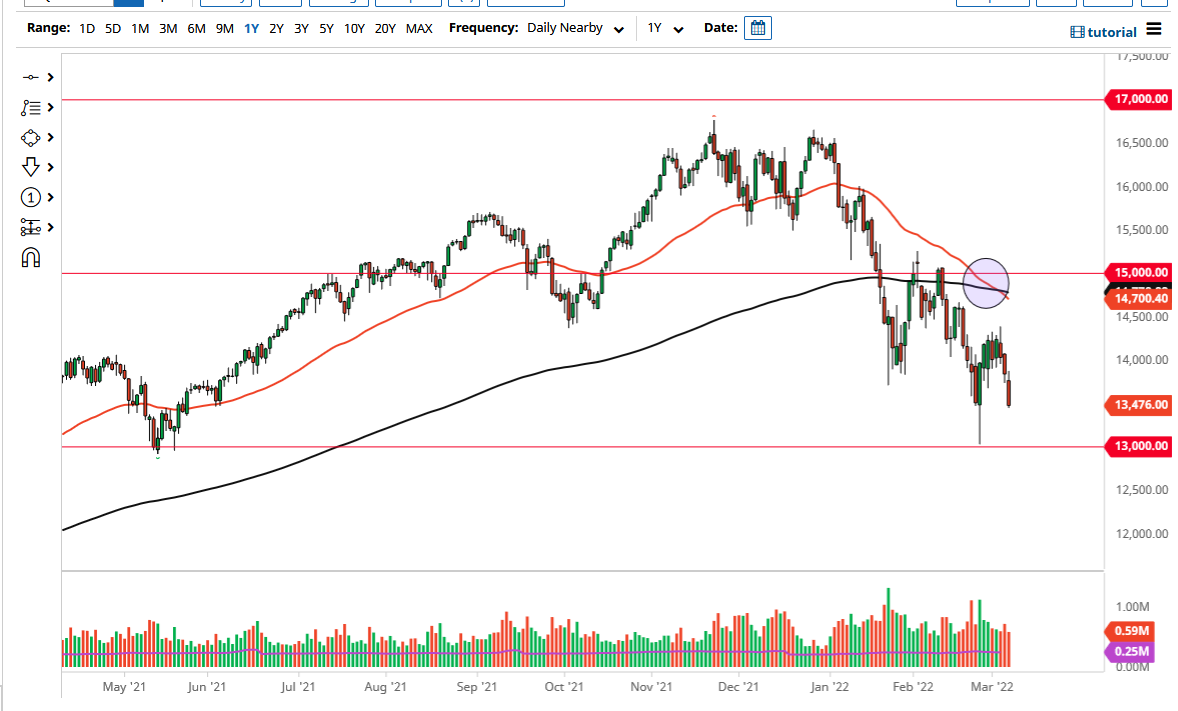

The NASDAQ 100 broke down pretty significantly on Monday, initially gapping lower before filling the gap and then plunging. The NASDAQ 100 has been struggling for some time, so the fact that we broke down on Monday was not necessarily a big surprise. After all, the NASDAQ 100 is an index that is full of high growth stocks, which need liquidity and a high growth environment to get moving.

Growth in the United States is slowing down. The most recent Atlanta Fed GDP estimate for Q2 was 0%. This is a rapid deceleration of growth, and the high-flying stocks of the NASDAQ 100 will not fare very well. Beyond that, we also have to worry about geopolitics, which may or may not directly affect the companies listed in this index, so the reality is that it has a major effect on risk appetite. Furthermore, the Federal Reserve is looking to tighten monetary policy, which will also decelerate the US economy overall.

Rallies at this point in time should be a nice selling opportunity, with the first signs of exhaustion. The 14,000 level above should be a bit of a ceiling, and I think that the market will continue to see a lot of noisy behavior that get sold into on what would be best characterized as “bear market rallies.” Keep in mind that a bear market does get the occasional bounce that is rather brutal, so the best way to trade a bearish market like this is to simply short the market every time it rallies a little bit in order to show exhaustion. Exhaustion is the best way to jump all over it, and therefore drive towards the 13,000 level.

If we were to break down below the 13,000 level, the NASDAQ 100 will more than likely go looking towards the 12,500 level, possibly even the 12,000 level. Ultimately, breaking down below the 13,000 level does suggest that we have much further to go. If you look around the world at all these other indices, they all look horrible, so this is not necessarily something that is related to just this index. I have no interest in buying this market anytime soon, as we are most certainly going to see more destruction going forward.