Despite the state of risk aversion that dominates the markets with the continuation of the Russian war, the USD/JPY currency pair took a strong and sharp upward path and all currencies moved against the Japanese yen. The dollar-yen pair jumped to the 121.41 resistance level, the highest in six years, and is stable around it at the time of writing the analysis. After the Japanese yen collapsed in the forex market, Japanese Prime Minister Fumio Kishida is likely to act in front of the Bank of Japan to help support the choppy recovery and cushion the blow to households and businesses from escalating energy prices exacerbated by the yen's decline.

The currency pair's gains, its highest in years, came after Federal Reserve Chairman Jerome Powell hinted at the possibility of a 50 basis point increase in US interest rates in May.

The accelerated pace of US interest rate hikes will widen the policy gap between the Federal Reserve and the Bank of Japan as BoJ Governor Haruhiko Kuroda keeps his stimulus in place. This will put further downward pressure on the Japanese yen, adding to higher import costs and potentially hampering a recovery in consumption amid mounting calls for economic measures from the government.

Speaking last Friday before the recent devaluation of the Japanese currency, Kuroda stuck to his position that a weak yen was still beneficial for the economy in general. In 2015, the BoJ chief made comments that were interpreted as defending the yen around the 125 mark, a level that became known as the Kuroda Line.

If the Japanese yen does not slide towards that point in the coming days, market participants expect the government to act first.

The government should quickly consider fiscal stimulus measures amid price hikes, according to Seiji Kihara, a close aide to Kishida, in an interview on Friday. On Tuesday, local media reported that the government and the ruling coalition are preparing to formulate a stimulus package worth more than 10 trillion yen ($83 billion).

Most economists surveyed now expect the Japanese economy to shut down this quarter, largely due to the impact of Omicron's restrictions. Energy prices and a weak yen are now threatening to limit the hoped-for recovery in consumer spending over the coming months.

It is crucial that Kishida bolster the economy and make voters feel less economic pain ahead of national elections this summer that could determine whether he will continue as prime minister or be added to a long list of short-lived leaders. For his part, Kishida said last week that cost-rise inflation in Japan is driven by global commodity prices, not by foreign exchange rates, so the government will act flexibly. Meanwhile, Kuroda said that the government, not the central bank, is responsible for foreign exchange policy.

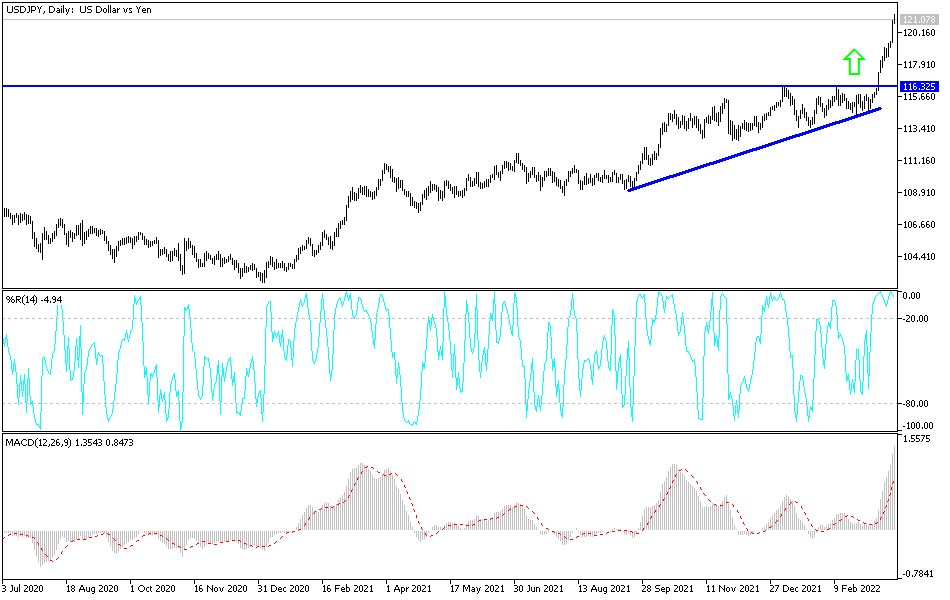

According to the technical analysis of the pair: The bulls of the USD/JPY currency pair ignored the technical indicators' arrival towards overbought levels after the recent gains. The general trend of the currency pair is getting stronger to the upside and I still see that profit taking sales could happen at any time. The closest targets are 121.20 and 122.00, respectively. It must be considered that the Japanese yen is one of the most important traditional safe havens for investors in times of uncertainty. Therefore, the aggravation of matters regarding the Russian war may restore the Japanese yen's strength.

According to the performance on the daily chart, a break of the 118.50 support will be important to return the bears' dominance.