Throughout the last week’s trading, the gold price is on an upward path, because of which it achieved the resistance level of 1966 dollars an ounce. It retreated by the end of the week’s trading to the level of 1943 dollars an ounce and closed the week’s trading stable around the 1957 dollars an ounce. Overall, gold prices are dampening growing expectations that the Federal Reserve will take a hawkish tone at its policy meeting next May and raise US interest rates at higher levels.

The price of the yellow metal recorded a weekly increase of about 1.65%, in addition to its rise since the beginning of the year 2022 to date by about 7%. Silver, the sister commodity to gold, took a breather after its impressive rally last week. Silver futures fell to $25.66 an ounce. Overall, the price of the white metal rose by 2% last week, bringing its rise in 2022 to about 10%.

The biggest challenge for the metals markets now is the future of Fed policy.

Many US central bank officials have made comments in recent days, indicating that it is very likely that the Fed will pull the trigger on a 50 basis point US interest rate hike at the upcoming FOMC policy meeting in May. This month, the Eccles Building raised US interest rates by 25 basis points for the first time since 2018. Given that price inflation is rising and is likely to exceed 8% in the next Consumer Price Index (CPI) report, the Fed may be more aggressive in its tightening cycle.

Meanwhile, the Fed acknowledged that it needs to engage in "soft ground" as it deals with the 40-year-old high inflation.

The gold market is usually sensitive to a price appreciation environment because it increases the opportunity cost of holding bullion that is not yielding.

As for the factors affecting the price of gold. The US Treasury market was positive, with the 10-year bond yield rising to 2.488%. One-year bond yields increased 0.107% to 1.65%, while 30-year yields increased to 2.62%. Metal commodities failed to benefit from the dollar's weakness at the end of last week's trading. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 98.62, from an opening at 98.75. DXY is still on track for a weekly boost of 0.4%, adding its annual increase to 2.75%.

In other metals markets, copper futures fell to $4.7055 a pound. Platinum futures fell to $1011.60 an ounce. Palladium futures fell to $2,438.00 an ounce.

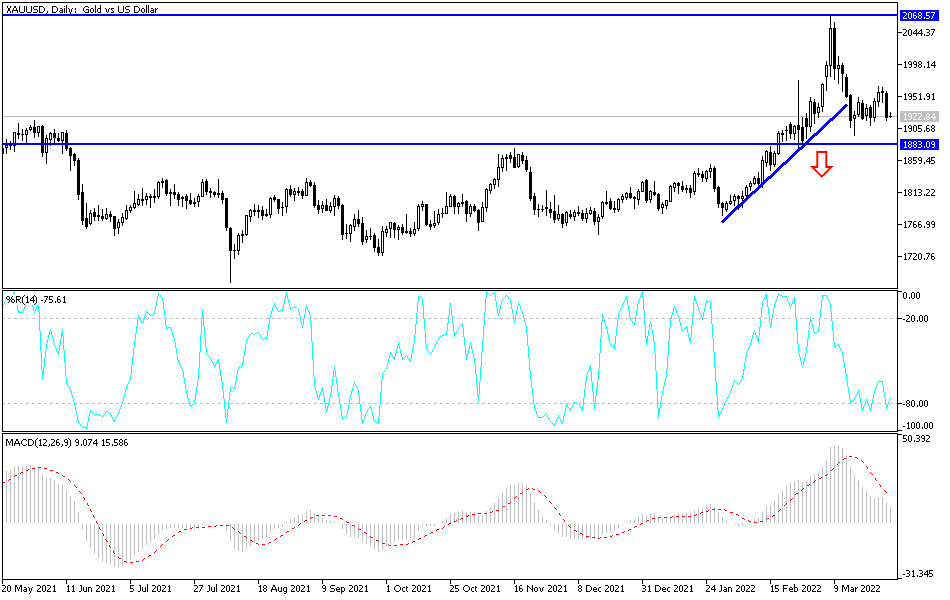

According to gold technical analysis: So far, the general trend of gold is bullish. We often recommend buying gold from every descending level, as global geopolitical tensions and the survival of the epidemic are the most prominent factors for its gains, which may last for longer periods. The closest targets for the bulls are the resistance level of 1975 and the next psychological top of $2000 an ounce. On the other hand, according to the performance on the daily chart, the gold market will not abandon the upward path without breaching the $1880 support for an ounce. Today's gold market will be affected by the price of the US dollar and the extent to which investors take risks or not, as well as the reaction from developments to the Russian-Ukrainian war.