The S&P 500 futures initially tried to rally a bit on Monday, breaking above the 4200 level. That being said though, traders have jumped back in to press this market lower, and now it looks as if we are going to threaten a bigger breakdown. Obviously, we have a Federal Reserve meeting during this week that will have a massive influence on where we go next, so we will have to wait to see how the market reacts to that announcement and press conference on Wednesday.

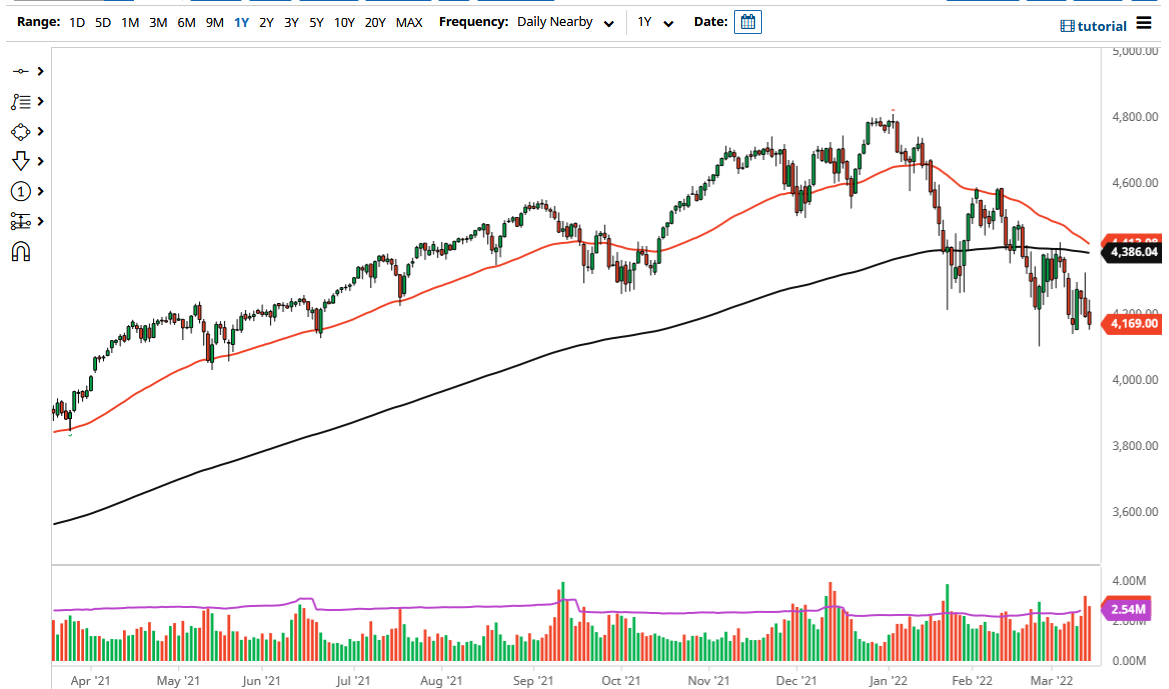

Looking at this chart, we are getting ready to form the so-called “death cross”, which is when the 50-day EMA breaks down below the 200-day EMA. While I am not a big fan of this indicator, because you would have missed the entirety of the last several months to the downside, it is something that causes even more fear in the market. The market continues to see a lot of noisy behavior, but I think that there will be plenty of sellers on short-term rallies. In fact, I do not really have a situation in which I am going to be buying this market between now and the FOMC announcement.

If we do break down below the 4100 level, then it opens up the possibility of the 4000 level being targeted. That is a large, round, psychologically significant figure, and an area that I think a lot of people will be paying attention to. A breakdown below there could open up the floodgates, because not only is it a large, round figure, but it is also an area where we would see a lot of defense of the market due to options. The market will be paying close attention to that 4000 level.

On the upside, I need to get through the Wednesday announcement before I put money to work, but if we were to break above the 200-day EMA, then I think you need to start to change the overall trend. Not only would that be a break of a major moving average, but when you look at this chart, it does not take a lot of imagination to suggest that we are in a falling wedge, which is quite often a very bullish sign when you break out to the upside. At this point, we will see whether or not that happens.