The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

The world is beginning to see a sentiment rebound from a major geopolitical crisis which is producing a few strong trends in the markets, so it is an interesting time to be trading.

Fundamental Analysis & Market Sentiment

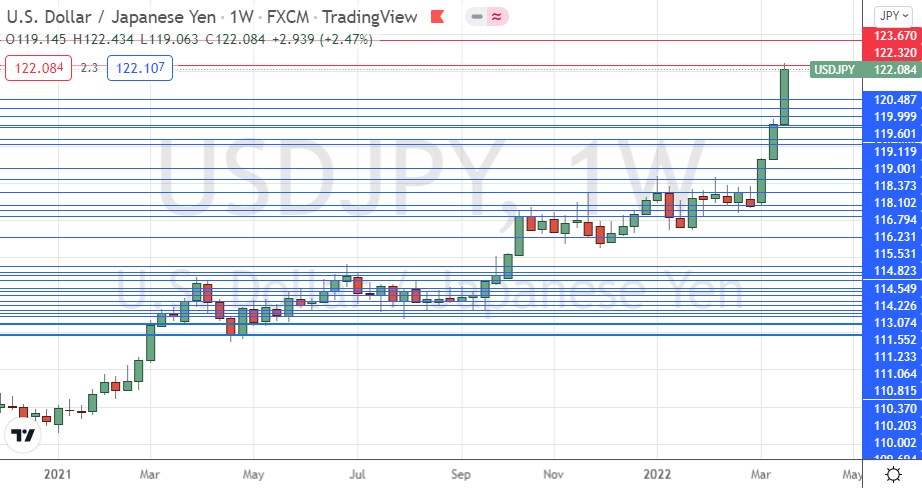

I wrote in my previous piece last week that the best trade for the week was likely to be long of USD/JPY, and possibly long day trades on very strong bullish momentum in the S&P 500 Index. This was a great call as USD/JPY rose by 2.47%, while the S&P 500 Index also rose over the week, by 1.81%.

The news remains dominated by the Russian invasion of Ukraine which is now well into its fifth week. However, it no longer seems to be having much impact on markets, with all the commodities it boosted, most notably crude oil and wheat, trading within more normal price ranges.

US President Biden was in Poland yesterday, where he clearly and openly called for regime change in Russia before his office walked back the comments after a strong Russian reaction. Biden has also been calling for Russia’s removal from the G-20 group of nations.

It seems that Ukrainian forces have fought the Russians close to a standstill, except in the eastern region of the country where the Russians may be able to consolidate their gains. Clearly, the Ukrainian defense has been far more effective than the Russian leadership or anyone else anticipated, and Russian losses may already be exceeding 10,000 dead troops – nearly two thirds the Soviet Union’s total losses in the 10-year war in Afghanistan in the 1980s. Strong sanctions have been placed on Russia and the Russian economy, with many multinational companies pulling out of Russia or shutting down operations and sales there, while several Russian banks have been cut off from SWIFT. Russian assets abroad are also being seized and frozen. This is going to cause a great deal of economic pain in a country where a lot of people are already barely getting by paycheck to paycheck. The USA has banned Russian oil imports, but EU and other nations are refusing to do so.

Despite the worrying conflict in Ukraine, markets have continued their shift towards a risk-on sentiment and pattern over the past week, with stock markets rising, commodities generally strong, currencies mixed, and the Japanese Yen very weak. This can probably be explained by three factors:

Markets have recovered from the initial shock of the Russian invasion of Ukraine, which is now seen as unlikely to spiral into a wider conflict, or even to end in any kind of Russian victory. This view is boosted by the fact that Russia and Ukraine are holding what seem to be more serious peace talks.

The Bank of Japan has reacted to Japan’s relatively low (in G7 terms) inflation rate, which remains below the Bank’s target of 2%, by saying it will continue with a dovish monetary policy until 2% inflation is reached. This makes the Bank of Japan very divergent from almost all other major central banks which are tightening policy and gives a strong tailwind to a continued weakening of the Japanese Yen.

Continued robust jobs and wages growth in the US, which suggests that economic fundamentals are sound apart from rising inflation at a 40-year high and consumer sentiment is at an 11-year low, which surprisingly has not been enough to trigger a further slide in the US stock market. The Federal Reserve is signaling ongoing rate hikes will continue and an increasing pace to the withdrawal of all remaining monetary stimulus.

In other news last week:

British inflation came in higher than expected, at a new 30-year high annualized rate of 6.2%, compared to a rate of 6.0% which had been expected. The British government budget raised the total tax burden to its highest level in more than 70 years.

German Flash Manufacturing & Services PMI data came in somewhat higher than had been expected.

The Swiss National Bank maintained its Policy Rate at -0.75% and stated that parity with the Euro is not important.

Last week saw the global number of confirmed new coronavirus cases fall slightly. Approximately 64.2% of the global population has now received at least one vaccination, and 7% is known to have contracted the virus.

The strongest growths in new confirmed coronavirus cases overall right now are happening in Australia, Cyprus, France, Italy, Laos, Luxembourg, Malta, Monaco, Samoa, Tonga, the UK, and Vanuatu.

The Week Ahead: 28th March – 1st April 2022

The coming week in the markets is likely to be dominated by continuing weakness in the Japanese Yen and general strength in agricultural commodities, precious metals, and the Australian Dollar. Volatility is quite high and is likely to remain so although the coming week may see somewhat smaller price movements.

There a few several economic data releases due this week, in order of probable importance:

US Non-Farm Payrolls, average hourly earnings, and unemployment data

Us Core PCE Price Index data

Canadian GDP data

US JOLTS Job Openings

There will also be a meeting of OPEC.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index rose last week, in line with the long-term bullish trend, printing a small bullish inside candlestick, albeit with a notable upper wick indicating some weakness. Dollar bulls will be encouraged that the nearest support level, shown in blue at 12293 within the below price chart, has continued to hold, giving hope that the greenback will resume its advance more strongly.

It may be wise to look to other currencies as key drivers of the Forex market over the coming week, as we are seeing the most pronounced movements against the Japanese Yen, and in favor of non-USD currencies, especially commodity currencies such as the Australian Dollar.

S&P 500 Index

The world’s most important stock market index, the S&P 500, rose again last week, despite two weeks ago making the first “death cross” / “bear cross” (50 day moving average crosses below the 200-day moving average) seen since the coronavirus shock of March 2020.

The price closed Friday with strong short-term bullish momentum back above the 200-day moving average. These are bullish signs, but I still see the US stock market as an uncertain trade right now due to signs of deteriorating consumer demand and a tightening monetary policy from the Federal Reserve. Long day trades on strong short-term momentum may be the best strategy here over the coming week.

There is an obvious key resistance level at 4596 which bulls should beware of.

USD/JPY

The USD/JPY made a third consecutive unusually strong weekly rise last week, closing near its high at its highest closing price seen in over 6 years. In fact, last week’s move was the strongest seen in several years. These are very bullish signs, with the Japanese Yen showing the greatest weakness of all major currencies putting this pair in focus right now. I made a good call last week seeing this pair as a buy.

Despite all these bullish signs, there is a reason for bulls to be cautious here: the price has hit an inflection point at 122.32 which has so far held as resistance. Friday also saw a strong drop of more than a day’s average true range (ATR) based upon recent volatility, and this can be a sign that a bullish move has run its course, at least for a while. However, the price did recover over the rest of the day to close above 122.00.

I think short JPY remains attractive as a long trade, but traders need to be careful with stop losses and make sure they are kept quite tight, as the price may now need to consolidate for a while before resuming its rise.

USD/ZAR

The ZAR has been a very strong currency over recent weeks, consistently moving higher against the USD which has itself been in a long-term bullish trend. The USD also rose against a basket of currencies last week but fell quite strongly against the ZAR as can be seen in the price chart below.

Last week’s price action saw a close near the low of the week’s range, and it was the lowest weekly close made since September 2021.

There are good reasons to look for a short trade here to exploit the bearish momentum, but bears should watch out for the potentially inflective low point at 14.3518 which might be supportive.

AUD/JPY

Over the past week and during the calendar month of March, the Australian Dollar has been the strongest currency while the Japanese Yen has been the weakest. This currency cross is at the heart of the Forex market now. The Yen is weak as the Bank of Japan wants to bring inflation up to 2%, while the Australian Dollar is strong on improved global risk sentiment and a relatively buoyant commodities sector concerning Australian exports.

Technically, the price has powered to a new 6.5-year high, again making a very strong rise last week – this was the biggest weekly rise in this currency cross seen in many years.

Cotton

Cotton has been in a very reliable bullish trend ever since April 2020 and rose strongly last week on above-average volatility to close right on a multi-year high. Going long of Cotton can therefore be interesting to trend traders now, but allowances should be made for the typically high volatility of this commodity, in common with other agricultural commodities. Small position sizes should be used if this ETF or cotton futures are traded.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be long of USD/JPY, and possibly long day trades on very strong bullish momentum in the S&P 500 Index. There may also be a short trade opportunity on USD/ZAR.