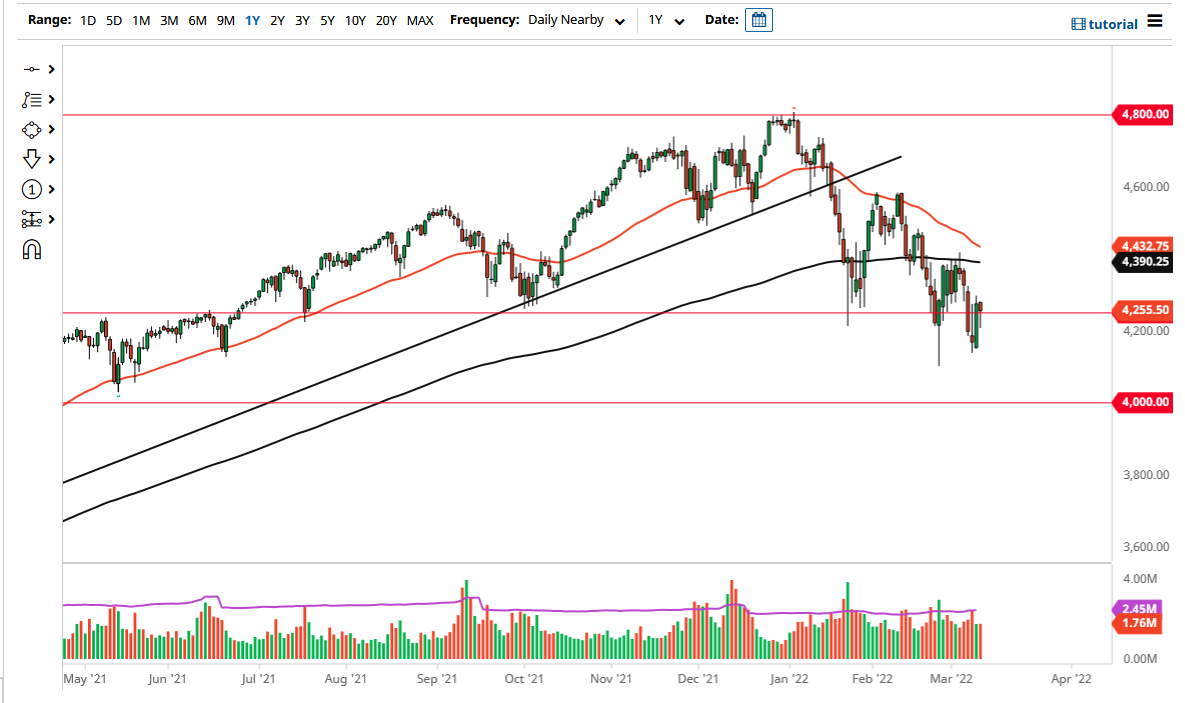

The S&P 500 has initially fallen during the trading session on Thursday to reach down below the 4250 level and reach the 4200 level. The 4200 level has been important a couple of times, so it certainly makes sense that we would bounce from there. That being said, we can break above the highs of the previous session, then the S&P 500 could go looking towards the 200 day EMA near the 4390 handle.

The stock market will continue to be very noisy as we worry about multiple issues at the same time. We have geopolitical concerns when it comes to the war in Ukraine, but we also have other things that are going to be just as damaging. For example, the Federal Reserve has its meeting next week and almost certainly tightly and monetary policy does work against the animal spirits of the stock markets. The question at that point in time will be whether or not the central bank sounds hawkish or if they are open to being a bit more dovish. If it is the latter of the two, then it is likely that will have Wall Street celebrating by purchasing more stocks.

Keep in mind that the last 13 years have been about liquidity more than anything else. After all, we have seen stocks go higher regardless of what happens, and therefore it is an obvious correlation. In fact, one of the few times that we have had a serious crash has always been something to do with the Federal Reserve pulling back liquidity. We are in that area now, but the Federal Reserve has been a little bit better about communicating its intentions. That being said, we also have a lot of concerns when it comes to inflation and economic growth in general. Because of this, I think that the market still is easier to sell than buy, especially as we are getting ready to form a “death cross.”

A breakdown below the 4100 level opens up the possibility down to the 4000 level, which is a large, round, psychologically significant figure that would more than likely attract a lot of attention. In that area, there has been quite a bit of price action in the past, so I would have to reassess my next move at that point in time.