The currency pair tried to recover stable around the 115.16 level at the time of writing the analysis in preparation for the reaction from the testimony of Federal Reserve Governor Jerome Powell later today. The US dollar may take its cues from the leading jobs indicators, as this will allow traders to weigh in against the US non-farm employment data. Improvements are seen from the ADP and ISM reports, but the NFP is expected to show slower job growth at 400K for February.

However, any bullish number surprises could mean gains for the dollar as this should keep the Fed on the right track towards monetary tightening soon. He noted that some policy makers are pushing for a US interest rate hike in March while some say they may be able to raise the entire rate by the middle of the year.

On the other hand, weak data could dash hawkish hopes and spur losses for the dollar, especially as geopolitical risks may force global central banks to re-evaluate their biases.

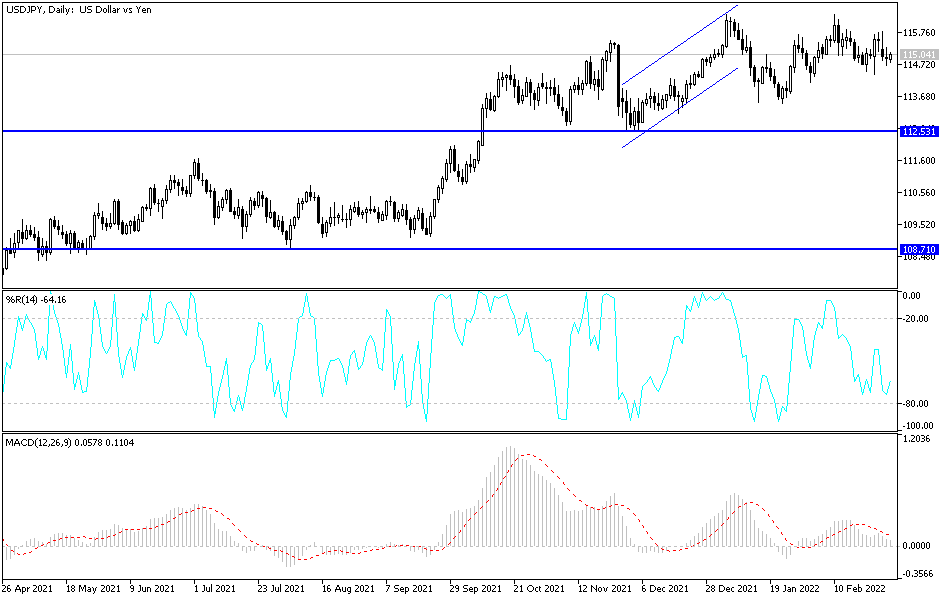

According to the technical analysis of the pair: USD/JPY formed higher bottoms and higher tops within the rising wedge pattern on the 4 hour chart, and the price is currently testing the support. Any bounce could bring it back to the resistance around 116.50. So far the 100 SMA remains above the 200 SMA to confirm the chance for an upside move and that the support is more likely to hold than break. The price drops below the 100 SMA a dynamic inflection point, but the 200 SMA still looks like it is holding as a floor near the bottom of the wedge at the 115.00 mark.

Stochastic is heading down to show that the bears are still in control and may be able to break down. If that happens, the USDJPY may slide as high as the wedge pattern or about 250 pips. The RSI is also pointing down, so the price may follow suit while sellers are in control. Both oscillators have some room to go down, which means that the downward pressure can continue for a longer period.