For three trading sessions in a row, the price of the USD/JPY currency pair is moving amid important and sharp bullish breaches with gains to the 118.45 resistance level, the highest for the currency pair in five years. The currency pair is stabilizing around its gains at the time of writing the analysis, which came in the first place with the expectations of raising the US interest rate from the US Federal Reserve tomorrow, Wednesday, for the first time since 2018.

It is worth noting that US Federal Reserve Governor Jerome Powell indicated earlier in March that tomorrow, Wednesday, he was likely to see the Fed raise the US interest rate from 0.25% to 0.5%, although financial markets were still pricing the week. While a 0.25% rate hike from the Fed is likely to frustrate some parts of the market and act as headwinds for the dollar, it's also possible that the latest point of forecasting members of the Federal Open Market Committee (FOMC) are expecting a larger number. of interest rate increases this year from what was directed last December.

It is also possible that there will be cuts in the Fed's GDP growth forecast, and a rating downgrade that typically supports the dollar even without any concomitant increase in the Fed Funds benchmark rate; The US dollar strengthened against other currencies as rising inflation fueled the prospects of the Federal Reserve's tightening of monetary policy. Concerns about the impact of the ongoing Russian-Ukrainian war also contributed to the dollar's rally.

A report issued by the University of Michigan showed a decline in the US consumer confidence index to 59.7 in March from 62.8 in February. Economists had expected the index to fall to 61.4. With a larger-than-expected decline, the Consumer Confidence Index fell to its lowest level since it reached 59.5 in September 2011. One-year inflation expectations jumped to 5.4 percent in March from 4.9 percent in February, while five-year inflation expectations held steady at 3.0 percent.

While the report showed the current economic conditions index declined to 67.8 in March from 68.2 in February, the consumer expectations index declined to 54.4 from 59.4.

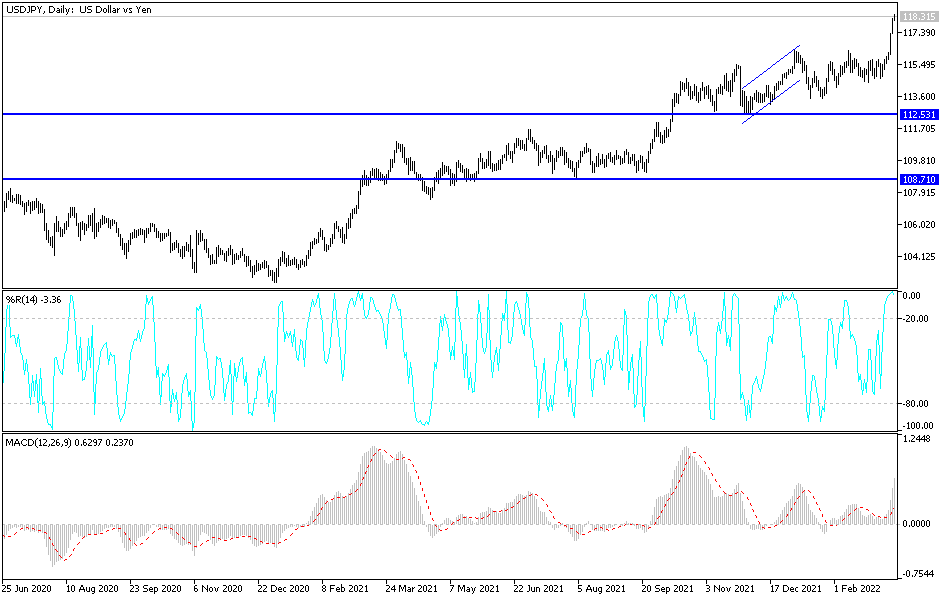

According to the technical analysis of the pair: On the daily chart below, it seems clear that the gains of the USD/JPY currency pair moved the technical indicators towards overbought levels. If the markets raise US interest rates, the gains of the US dollar may stop for a moment, as the profit-taking operations are sold. The gains may increase if the US Central Bank confirms tomorrow further rate hikes with strong and sharp rates throughout the year, which is a relatively unattainable expectation. In any case, the general trend of the dollar-yen pair today is still bullish, but it is necessary to beware of activating the selling operations to take profits at any time.

The current bulls’ targets may reach the psychological top 120.00 if the current gains factors of the pair remain, and in return the break of the 116.00 support is important to anticipate a change in the trend.