The S&P 500 initially pulled back just a bit on Wednesday but then turned around to show signs of life again as it shot straight up in the air. Keep in mind that Jerome Powell was speaking in front of Congress during the session, so as he suggested that the 50 basis point hike was off the table in March, people became much more bullish.

Furthermore, it is worth noting that there have been mentions that the Russians and the Ukrainians may be ready to talk about a cease-fire, so obviously, that would lift one of the burdens on the market. The markets have been pricing in an extreme amount of interest rate hikes over the next year, far more than the Federal Reserve will ever be able to do. It appears as if Wall Street is starting to come back to reality, but we still have a lot of issues out there that could weigh upon the S&P 500.

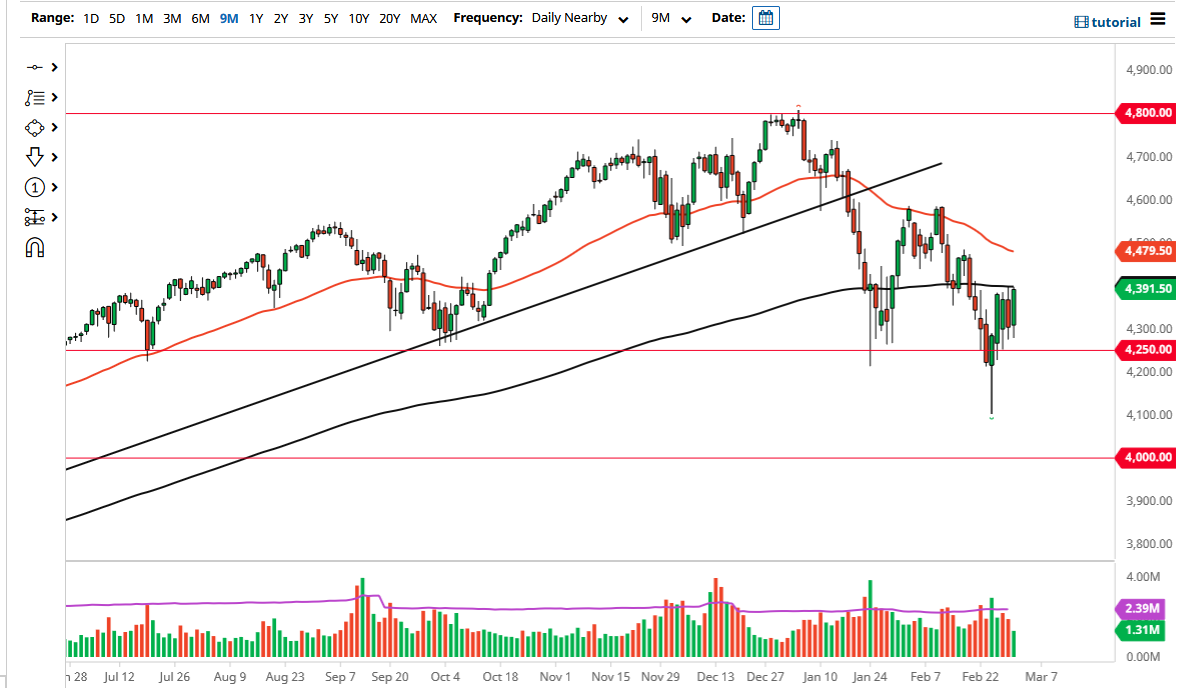

From a technical perspective, the 200 day EMA sits at roughly 4400, and that should continue to cause problems. Because of this, we may see some technical selling, and it is probably worth noting that the massive rally that we had later in the day on Wednesday was simply a reclamation of the losses from the previous session. We have been going sideways over the last four sessions or so, so I think we are trying to figure out where we are going to go long-term.

I am looking at the 200 day EMA/4400 level as a barrier that opens up a potential move towards the 4500 level and the 50 day EMA. On the other hand, if we break down below the 4250 handle, it is possible that the market would go looking towards much lower levels, perhaps as low as 4100 in the short term. We are essentially “squeezing” between the two levels, so once we get some type of decisive daily close outside of the area, then we can start to look at the possibility of a bigger move. Until then, I think it is simply a matter of the latest headline causing havoc in the markets. Keep in mind that we are towards the end of earnings season, so that also has a bit of a part of the play.