Today's recommendation on the lira against the dollar

Risk 0.50%.

None of the buy or sell transactions of yesterday were activated

Best entry points buy

- Entering a long position with a pending order from 14.55 levels

- Set a stop loss point to close the lowest support levels 14.36.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 15.00.

Best selling entry points

- Entering a short position with a pending order from 14.87 levels.

- The best points for setting the stop loss are closing the highest levels of 14.98.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish lira fell during European trading to swallow its morning gains against the US dollar. The war in Ukraine, in addition to the lira's long-running weakness, caused the country's inflation rate to rise, especially with fuel prices three times higher than their levels a year ago. In this regard, Turkish President Recep Tayyip Erdogan commented on a government orientation to help families during the current inflation period. It is noteworthy that the war in Ukraine has contributed to putting pressure on the price of the lira, with most of the cash flowing into the dollar. On the data front, early reports showed that the unemployment rate in Turkey decreased by 1.1 points during 2021, to record unemployment at 12 percent, to witness an improvement from the pandemic year.

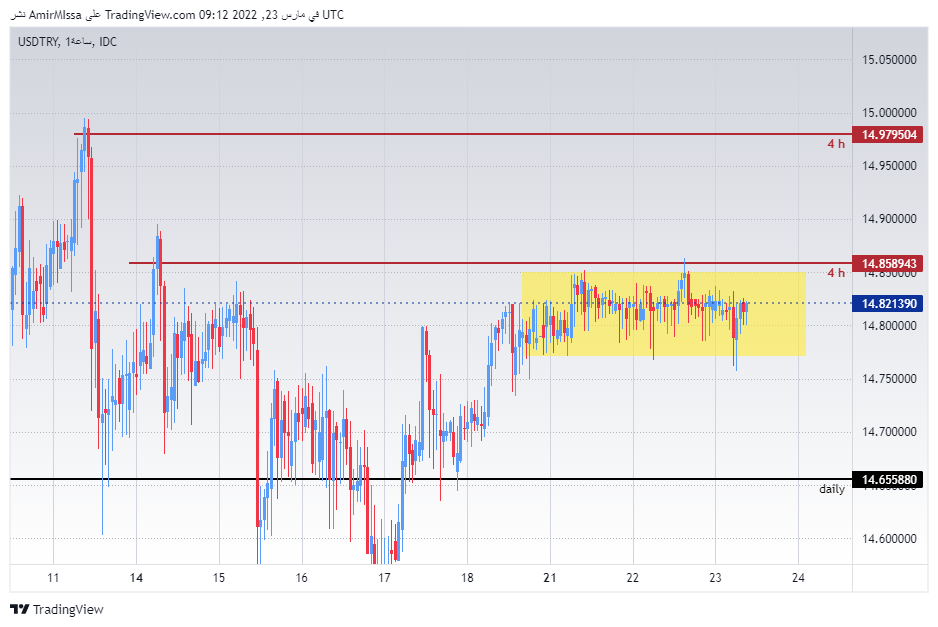

The Turkish lira settled against the dollar without significant changes, as the pair settled within a narrow range on the 60-minute time frame, shown through the rectangle on the chart. However, the pair in general is trading within the general continuous upward trend. The pair is stabilizing above the moving averages 50, 100 and 200, respectively, on the daily time frame, the four-hour time frame, and the pair also bounced from the moving average 50 on the 60-minute time frame. The pair is also trading the highest support levels, which are concentrated at 14.65 and 14.51 levels, respectively. On the other hand, the lira is trading below the resistance levels of 14.85 and 15.97, respectively. We expect the pair to vary as long as it stabilizes within the aforementioned rectangle range. The pair can target 14.50 levels in the event of a decline, but in the continuation of the rise, 15.26 levels, which represent 61 Fibonacci for the last bearish wave, which started at 20-12-2021 and ended at 23-12-2021. Please adhere to the existing numbers in the recommendation with the need to maintain capital management.