The NASDAQ 100 initially fell on Thursday but found enough volatility to go back and forth over the course of the trading session. All things being equal, this is a market that I think continues to be very difficult to handle, as we obviously have a lot of moving pieces out there. Because of this, I think you need to be very cautious with your position size and recognize that the next headline can cause a major freak out in either direction.

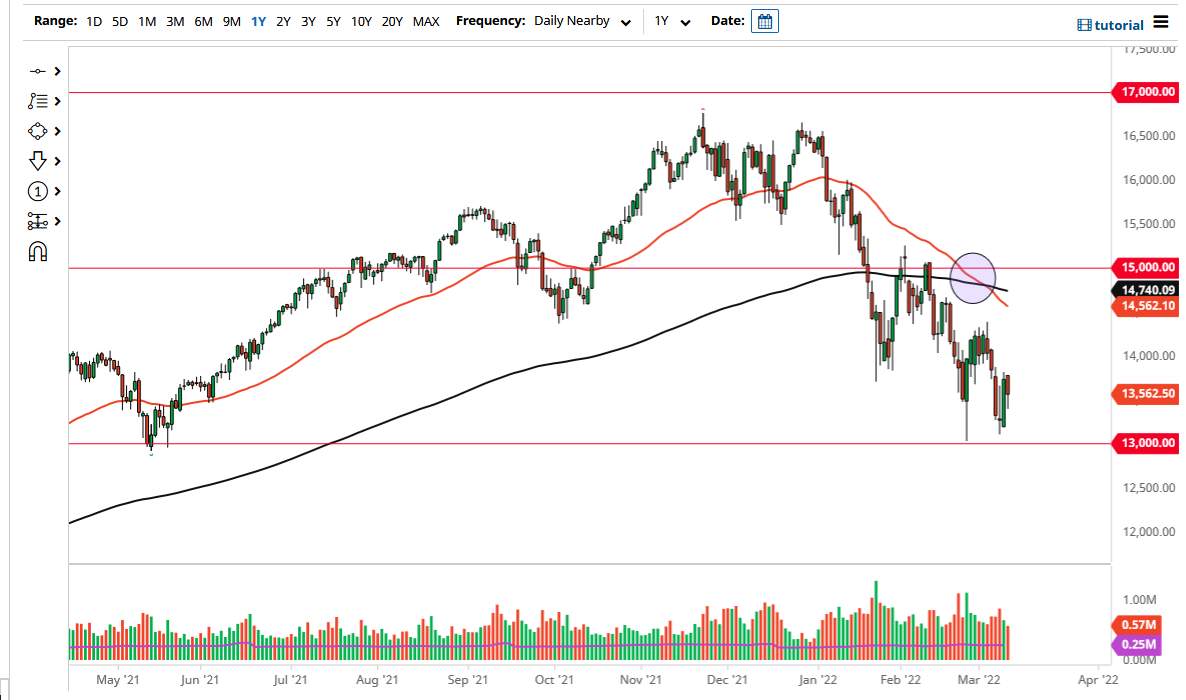

As long as volatility stays this high, it is difficult to imagine this is a market that is going to go higher with ease. Quite frankly, volatility scares off most traders and therefore tends to weigh upon risk appetite. The NASDAQ 100 is all about risk appetite, and as long as that wanes, it is difficult to imagine buying this. I think any rally at this point in time will be looked at with suspicion, and I will be more than willing to short any signs of exhaustion that appear. At this point, it appears that the 13,000 level underneath is the “floor of the market”, so a break down below that level would send this market tumbling.

Whether or not we are done selling off is the question everybody is asking, and I do not think we are there yet. There are still plenty of things out there that could cause issues, not the least of which would be the war in Ukraine. However, energy can cause issues as well, and in an environment where we have the Federal Reserve raising interest rates next week, that is not generally good for the NASDAQ 100.

Speaking of the Federal Reserve, that is the most important thing to watch at the moment as we will have to see whether or not they are going to be aggressive about raising rates, or if they are going to be a little bit more relaxed about it. The statement will be the most important thing to pay attention to, and if they are going to stay on course, Wall Street may express its displeasure by selling off. Keep in mind that the rally for the last 13 years was mainly about liquidity, and if that continues to be taken out of the market, it is obvious that we need to go much lower.