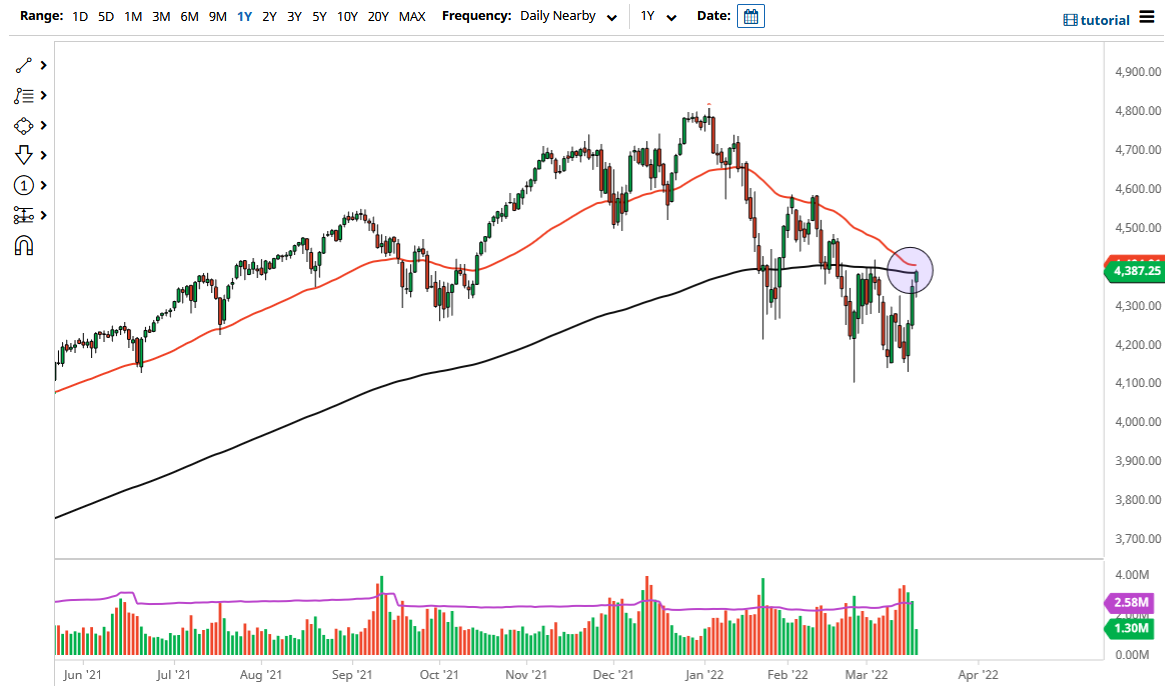

The S&P 500 initially fell during trading on Thursday but then turned around to rally towards the 200 Day EMA. This is an area that I think will attract a certain amount of attention, so it is interesting to see that we have ended up trying to continue going higher. The 50 Day EMA is sitting just below, so I think that also comes into the picture as well.

The shape of the candlestick during the session on Thursday does suggest that we are going to go further, but there are also a lot of technical issues just above that could come into the picture. After all, both of those moving averages are very commonly followed, so ultimately, I think that could come into the picture.

This is a market that has been in a downtrend for a while, but now is threatening the 4400 level. That is a good sign, but I am not wholly convinced until we can take out the 4500 level to the upside. If that happens, then we could go looking to much higher levels, reaching towards 4600, perhaps reaching towards the 4800 level. The market is getting ready to run into resistance sooner or later, especially as the Federal Reserve continues to see the reasoning to tighten monetary policy through the end of the year. Essentially, that could cause quite a bit of a problem for the stock market in general, due to the fact that growth is more than likely going to slow down. If that is the case, then companies are going to struggle to put up reasonable numbers in comparison to last year, and therefore I think it will weigh upon the stock market given enough time.

This has been a nice rally recently, but this is still what I would consider being a bit of a “bear market rally.” If we break down below the bottom of the candlestick for the trading session on Thursday, then it is likely that we could go looking towards the 4250 level. If we do take out the 4500 level on the upside, then it is likely that we could go much higher, perhaps reaching towards the all-time highs given enough time. Keep in mind that the markets are going to continue to be volatile, so preserving your account through money management will be crucial.