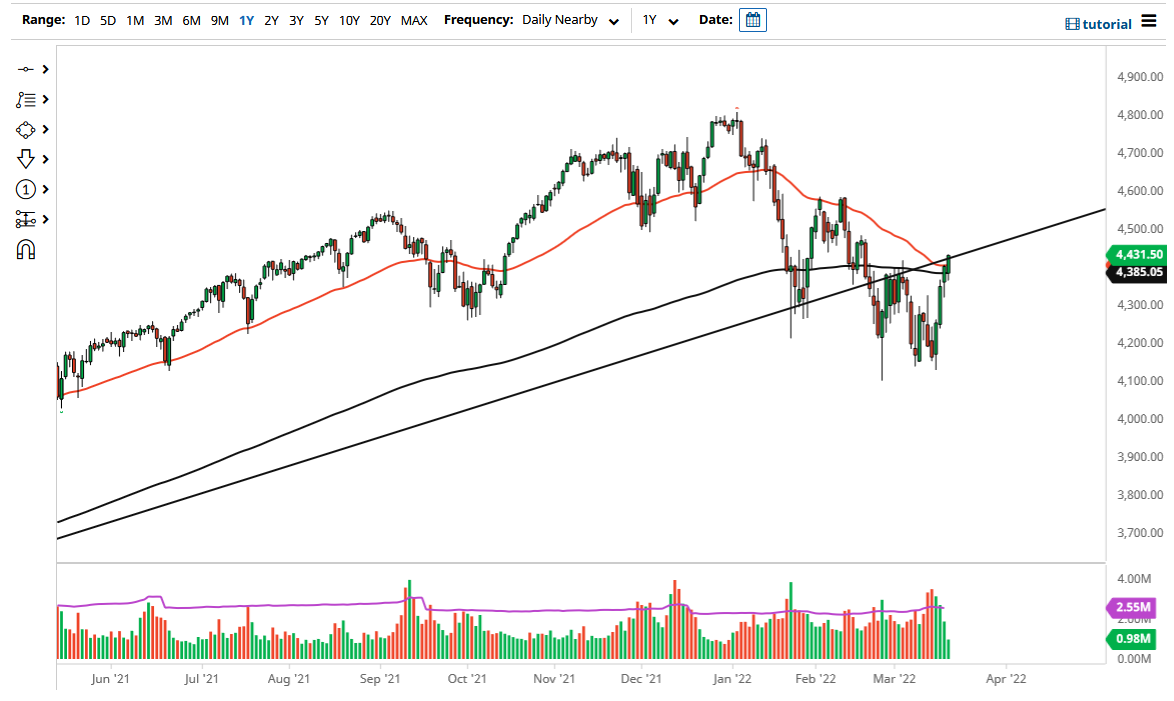

The S&P 500 rallied a bit on Friday to break above both the 50-day EMA and the 200-day EMA. That being said, the market is very likely going to continue to see a lot of noise, so you need to be very cautious. Breaking above the 4400 level was very bullish, and we are now testing a previous downtrend line. This is something worth watching, but at the end of the day, I think this is a market that is starting to ignore fundamentals.

What we are looking at here is a bit of a short-covering rally maybe, or perhaps just the idea that the Federal Reserve has come out with its plan and that people are at least willing to accept the fact that there is a bit of certainty when it comes to the monetary policy and raising interest rates. That being said, the market is likely to see monetary tightening work against corporate profit. Because of this, even though we have had a nice bounce, I still cannot get myself to buy this market until we get above 4500.

Furthermore, good headlines are not easy to come by these days, but it is worth noting that we closed at the very top of the range. It is also worth noting that it was a rather important options expiration Friday, so it is possible that we could see a complete turnaround. At this point, who knows?

I simply decided to pick a resistance barrier, in this case, the 4500 level, in order to get long. Until then, I am very suspicious. If we break down below the lows of the Thursday session, then I am more than willing to start shorting this market as I think it will probably send the S&P 500 back down to the 4200 level.

A little bit of an anecdote: There has been a massive surge in gasoline theft in the United States, where people are even starting to steal gas tanks full of gasoline. At the same time, Wall Street is pricing in a very robust economy. That at least is what the headlines say. The reality is they do not believe that the Federal Reserve is going to turn off the spigot quite as tight as Jerome Powell mentioned. This is the ultimate proof that liquidity trumps the economy in the stock market.