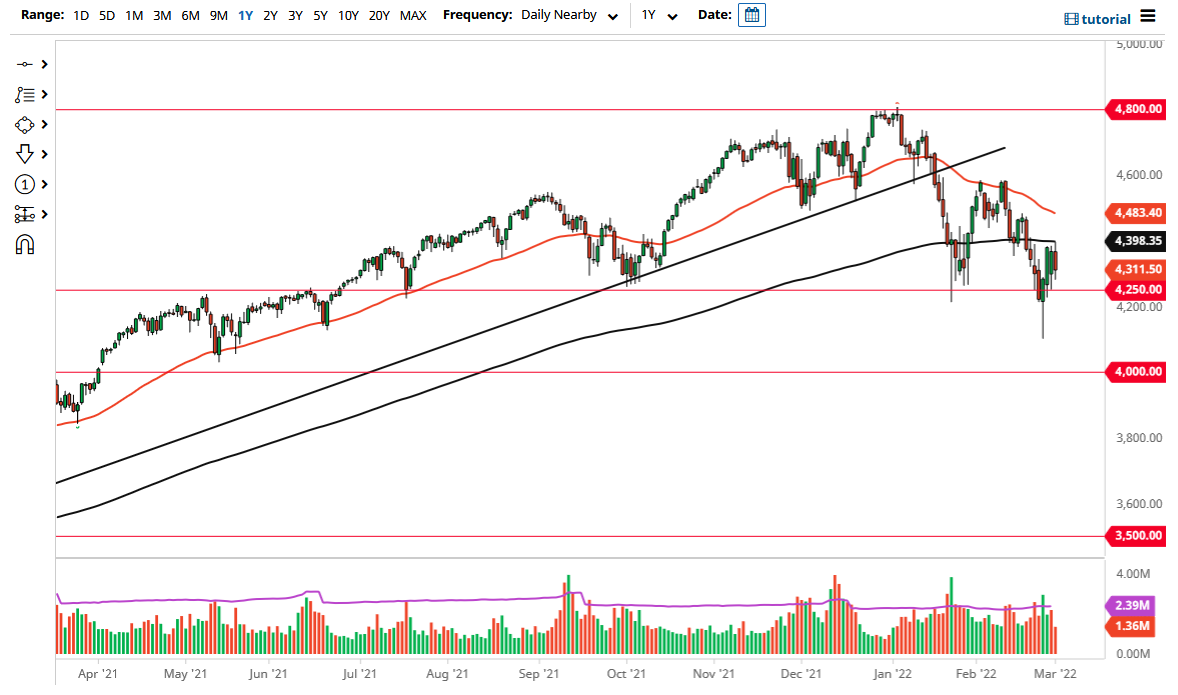

The S&P 500 tried to rally during the day on Tuesday, only to fail at the 200-day EMA which is at the 4400 level. At this point, the market looks as if it is going to continue to sell off on signs of exhaustion, and fear coming out of the Ukraine/Russia conflict. The market is going to continue to see a lot of volatility and choppy behavior between here and the 4250 level. That is an area that is significant support, but I think it more likely than not is an area that will probably be tested again. If we break down below that level, then it is likely that we could go looking towards 4200, and then perhaps down to the 4100 level.

On the upside, we have the 200 day EMA, and if we can break above the 200 day EMA it is likely that we could go looking towards the 50 day EMA that sits just below the 4500 level. That is an area that attracts a certain amount of attention, and I think we would see a lot of sellers coming back in. We are in the midst of the end of the earnings season, and it is likely that we will see a lot of hesitation on rallies.

The downside could have the market looking towards the 4000 handle which is a large, round, psychologically significant figure. The 4000 level being broken to the downside would attract a lot of attention and therefore could have a lot of people scrambling to cover leveraged positions, and it may cause a massive “flush lower.” On the other hand, it could also have the Federal Reserve finally saying something to stabilize markets. While they do not look ready to do it right now, sooner or later they probably will have to. The markets are probably waiting for some type of help from the Federal Reserve, so in the meantime I think is probably only a matter of time before we do in fact drift lower. I look at rallies as selling opportunities and have absolutely no interest in getting long anytime soon. The 50 day EMA is crashing towards recent price action, and therefore I will add even more downward pressure going forward.