The S&P 500 rallied rather significantly on Wednesday to break above the top of the inverted hammer that formed during the Tuesday session. That being said, it is not like we are taking out to the upside with any great vigor, I think it is more or less going to be a short covering rally.

Keep in mind that next week is the FOMC meeting and press conference, and although most people are expecting an interest rate hike, the question will be whether or not the FOMC statement sounds overly hawkish or dovish. If they seem hell-bent on going forward with monetary tightening, then it is likely that it will put an anchor around the neck of the S&P 500. After all, that is what we had been selling off before Russia invaded Ukraine.

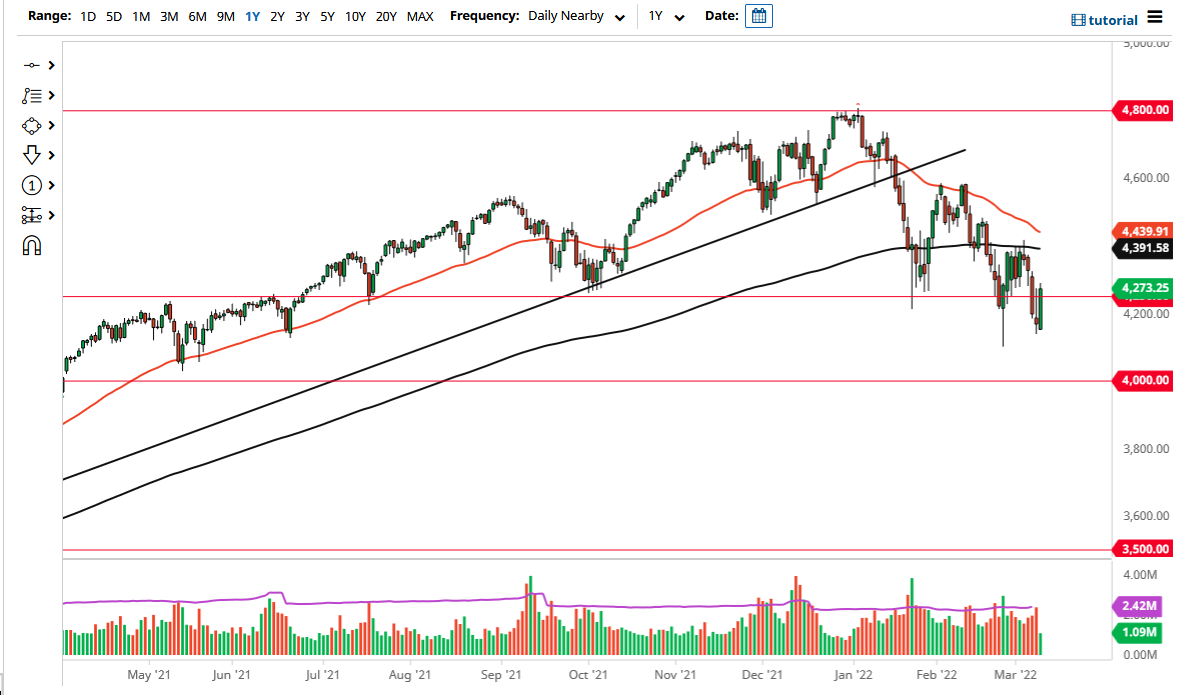

The size of the candlestick is somewhat important, as it does suggest that there might be a little bit of follow-through, but with all of this selling pressure that we had seen previously it would not be a huge surprise to see a big bounce. The 200-day EMA sits at the 4391 level and is sloping ever so slightly lower, and it is also worth noting that the 50-day EMA looks as if it is trying to break down below that moving average, looking to form what is known as the “death cross.” This is a very bearish technical indicator and will attract a lot of headlines.

There is a counterargument to be made from a technical analysis standpoint though, and that is that we are trying to form some type of falling wedge. I think we need a catalyst to make this happen, and I suspect that either some type of cease-fire agreement in Ukraine is needed, or perhaps more likely, Jerome Powell to sound not nearly as hawkish as he did just a couple of months ago.

That is really the rub here: the Federal Reserve. They are stuck with either fighting inflation or loosening monetary policy. They do not seem to be in a situation where they have the ability to deal with both at the same time, so I think we might have a bit of choppy trading between now and the meeting early next week. With that, keep your position size reasonable and expect more or less a neutral market.