The price of an ounce of gold fell to the level of 1914 dollars before it returned to stability around the resistance of 1930 dollars an ounce at the time of writing the analysis. The Russian-Ukrainian conflict is still supporting the gold bulls. Expectations of further talks between Russia and Ukraine, and expectations of an interest rate hike by the Federal Reserve have also contributed to lower demand for gold.

On the US economic front, payroll processor ADP released a report showing that US private sector employment jumped much more than expected in February. The data added that employment in the US private sector rose by 475,000 jobs in February, compared to economists' estimates, an increase of 388 thousand jobs.

The report also showed a substantial revision of January's data, as revised data showed an increase in US employment by 509 thousand jobs compared to a previously reported loss of 301 thousand jobs.

Meanwhile, Federal Reserve Chairman Jerome Powell told the House Financial Services Committee that the Fed still believed it would be appropriate to raise US interest rates later this month, citing inflation above 2% along with labor market strength. The potential increase in interest rates comes despite Powell's acknowledgment that the conflict between Russia and Ukraine has created uncertainty over the US economic outlook.

Moscow's war on Ukraine and the ferocious financial response it unleashed is leading to an economic catastrophe in Russia of President Vladimir Putin. At the same time, it threatens the repercussions for the global economy, shakes financial markets and makes life more dangerous for everyone around the world. Even before Putin's forces invaded Ukraine, the global economy was reeling under a combination of burdens: rising inflation.

The Ukraine crisis has amplified each threat and complicated potential solutions.

For now at least, the damage to the global economy in general appears to be relatively minor, if only because Russia and Ukraine are not economic powers. Given their importance as sources of energy, precious metals, wheat, and other commodities, together they account for less than 2% of the world's GDP. Most major economies have only limited trade exposure to Russia: for the United States, it accounts for 0.5% of total trade. For China, it's about 2.4%.

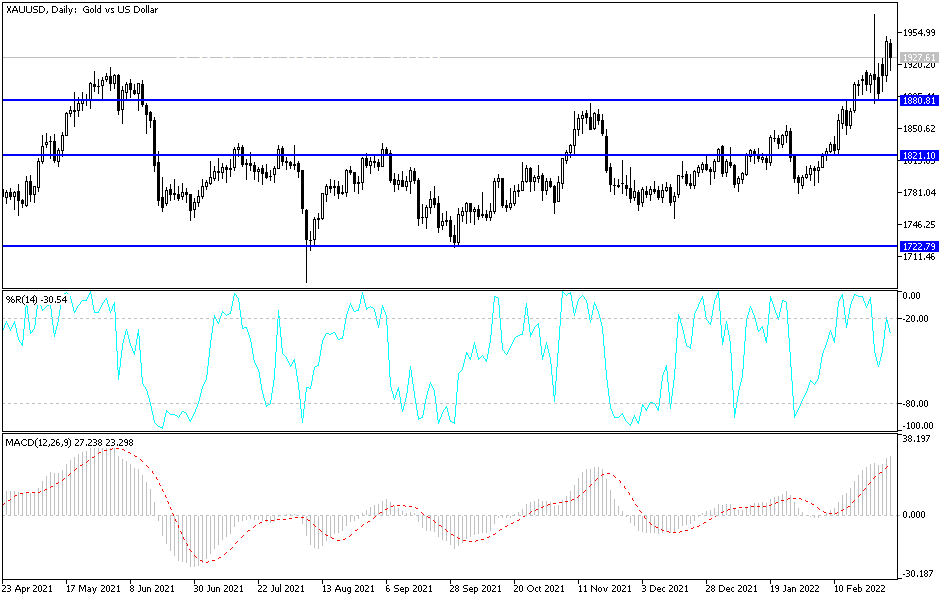

According to gold technical analysis: There is no change in my technical view of the future price of gold, as the general trend will remain bullish, and stability around and above the psychological resistance of 1900 dollars per ounce confirms a stronger control of the bulls on the trend. The continuation of the Russian war and its repercussions on the future of global economic growth will remain strength factors for the gold market. Accordingly it may be a strong opportunity to move towards stronger peaks.

I still prefer buying gold from every bearish level with the continuation of the current global anxiety, and the closest support levels for gold are currently 1910, 1885 and 1860 dollars, respectively. The price of gold will be affected today by the extent to which investors take risks or not, along with the price of the US dollar, in interaction with the announcement of the number of weekly jobless claims and the following testimony of Federal Reserve Governor Jerome Powell