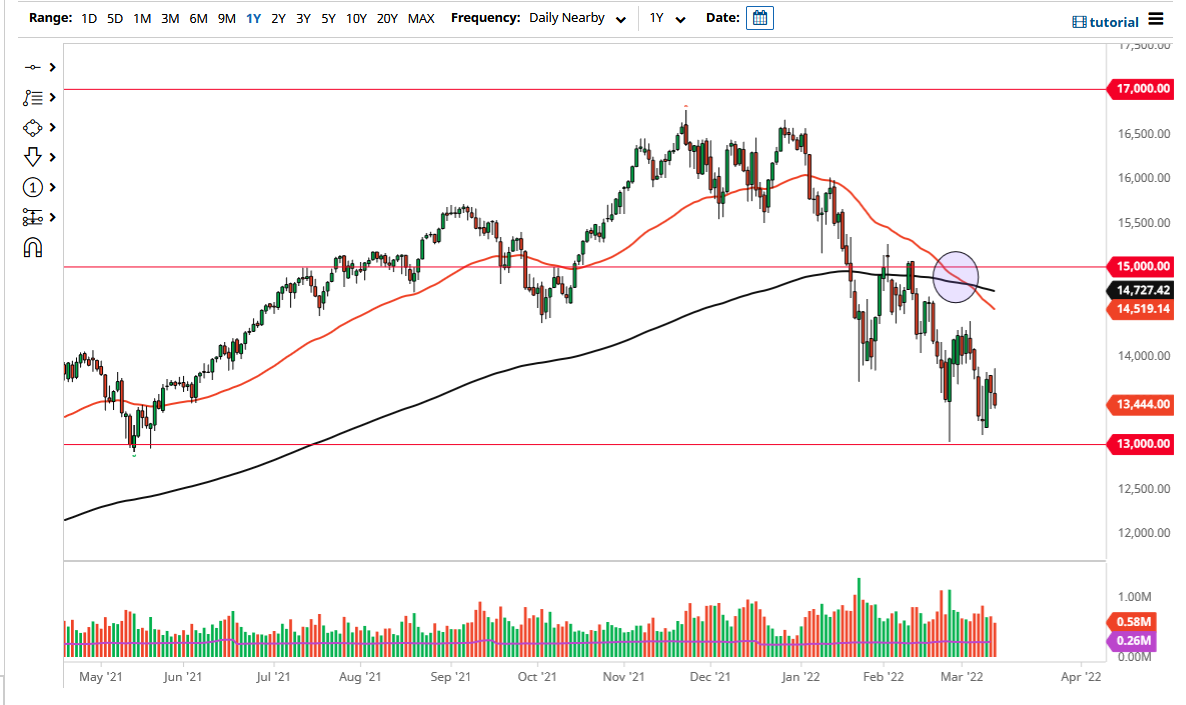

The NASDAQ 100 initially tried to rally on Friday to reach towards the 13,860 level before falling and turning negative for the session. The inverted hammer that is forming for the session suggests that we are going to go looking towards the 13,000 level underneath, which is an area that has been important a couple of times. That being said, I think we are looking at a situation where we will have to retest that area.

If we were to break down below the 13,000 level, then it opens up a trapdoor for much lower pricing. In that attitude, I would expect to see this market go looking towards the 12,500 level, followed by the 12,000 level. Keep in mind that NASDAQ stocks need a high growth environment in order to truly take off, and at this point, I just do not see that happening. We are heading into a recession and tightening monetary policy. In other words, we have a situation where we could head into “stagflation.”

If we break above the top of this candlestick, that could send this market looking towards the 14,300 level, and then perhaps the 50-day EMA after that. This is a market that continues to drift lower, but if we were to get a situation where the Federal Reserve ends up being much more dovish than anticipated in its statement, then it could send the NASDAQ 100 higher, at least for the short term. Nonetheless, this is a market that does tend to be very volatile, so you need to be cautious about your position size, especially as a random headline could move this market quite drastically in one direction or the other. I do think that we will go lower and will have to retest that 13,000 level.

However, if Jerome Powell changes his overall attitude, that could have a massive influence on what happens next. Whether or not we can break above the crucial 15,000 level is a completely different question altogether, and at this point we will have to wait and see. The Federal Reserve is stuck in the sense that it has to fight inflation at the same time, which may make the market go lower simply because there will be no growth, and there will be no cheap and easy money.