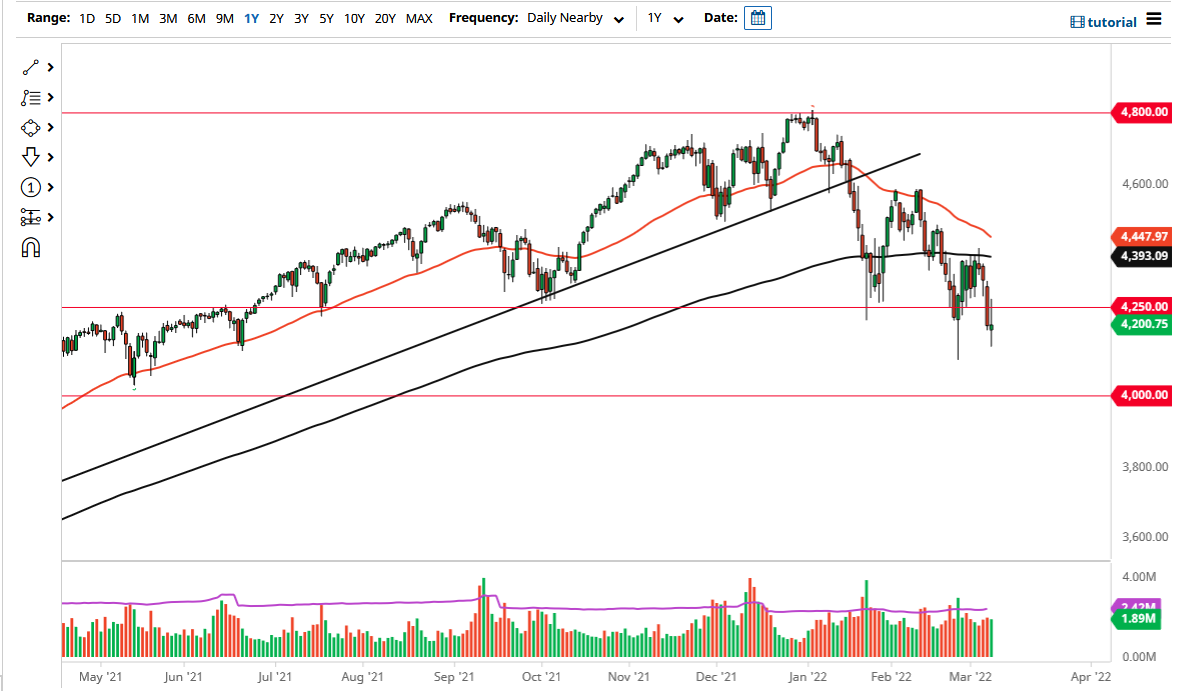

The S&P 500 went back and forth on Tuesday as we hang about the crucial 4200 level. That is an area that has been important a couple of times in the past, so it is not a huge surprise to see that we are trying to hang about in this area.

On the upside, we have the 4250 level as short-term resistance, and a break above there could open up the possibility of a move towards the 200-day EMA which is sitting just below the 4400 level. This is a market that I think continues to see a lot of noisy behavior, but I think that any time we see a massive rally, it is time to start thinking about shorting again. Remember, just because the markets have rallied does not necessarily mean that we are going to see a massive trend change. That being said, one of the big drivers of the market to go higher is that the Ukrainians are now not demanding to be part of NATO.

The idea that Ukraine is okay with not being involved in NATO could in theory calm the Russians down, but I do not see that happening. This is only one of the major issues that the Russians had with Ukraine, so I believe the conflict will continue to be part of the scenario that we are in right now. Furthermore, you need to keep in mind that the Federal Reserve is likely to raise interest rates in the next couple of weeks, and it is likely that we are going to continue to see plenty of reasons why we are selling off. Rallies at this point in time should be a nice selling opportunity at the first signs of exhaustion.

On the downside, I believe the market could very well go looking towards the 4000 handle, which is a large, round, psychologically significant figure and an area that will attract a lot of headlines. In general, I believe that the S&P 500 will continue to see plenty of reasons to drop, but it might be in the midst of a short-term stabilization that could cause a little bit of a bounce. I will be looking at that with suspicion and shorting the first opportunity I get.