Coinciding with the opening of trading this week, the gold market got a bullish price gap that pushed it towards the psychological resistance level of 2002 dollars an ounce. This was near the historical level of the gold price in light of the Corona epidemic crisis. After the announcement of safe corridors and the continuation of talks between Russia and Ukraine, the price of gold fell considering profit-taking sales to the level of 1961 dollars an ounce before settling around the level of 1986 dollars an ounce at the time of writing the analysis. The gold market was sharply bullish as the Russian-Ukrainian crisis entered its thirteenth day. For its part, the White House said that it is proposing a ban on oil imports from Russia in connection with the conflict in Ukraine, which poses the risk of global inflation.

In a letter to lawmakers on Sunday, US House Speaker Nancy Pelosi said the chamber was considering a bill that would ban the import of oil and energy products from Russia amid the intense fighting in Ukraine.

Russian President Vladimir Putin, in a telephone conversation with Turkish President Recep Tayyip Erdogan, said on Sunday that his military operation in Ukraine is progressing according to plan and will not stop without meeting his demands or Kyiv stops the fighting. Russia announced a limited ceasefire and opened several civilian evacuation corridors in Kyiv, Mariupol, Kharkiv and Sumy, Ukraine, to allow civilians to evacuate.

An attempt to evacuate 200,000 people from the Ukrainian city of Mariupol failed on Sunday, as Russian forces violated the ceasefire plan.

On the other hand, affecting the gold market, US employment data for February indicates that two years after COVID-19 shut down the country and lost 22 million jobs, the disease has lost its grip on the US economy. More people are taking jobs or looking for work - a trend that, if it continues, will help alleviate the labor shortage that has baffled employers over the past year.

Recent economic data also shows that the US economy is maintaining its strength with a decline in new infections with the Corona virus. Consumer spending has risen, driven by rising wages and savings. Restaurant traffic has regained pre-pandemic levels, hotel reservations are up, and many more Americans are traveling than at Omicron's peak.

However, the escalating costs of gasoline, wheat, and metals such as aluminum, which both Ukraine and Russia export, are likely to accelerate inflation in the coming months. Rising prices and war concerns may slow employment and growth later this year, although economists expect the consequences to be more dire in Europe than in the United States.

US inflation has already reached its highest level since 1982, with prices rising especially for necessities like food, gasoline, and rent. In response, the Fed is set to raise US interest rates several times this year starting later this month. These increases will eventually mean higher borrowing rates for consumers and businesses, including homes, cars, and credit cards.

For his part, US Federal Reserve Governor Jerome Powell said that he plans to propose that the Fed raise the benchmark short-term interest rate by a quarter of a point when it meets in about two weeks. Powell acknowledged that high inflation has proven to be more stable and has spread more widely than he and many economists had expected. One number in Friday's report may provide reassurance to Fed

policy makers as they assess inflation pressures. Higher wages, while beneficial to workers, often cause companies to raise prices to cover higher labor costs and thus increase inflation.

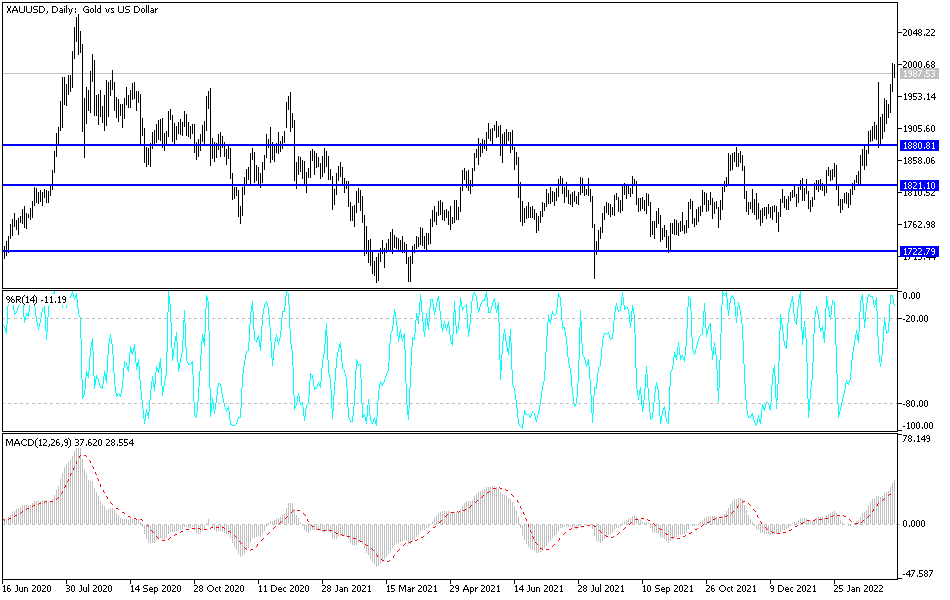

According to the technical analysis of gold: the general upward trend in the price of gold is getting stronger. We have often mentioned the opportunity to move towards the historical psychological resistance of $2000 an ounce, and indeed gold has reached it. These gains are sufficient to push technical indicators towards sharp overbought levels. Today’s gains are not the end of the day if the Russian-European crisis continues. The continuation of Russia’s war and the expansion of the scope and increasing global pressure means the continuation of gold buying and that an event may move the price of gold towards the next resistance levels 2015, 2055 and 2085, respectively.

The opportunity to break the general trend will not happen unless the war stops and ends, and if that happens, we may witness sharp selling to reap profits.