Despite the increasing expectations of the chance of an aggressive hike in US interest rates this year, the gold price is in a sharp bullish range. This is a result of which it moved towards the historical psychological resistance level of 2000 dollars an ounce this morning before the price of gold settled around the 1985 level of dollars an ounce at the time of writing the analysis. The price of the yellow metal rose despite the strength of the US dollar as investors flock to traditional safe-haven assets. Last week, the gold price recorded a weekly gain of 4%, which adds to its rise since the beginning of 2022 to date by more than 7%. The price of silver, the sister commodity to gold, is looking to rise above $26 an ounce. Accordingly, the price of the white metal went on its way to achieving a weekly gain of 5.85%, which raises the increase recorded since the start of the year 2022 to date to more than 10%.

Investors are increasingly concerned as the latest Russian attack on Ukraine has many traders anticipating a protracted military conflict, which could tilt in President Vladimir Putin's favour. A recent development included Moscow's seizure of Ukraine's largest nuclear power facility.

Although positive economic data and higher interest rates would normally hurt gold, investors are supporting buying the yellow metal as they seek shelter in times of crisis. “Gold has been one of the few beneficiaries of the horrific scenes in Ukraine as investors rush into safe havens in a time of crisis,” Robert Rowling, market analyst at Kinesis Money, wrote in a daily note. And “while the Fed will have to deal “cautiously” with the situation in Ukraine, this emphasis on raising interest rates is putting a ceiling on gold, with its lack of yield making it less attractive in a higher interest rate climate.

According to the US Bureau of Labor Statistics (BLS), the US economy created a total of 678,000 new jobs in February, above market expectations of 400,000. The US unemployment rate fell to 3.8% last month, better than the average estimate of 3.9%. According to the figures, the average hourly wage rose 5.1% year-on-year to $31.58. The average weekly working hours increased to 34.7%, while the labor force participation rate increased to 62.3%.

Job creation was broad, although a large part of the gain was in leisure and hospitality, which added 179,000 jobs. The top sectors in terms of employment gains were education and health (112,000), professional and business services (95,000), construction (60 thousand), transportation and warehousing (47,600), and retail (36,900). Utilities and information were the only industries that did not record any gains.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 98.65 A stronger exchange rate is usually bad for dollar-denominated commodities because it makes it more expensive to buy for foreign investors. The US Treasury bond market, turned red across the board, with the 10-year bond yield dropping to 1.703%. One-year yields fell to 0.993%, while 30-year yields fell to 2.135%.

Low yields are considered an upside for gold because they can reduce the opportunity cost of holding non-yielding bullion.

In other metals markets, natural gas futures rose to $4.926 per million British thermal units. Gasoline futures rose to $3.4161 a gallon. Heating oil futures rose to $3.6605 a gallon.

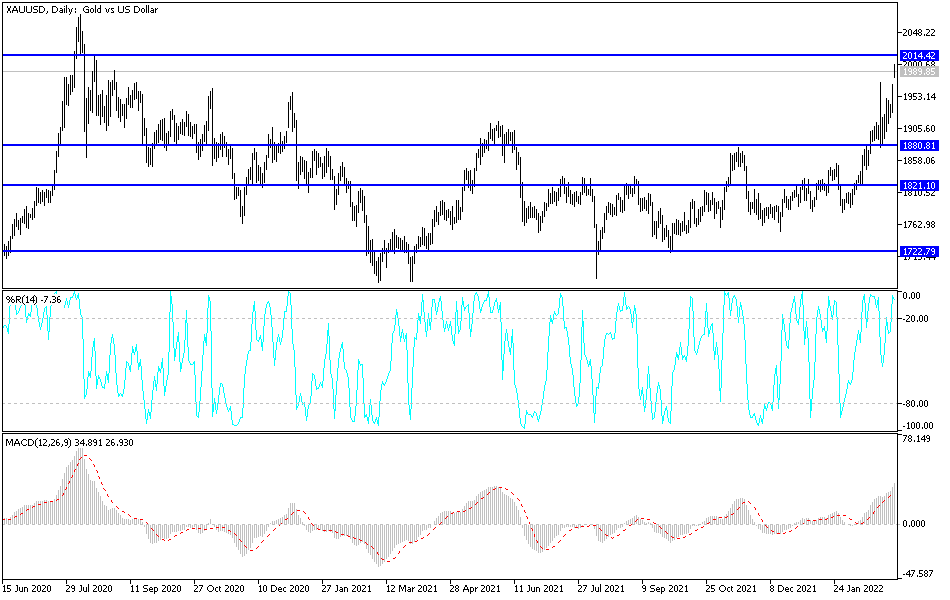

According to the technical analysis of gold: The general upward trend in the price of gold is getting stronger. We mentioned the opportunity to move towards the historical psychological resistance of $2000 an ounce, and indeed gold has reached it today. These gains are sufficient to push the technical indicators towards overbought levels. Today’s gains are not the end if the Russian-European crisis persists. The continuation of Russia’s war and the expansion of the scope and increasing global pressure means the continuation of gold buying and that an event may move the price of gold towards the next resistance levels 2015, 2055 and 2085, respectively.

The opportunity to break the general trend will not happen unless the war stops and ends, and if that happens, we may witness sharp selling to reap profits.