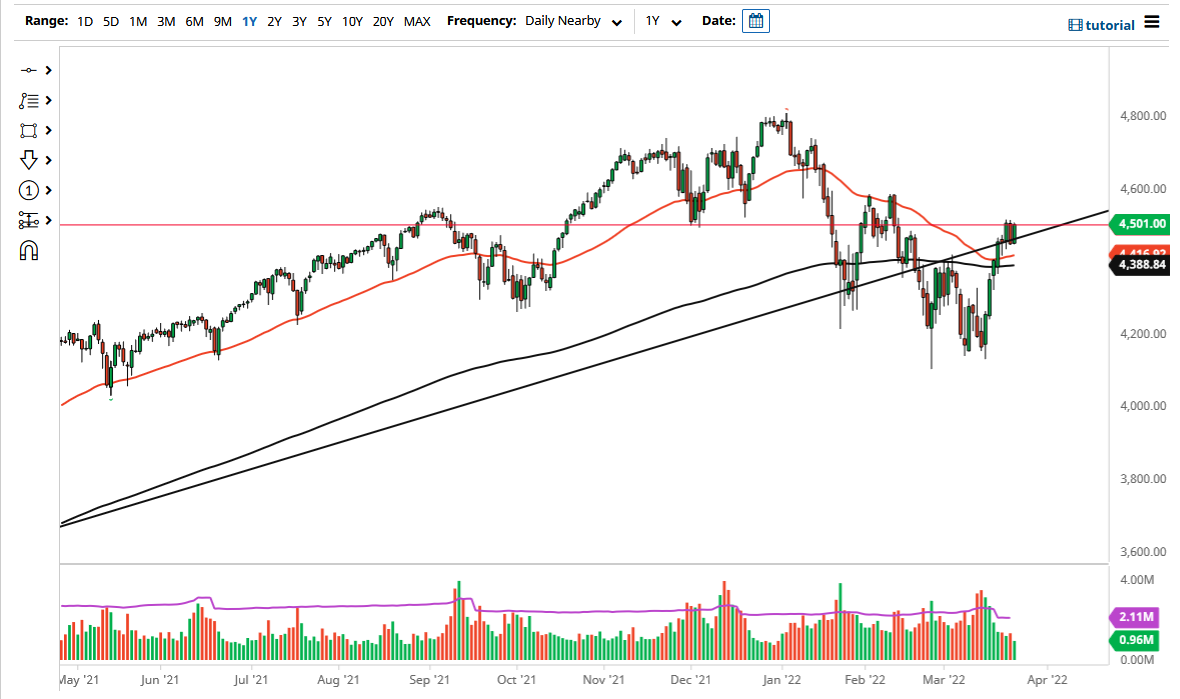

The S&P 500 futures market has reached the 4500 barrier yet again, an area that has been important more than once. That being the case, the market looks as if it is ready to continue going higher, but there is a short-term target that may be a bit of a problem. The market has been rather difficult, but at this point, it looks like we are probably going to go looking at the 4585 level, where we had formed the short-term double top previously. That double top is also backed up by the 50 Day EMA, so it all ties together quite nicely.

Looking at the chart, you can see that we have had three days of back-and-forth action, so if we can break out of this little box, it would show that the market has made up its mind to continue going higher. However, if we were to break down below it, that would be a sign that we just formed a short-term top. In that scenario, I would assume that we go looking towards the 200 Day EMA near the 4388 handle. That is an area that will cause a certain amount of interest and breaking down below there could be a very negative turn of events.

The choppy behavior of the last couple of days will either be the market hesitating or building up enough momentum to continue the big move higher. It is a bit early to make that distinction, but the Thursday candlestick certainly suggests that the buyers are still very much alive, and very likely to continue pressing the issue.

If we finally do break above that 4585 level, it opens up the possibility of a much bigger move, perhaps reaching the recent all-time highs over the longer term. That would be difficult, but possible. Obviously, we need either good news or just a simple lack of volatility to make that move. It is worth paying close attention to the bond markets because if they start to agree with the S&P 500 and stock traders, that the Federal Reserve will not be able to raise interest rates, that will probably give even more fuel to the fire in this market. Markets continue to be noisy but at the end of the day it is obvious that we have seen the buyers quite clearly.