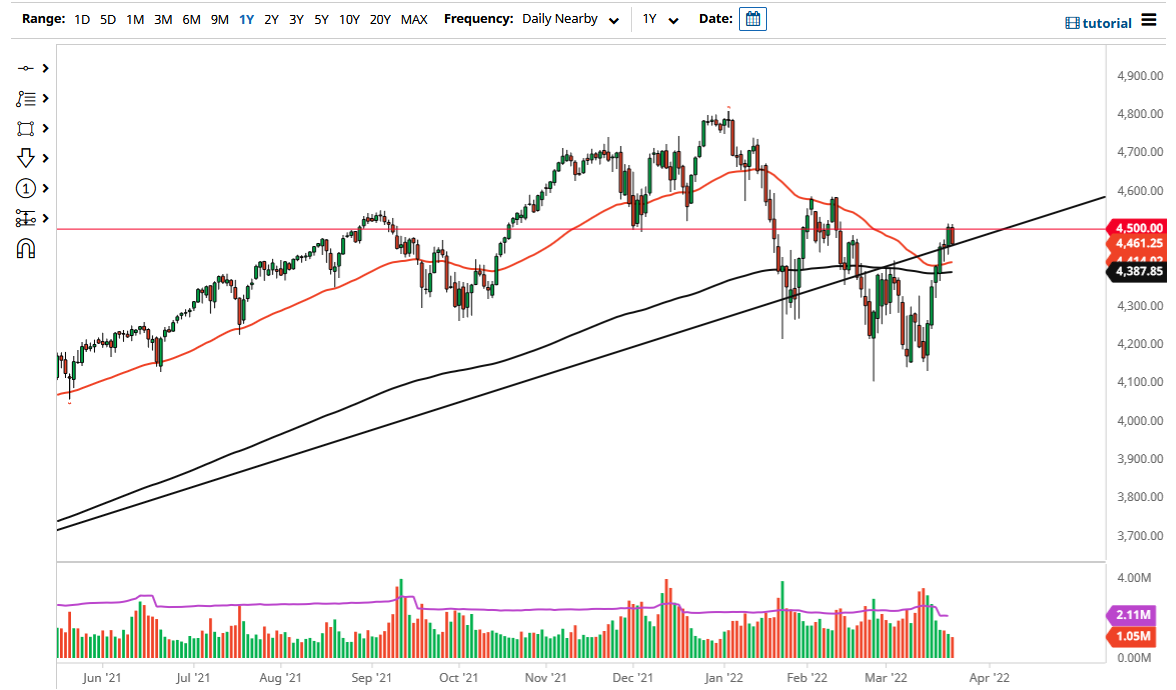

The S&P 500 pulled back a bit on Wednesday as the 4500 level has proven to be a bit too much to get above. With this being the case, I think it is probably only a matter of time before we see a little bit more of a pullback because there is still a whole plethora of issues out there that have gone nowhere. The market has shown itself to be a bit overdone, so the question now is whether or not we can fall from here to continue the overall downtrend?

Looking at this chart, if we were to break above the 4500 level, we will likely go looking towards the double top at the 4585 level. If we break above there, then the market will continue to go towards the 4800 level over the longer term. I believe that this is a situation where you would see a certain amount of hesitation to go higher due to the fact that there are a lot of negative issues going on at the moment. When you look at the last two candlesticks, the bodies of these candlesticks show a complete reversal, so if we were to break down below the bottom of the Tuesday session, it is very likely that we would see the S&P 500 drop.

The market will continue to be very volatile, so it is going to be a situation where you want to keep your position size reasonable because the volatility is something that we will probably see for the rest of the year. It is interesting that the bond market found a bit of a bid, because it has been in a freefall, and it was overdone. At this point, the bond market believes that the Federal Reserve is going to raise interest rates multiple times, while the stock market seems to think that they would not dare. A lot of this is going to come down to inflation and the integrity of the Federal Reserve, so it is very likely that Wall Street will get disappointed. The market will continue to hear a lot of questions asked about its longer-term efficacy, but at this point I think it is obvious that we do not have anything close to clarity as this recent bounce has been brutal, but at the same time the biggest balances are always in bear markets.