The S&P 500 has been all over the place during the trading session as the Federal Reserve meeting and announcement has come and gone. An addition of 25 basis points should not be a huge surprise, and quite frankly I think most of the market expected that. Because of this, by the end of the day, we had seen a little bit of a noisy session, but at the clothes, not much had changed. We are still fighting the same battle.

It will be interesting to see this plays out because quite frankly there are a lot of reasons to think that the S&P 500 is going to struggle going forward. After all, we have a lot of concerns when it comes to the tightening monetary policy, as higher interest rates themselves will be an issue, but what will be is the fact that the economy looks like it is slowing down. Tightening into a slowdown is a great way to cause not only a recession but a lot of financial damage.

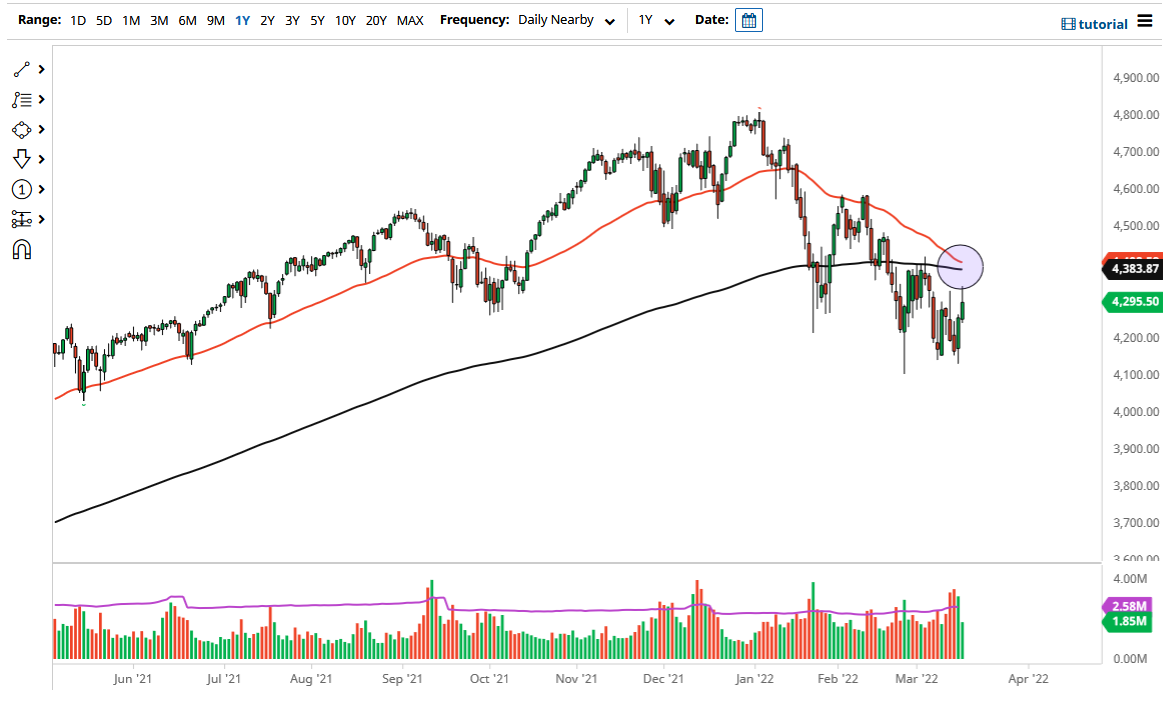

The 200 Day EMA sits just above current pricing, and it is worth noting that the 50 Day EMA is starting to reach towards it in order to form the so-called “death cross.” Because of this, longer-term traders may look at this as a potential selling opportunity, but quite frankly there are so many other things out there to short the market based upon that I do not really care one way or the other if there is any efficacy to that signal.

Comparisons to earnings from last year are going to be horrific, as there is no real way to match them. After all, last year was about reopening the economy, and now we have to start thinking about trying to normalize things. We are a long way from normal, as inflation is out of control, and of course, the global growth picture looks anemic at best. Notice how I have not even mentioned the war in Ukraine, which is going to cause major problems with the food supply in various parts of the planet as well. I still look at this as a “fade the rallies” type of situation, although it should be noted that bear markets do have nasty rallies from time to time.