Amidst a state of instability with a bullish tendency, the gold market moved in the last trading session. For three trading sessions in a row, the price of gold moves in a range between the level of 1883 dollars per ounce and the resistance level of 1927 dollars per ounce, and settled around the 1906 dollars per ounce at the time of writing the analysis. In general, the price of gold rose with the escalation of Western sanctions against Russia for the invasion of Ukraine, which increased fears that global economic growth would be damaged.

Gold rose as much as 2.2% at open trading this week, after sanctions were imposed on the Bank of Russia to prevent it from using foreign reserves to ease sanctions. They also excluded some Russian lenders from the SWIFT messaging system that supports transactions worth trillions of dollars. This prompted the Russian Central Bank to raise its key interest rate to its highest level in nearly two decades and imposed some restrictions on capital flows to protect the economy as its currency weakened. Concerns are now growing about whether the financial chaos could damage global economic growth or require action by the Federal Reserve to save dollars.

The bullion market is on track for its best month since May amid charged geopolitical tensions, after outperforming other havens. It will also get support from lower expectations of strong monetary tightening by the Federal Reserve to tame the highest US inflation rate in decades.

Meanwhile, the Russian Central Bank said on Sunday that it would resume its purchases of gold in the domestic market after a two-year hiatus. It already owns more than 2,000 tons of bullion, making it the fifth largest sovereign owner. Commenting on this, Nikki Shiels, Head of Metals Strategy at MKS PAMP SA, wrote in a note: “The purpose of buying gold (in the domestic market) is to liquidate it when needed,” and “Fear of potential central bank sales that could flood the market.”

Bullion is heading for the biggest monthly gain since May as recent developments in Ukraine cast a shadow over the markets. Aside from the role of its assets as a safe haven, gold is also a hedge against inflation, which can be heightened by rising wheat, energy and metal prices.

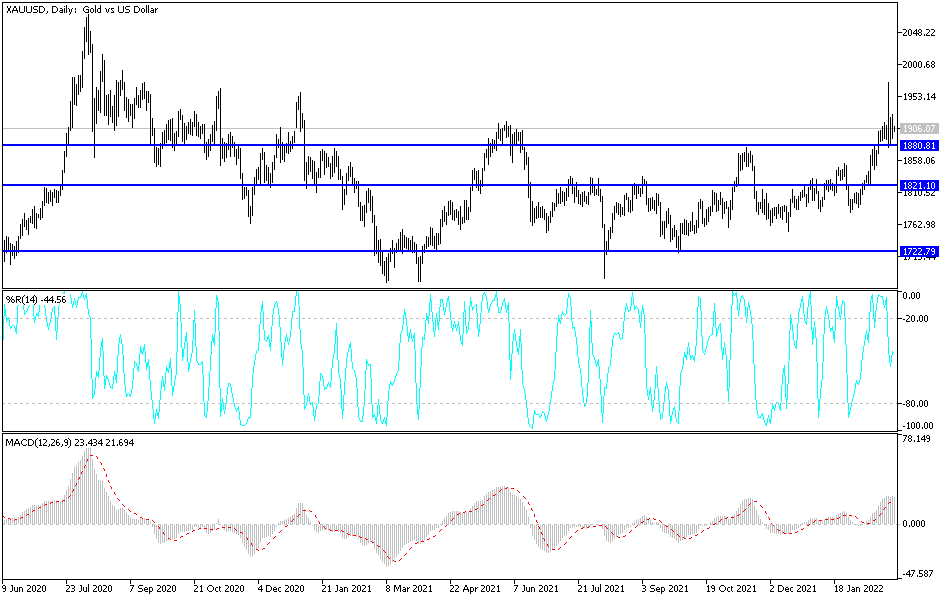

According to gold technical analysis: There is no change in my technical view of the price of gold. The general trend of the gold price is bullish, and the bulls stuck to the psychological resistance of 1900 dollars an ounce. It highlighted the importance of their control over the trend and their readiness to test stronger ascending levels, and the closest ones are currently 1925, 1955 and 1980 dollars, respectively. The last level is important to move towards the next historical peak of 2000 dollars per ounce.

On the downside, the most prominent support levels in the event of profit-taking were the areas of 1895 and 1875 dollars, respectively. I still prefer buying gold from every bearish level as long as the Russian war continues. In the environment of global geopolitical tensions, buying gold is the most important for investors.