise slightly for the first week since January. Approximately 63.5% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Australia, Austria, Finland, Greece, South Korea, Liechtenstein, Luxembourg, Malaysia, Netherlands, New Zealand, Switzerland, Tonga, Tunisia, Vanuatu, the UK, and Vietnam.

Fundamental Analysis & Market Sentiment

The dominant market paradigm of the last few years has been one of risk on vs risk off, with stocks, commodities, and riskier currencies rising in one case, and the US Dollar, Japanese Yen, and Swiss Franc broadly rising in the other case. This was upended in recent weeks, when we saw stocks ranging, commodities soaring, and the Euro plummeting while the US Dollar and Japanese Yen were showing some relative strength. As the commodities markets calmed down while stock markets closed the week firmly lower, the S&P 500 saw its lowest close since June, so the risk-off paradigm seemed to be back. However, we are seeing weakness in the Japanese Yen, which should be strong in risk-off sentiment, so there is clearly an unusual market condition based upon US Dollar strength, with the Japanese Yen and British Pound especially weak currencies. The coming week in the markets is very likely to be dominated by the US Dollar in the Forex market and the US stock market, and a continuing high level of volatility. There are several economic data releases due this week, in order of likely importance:

US FOMC Federal Funds Rate, Statement, and Economic Projections

Bank of England Official Bank Rate and Monetary Policy Summary

Canadian CPI (inflation) data

New Zealand GDP

US PPI data

US Retail Sales data

Australian Monetary Policy Meeting Minutes

Australian Unemployment data

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a strongly bullish candlestick last week, as the price finally made a bullish breakout from its medium-term consolidation between the support level at 12174 and former resistance level at 12293. The price closed very near the top of its range, making the highest weekly close since June 2020. These are bullish signs.

Overall, it seems clear we have a bullish picture in the USD over the long and medium terms, with short-term bullish momentum. Therefore, it will likely be a good idea to only take Forex trades long of the US Dollar over the coming week.

S&P 500 Index

The world’s most important stock market index, the S&P 500, closed Friday with its lowest weekly close since June 2021, and is very close to making the first “death cross” / “bear cross” (50 day moving average crosses below the 200-day moving average) seen since the coronavirus shock of March 2020. This is typically a bearish sign and indicates lower prices are somewhat likely to follow, which is of course supported by the risk-off sentiment caused by the Ukraine crisis. It is probably not a good time to be buying stocks or trading this stock index long, and we can expect this moving average cross to happen very soon.

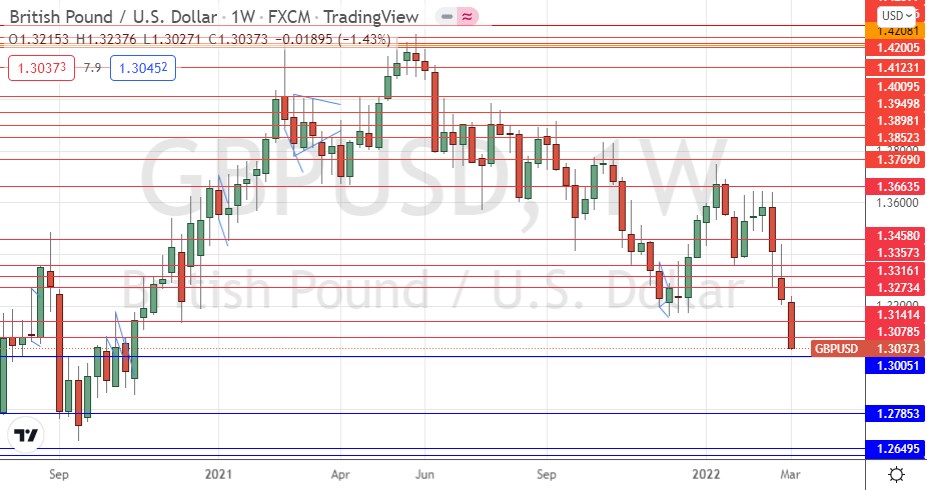

GBP/USD

The Russian invasion of Ukraine has produced a major shock in Europe. The British Pound and Euro have already been in long-term bearish trends but the threat of a war breaking out involving NATO in Europe, though slim, has clearly impacted European currencies except for the Swiss Franc which tends to act as a safe haven. The economic fallout from the sanctioning of Russia has also had a major impact.

Friday’s close in this currency pair was the lowest seen since October 2020, with the price ending the week at a new 16-month low, well into blue sky.

It is very likely that the price of this currency pair will fall again over the coming week, especially if Wednesday’s FOMC release boost the US Dollar, which is breaking to new long-term highs.

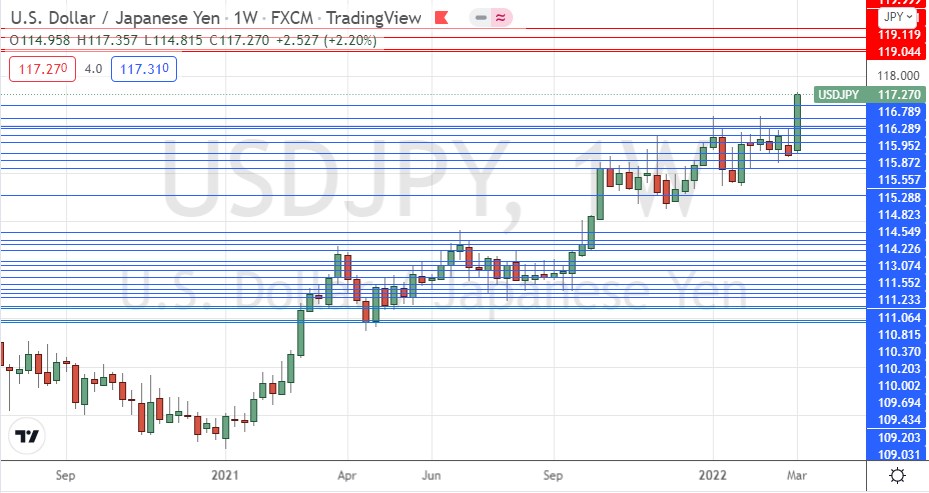

USD/JPY

The USD/JPY made an unusually strong weekly rise last week, closing right on its high at its highest closing price seen in over 5 years. These are very bullish signs, with the US Dollar making a strong bullish breakout and the Japanese Yen showing the greatest weakness of all major currencies putting this pair in focus right now.

I see this currency pair as a buy and as likely to see still higher prices over the coming week as it trades in blue sky.

Corn

Corn was one of the few agricultural commodities to see a further advance over the past week. It made its highest weekly close, in the ETF asset class, since 2015. The price closed right near the high of the weekly range. These are bullish signs.

Ukraine exports almost $5 billion of corn per year, which is a significant share of the global wheat market.

The past two weeks have seen the price of corn increase by more than 20%.

Investors and speculators have been buying corn futures, with the Teucrium Wheat Fund a major beneficiary.

Buying corn can be a risky trade as the volatility can be high, so it wise to size positions based upon recent price volatility.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of Corn and USD/JPY, and short of GBP/USD.