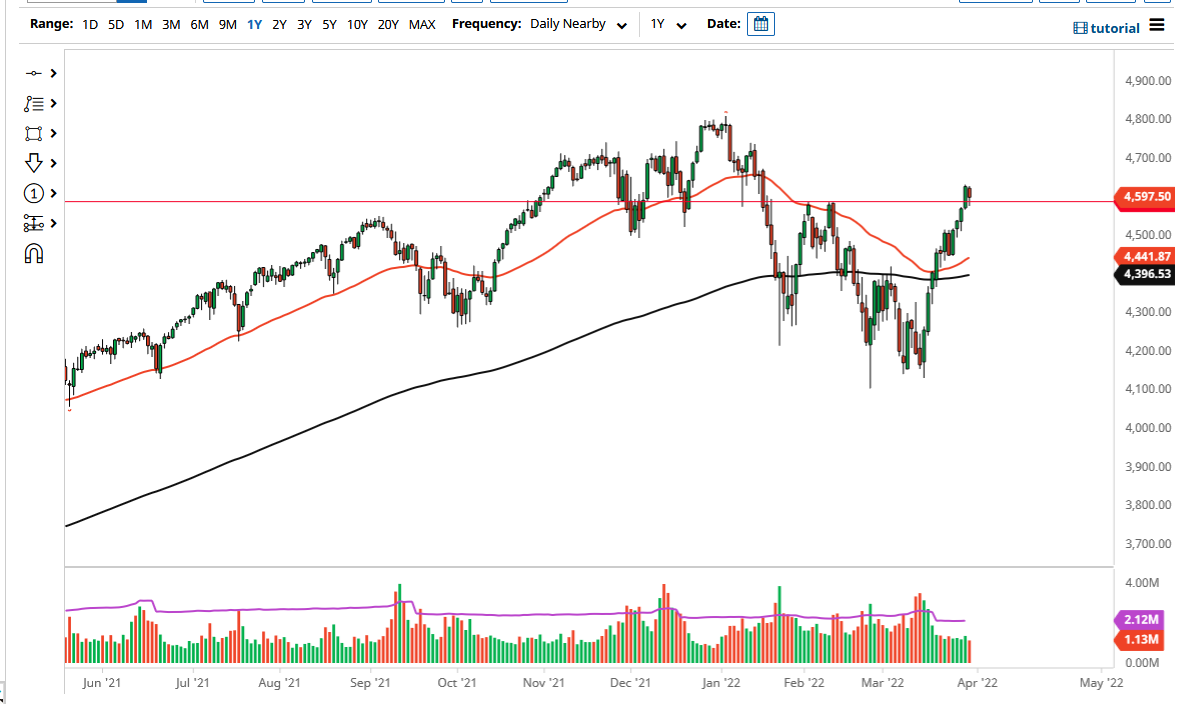

The S&P 500 has pulled back during the trading session on Wednesday to reach the 4600 level before bouncing a bit. At this point, the market looks as if it is trying to hang about and decide where to go next, as the market had gotten so overstretched. The market remains very noisy, but the fact that we found support at a previous resistance barrier is a good sign.

If we were to break back below the 4600 level, then we could go looking towards the 4500 level. The 4500 level is an area that a lot of people will pay close attention to and an area that could kick off a bit of a selling opportunity. That being said, the market is likely to see a lot of noisy trading in this area, especially as we have the jobs number coming out on Friday.

The market has been parabolic for some time, and I do not trust these types of moves. However, I also know that the US indices are not made to be shorted, because the markets are measured via a market cap, and therefore just a handful of stocks can send this index higher, regardless of what is going on underneath. In fact, it is quite common to see the index rally as huge swaths of stocks decline. That was the case before we started selling off quite drastically, and therefore you should watch some of the smaller stocks for a bit of a secondary indicator. Nonetheless, this is a market that certainly looks as if it is trying to find its footing, and a couple of days going sideways could work off a lot of the froth in order to make it a bit more viable of an uptrend.

The overall health of the market is questionable, simply because there are a lot of moving pieces out there that could suggest negativity, but quite often the market simply ignores this. I think we may be in one of the situations again because there is a huge disagreement amongst bond market traders and stock traders as to whether or not the Federal Reserve is going to save everybody again. I think the only thing you can count on is a lot of choppy behavior. If we break down below the 4500 level I will reassess the situation.