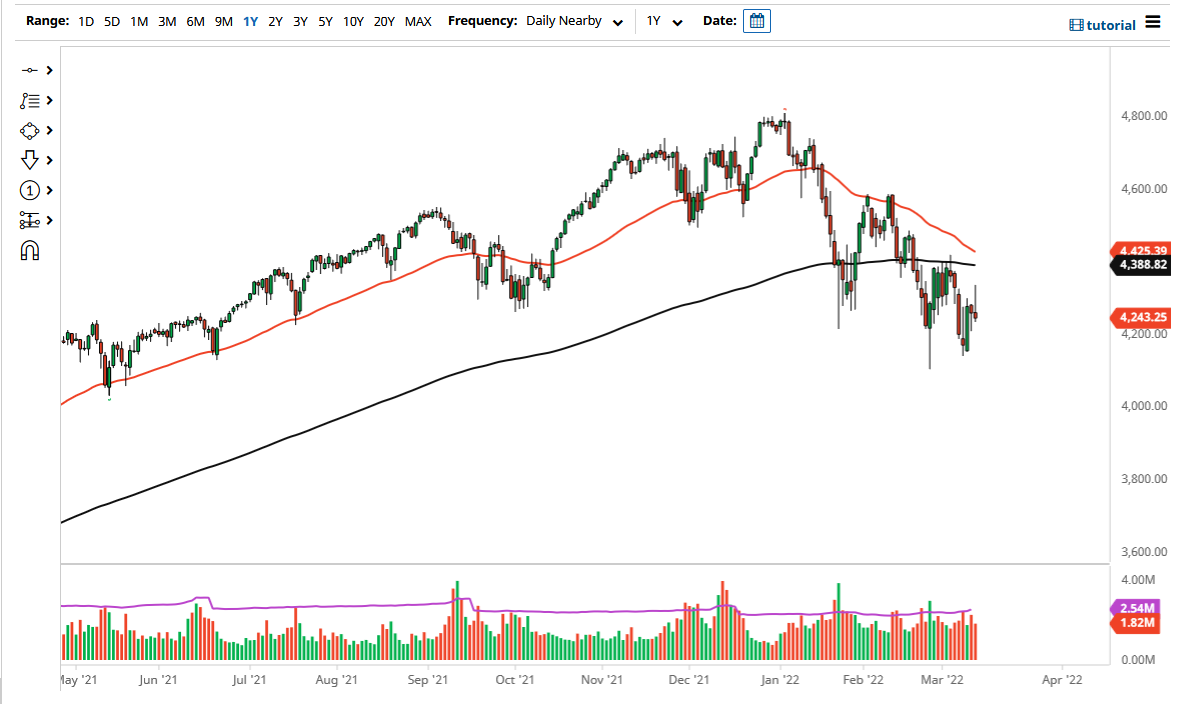

The S&P 500 initially tried to rally on Friday but gave back gains as we continue to struggle in general. That being the case, this looks likely to be a situation where we will see sellers jump in at any time as we try to get a little bit ahead of ourselves. That being said, keep in mind that we have the Federal Reserve meeting next week and that will make a big difference as well.

The market will continue to see a lot of volatility, and I think that is going to be the way forward. The 4200 level underneath will be targeted next, followed by the 4100 level. Breaking down below the 4100 level could open up the possibility of a move towards the 4000 handle.

Looking at the size of the candlestick shows just how much damage there has been done to the market during the day, and I think any time we rally there will more than likely be plenty of negativity coming back into the market. That being said, if the Federal Reserve meeting comes and goes and is much more dovish than anticipated, we could blow out to the upside. Breaking above the top of the candlestick for the Friday session would be a bullish sign, but I think we would have to struggle with the 200-day EMA. Breaking above there would be a bullish sign, but it should be noted that the 50-day EMA is starting to come back into the picture as well.

We are in a downtrend, but it is probably worth noting that the market is forming a bit of a descending wedge, which is sometimes thought of as a potential buying opportunity. The market breaking above the moving averages near the 4400 level could send this market much higher, but it is going to take a lot of momentum to make that happen. I think it is much more likely that we will go looking towards the 4000 level than that move. However, the reaction to the Federal Reserve meeting will determine what happens overall. In the short term, I am simply shorting this market on rallies, just as we had seen during the day on Friday.