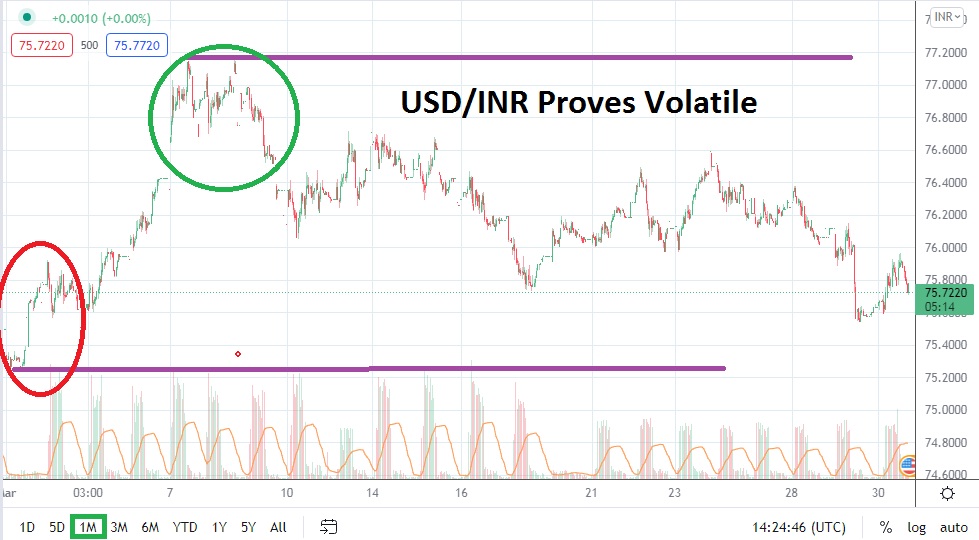

The USD/INR is trading near 75.7000 as of this writing, which is very close to values the forex pair started the month of March as momentum to the upside was becoming technically apparent. On the 7th and 8th of March the USD/INR shot past the 77.1000 level briefly as global forex trading also wobbled and financial institutions reacted to global political and economic issues. The high within the USD/INR achieved on the 7th of March reached an all-time high.

Traders of the USD/INR have had to deal with volatility that likely proved costly if too much leverage was used and the wrong direction was chosen. After hitting the apex highs at the end of the first week in March, the USD/INR began to trade in a more reasonable manner and started to produce downside. Incrementally the USD/INR has broken short term support levels, but speculators should remain ultra-aware regarding the forex pair’s ability to move fast.

The USD has taken a very strong undertone as the U.S Federal Reserve has begun to initiate it interest rate hikes. However as experienced speculators may know, the price of the USD/INR may have reacted too strongly to the combination of political and economic concerns shadowing the financial markets. The steep climb in the USD/INR appears to have been overbought to most observers. However, betting against the trend as velocity ran lightning quick in the first week of March may have resulted in significant losses for those trying to sell the USD/INR before it reached its apex highs.

The current price of the USD/INR still remains relatively high, but traders may feel quite nervous about looking for downside with questions still looming globally that could affect forex. The use of stop loss, and entry price orders is urged for traders who want to participate in the USD/INR. Traders should remain realistic regarding their price targets in April and should remain conservative.

The belief that U.S Fed interest rates have already been ‘baked’ into the price of the USD/INR may prove to be correct. However it doesn’t mean an instantaneous selling reaction of the forex pair will ignite and cause the USD/INR to suddenly test lows it has not seen since February when the 74.750 mark was being tested within a rather choppy range.

Traders may want to pursue technical trends, while hoping for reversals. The notion the USD/INR has displayed its most violent trading results may be logical, but speculators are encouraged to use their risk taking tactics carefully. Choppy trading during the month of April is likely as financial institutions react to sudden ‘noise’ that develops from afar.

USD/INR Outlook for April 2022:

Speculative price range for USD/INR is 75.1600 to 76.3700.

The 75.5000 level appears to be important short term support; if this level is proven vulnerable another wave downwards could be produced. Intriguingly the 75.6000 juncture may prove to be a sensitive trading area, this because the value of the USD/INR began March around this level. If this support level is broken lower and sustained, traders may believe a ‘recovery’ in strength for the Indian Rupee is about to emerge and challenge lower values.

If the 75.5000 breaks support and shows price velocity, the next logical level to look for may be the 75.4000 ratio. Prices below this juncture may produce a lot of buying from speculators who then seek reversals higher. Should the USD/INR actually fall through the 75.3000 level, lower depths could be demonstrated and be attractive for traders who believe the forex pair is then oversold in the short term.

Traders looking for upside may want to wait to remain patient and look for support levels to be flirted with in order to ignite buying positions. Having traded above the 76.0000 mark and even the 77.0000 level in March, the USD/INR displayed an ability to create massive moves higher, but these heights may prove to be too high for the forex pair moving forward. Bullish traders may find their best results waiting for lower levels to be hit and looking for quick hitting reversals upwards in the coming weeks. The USD/INR at 75.9500 appears to be overbought, but recent trading has proven logic sometimes does not work when market conditions are fragile.