For the second day in a row, the price of the USD/JPY currency pair is moving within profit-taking operations. This noted a lot about the possibility of it happening at any time after the pair’s gains towards the resistance level 125.10 at the beginning of this week’s trading, the highest for the currency pair in seven years. The recent selling operations pushed the pair towards the 121.30 level this morning. The Japanese yen has recently fallen sharply amid the widening gap between the monetary policies of the Bank of Japan (BoJ) and the Federal Reserve (Fed), but the USD/JPY may rise further, according to Mizuho's foreign exchange sales office, with potential implications for the GBP/JPY.

In this regard, the head of foreign exchange sales for financial institutions at Mizuho said on Tuesday that the Japanese yen is likely to fall further, and that the USD/JPY may reach the level of 130 in the coming months, a possible outcome that would raise the pound/ Japanese yen to 170 or more.

"I doubt the current uptrend is over," said Neil Jones, Mizuho's Head of FX Sales for Financial Institutions, in a note to clients. Looking for more yen sales in April and May. My personal sense is an orderly trend above the dollar at moderate speed with steady ranges.” He added, “The roadmap should prove 125 to 130 more liquidity than the recent price movement and limit official attention to only verbal references.”

The yen stabilized against the dollar and the British pound on Tuesday in what may be profit taking by speculative traders after overnight comments from Japanese Finance Minister Shunichi Suzuki, who said the government is watching the yen closely. This was after the yen fell to multi-year lows in the opening session of the week when the Bank of Japan said it would intervene in the Japanese government bond market with unlimited purchases in order to limit increases in government borrowing costs.

Lee Hardman, FX analyst at Japan's MUFG, said: "While comments from Japanese officials overnight are unlikely to reverse the yen's weakening trend on their own, they should at least help slow the recent rapid pace of yen selling that it has been evident over the past two weeks.”

Part of the Bank of Japan's monetary policy is to keep the 10-year government borrowing cost close to 0.10% and prevent it from rising above 0.25%, although enforcement of this policy has become more difficult in recent weeks due in part to Federal Reserve monetary policy. .

The Fed raised the US federal funds rate for the first time since 2018 this month. Markets are increasingly expecting that it will likely reverse further over the remainder of the year, cuts that previously lowered the benchmark from 1.75% back in year 2020. US inflation approached eight percent in February and could rise further, necessitating a quick pivot by the Federal Reserve to reset its monetary policy settings to a less stimulating calibration of the US economy that does not increase price pressures.

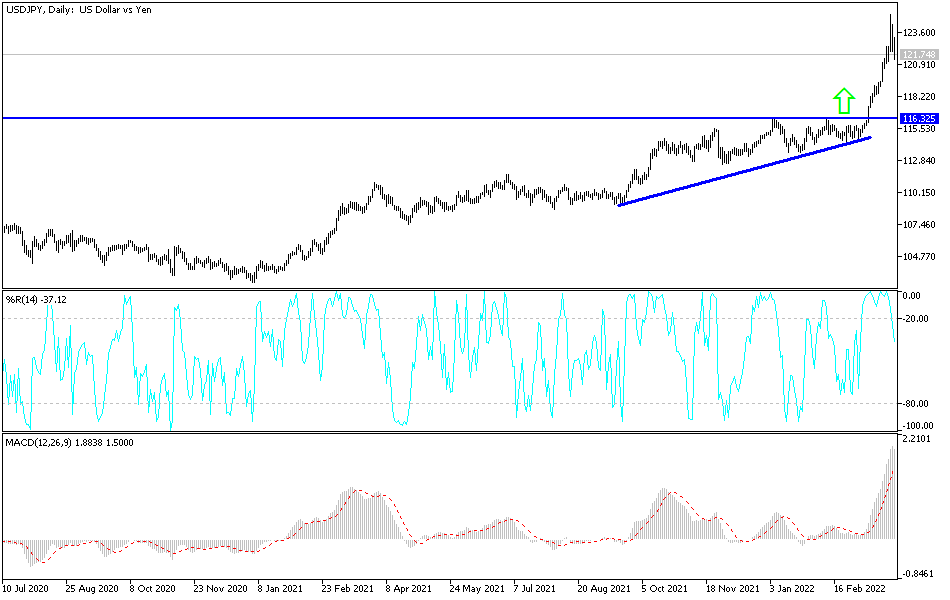

According to the technical analysis of the pair: The price of the USD/JPY currency pair may continue to move in limited ranges until the announcement of the US economic growth number and the number of US non-farm payrolls from ADP later today. So far, the general trend of the dollar-yen will remain bullish as long as it is stable above the 120.00 psychological resistance, and a clear break of this trend may occur if the currency pair moves towards the 118.50 support level, according to the performance on the daily chart.

In the same current path, the resistance levels will be 122.75 and 123.60, the closest targets. We still prefer to sell the dollar yen from each ascending level.