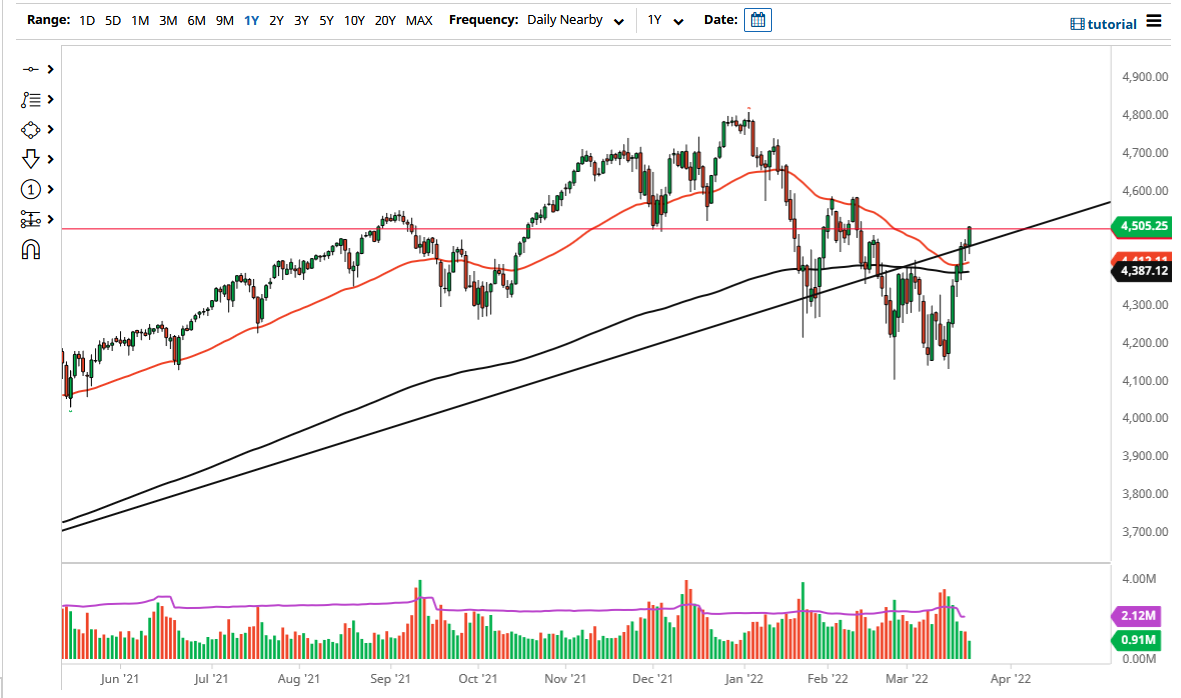

The S&P 500 initially pulled back on Tuesday but found enough buyers to turn around and break out above the 4500 level in the futures market. The market is getting a little overstretched at this point, so I still believe that there could be a bit of a pullback coming. The market certainly looks as if it is trying to change its overall attitude, but we are at a crucial point where, I have to admit, the sellers will disappear if we continue higher.

If we were to break above this level, the 4600 level will be your next target, where we have seen a bit of a short-term “double top.” A break above that then allows the S&P 500 to simply go higher over the longer term.

It seems as if traders are betting on the idea that the Federal Reserve cannot raise interest rates, but at the same time we continue to see a lot of pressure on rates in the bond market. This happens quite a bit, as stock traders and bond traders argue. As a general rule, over the longer term, the bond market wins because it is considered to be the “smart money.” However, until we get to see some type of bounce in the 10-year note, I think the S&P 500 is more likely to find buyers than not.

If we wipe out the candlestick from the Tuesday session, we could go looking towards lower areas, but at this point, we need a reversal of the 10-year note to get a significant selloff. The market has been rather parabolic as of late, so I do think that eventually, momentum becomes an issue. Volume has been a little bit suspect, and that leads to more speculation to the idea that this is a short squeeze.

That being said, if we get a significant close above 4500, I am simply going to hold my nose and buy this contract. It does look like this area is offering quite a bit of resistance though, so the next couple of days should be crucial. At this point, it seems as if we are trading on pure emotion more than anything else. The volatility is making things very difficult for that trading large-size. Because of this, keep your position size reasonable until we get a steady market.