For three trading sessions in a row, the price of the USD/JPY currency pair is moving in an ascending path, as a result of which it achieved a move towards the 115.95 resistance level, its highest in almost a month. Amid a state of optimism, US stocks recorded their biggest jump since June 2020 as a sharp drop in oil prices eased fears that inflation was about to worsen worldwide.

Accordingly, the S&P 500 Index rose 2.6%. The rise broke the four-day losing streak for stocks, but it was not enough to erase its losses for this week. The price of US crude oil fell 12%, the most since November, bringing relief after the sharp rise in crude prices since Russia's invasion of Ukraine. Big volatility has been rocking the markets in recent weeks as investors try to guess how much damage the war will do to the global economy.

Such high volatility has been rocking the markets in recent weeks as investors guess how much economic damage Russia's invasion of Ukraine will do. The fluctuations occurred not only from day to day, but also from hour to hour, with some days experiencing several major reversals.

The chaotic movements are likely to continue with very high uncertainty about the war in Ukraine and its eventual economic repercussions. The region is key to the markets as it is a major producer of oil, wheat and other commodities, whose prices have soared on fears of supply disruptions.

Stocks once again moved in the opposite direction to oil prices, and inflation was a dominant concern. Accordingly, analysts said bargain hunters may gain shares after concerns about a slowing economy coupled with high inflation led to the recent sharp decline. It appears that many of these buyers are "retail" investors with small pockets who trade on their phones and laptops. They often buy shares sold by large professional investors.

The recent big moves for the markets also show that prices are already reflecting a lot of pessimism, with crude oil prices up more than 50% so far in 2022. This may be the reason why crude oil prices fell on Tuesday, after US President Joe Biden announced US embargo on Russian oil imports. A ban would mean supply disruptions, but oil traders may have already done so when they briefly pushed US crude above $130 the day before the announcement.

Gold prices also eased and the extent of anxiety among Wall Street stock investors.

The Federal Reserve faces an increasingly delicate and difficult task as it moves to raise interest rates through 2022, slowing the economy. The central bank wants to raise interest rates enough to bring down inflation, its highest level in generations.

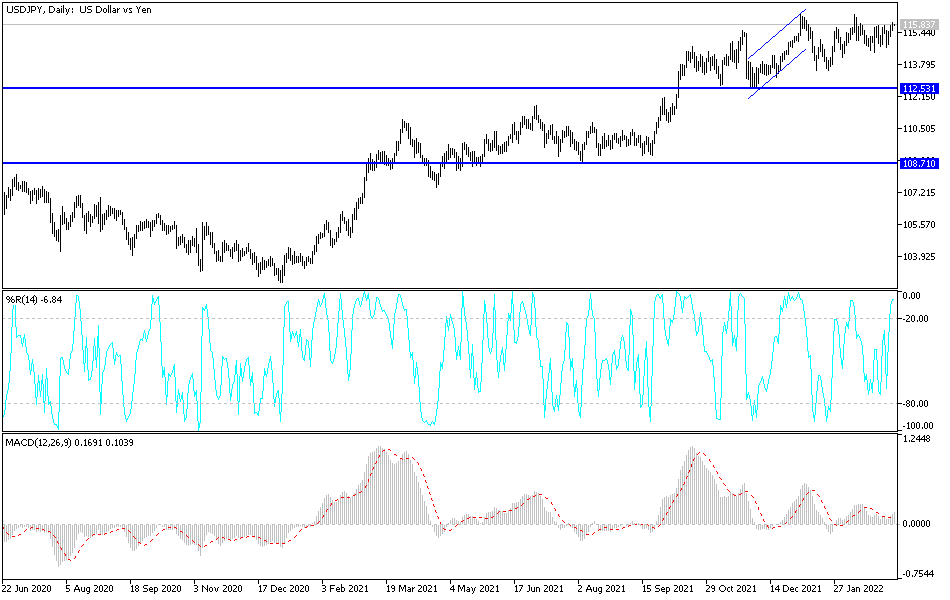

According to the technical analysis of the pair: The recent gains of the USD/JPY pair moved some indicators towards overbought levels. Since the Japanese yen is one of the most important safe havens, the currency pair is more a candidate for profit-taking operations instead of penetrating stronger ascending levels, the closest of which are currently 116.35 and 117.00. Selling operations, if they occur, might push the currency pair towards the 115.20 and 114.00 support levels. I still prefer selling the dollar yen from each ascending level.

The US dollar-yen will be affected by the release of US inflation readings, the consumer price index, the number of weekly jobless claims and the extent to which investors are taking risks.