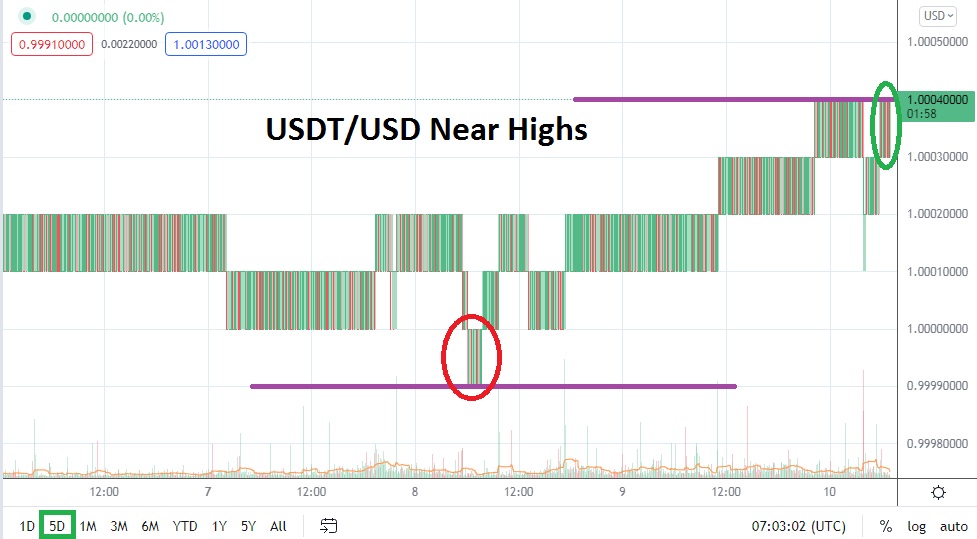

USDT/USD is traversing near its short-term high as of this writing, and Tether continues to offer speculative traders a more quiet trading landscape if they are able to be patient and conservative with their wagers. As the broad cryptocurrency markets continue to produce nervous sentiment, USDT/USD on the surface offers traders a price range which is extremely tight and free of vast waves of volatility.

However, if Tether can be speculated on by traders who have brokers that offer USDT/USD as a tradable speculative asset it must be treated with care. Like all wagers in cryptocurrencies, using a conservative amount of leverage is recommended. The calm price range of USDT/USD should not allure traders into positions which are too large and not realistic. Following a trend is possible technically, but having the patience and capability to wait for USDT/USD to trend in a chosen direction is also important.

USDT/USD is actually trading near its highs as of this morning, and this has occurred after the broad cryptocurrency market has displayed a sudden drop in value after many of the major digital assets tested short term highs the past day and a half. If nervous sentiment continues to build in the broad crypto market, USDT/USD may begin to see some of the volatility flow into its sphere and a move downwards back to 1.00010000 level may be demonstrated.

Entry price orders are very important when trading USDT/USD in order to receive fills that meet expectations. Traders need to pursue Tether with a careful attitude and they must be willing to wait for results to materialize. The use of stop losses are recommended, and the tactic of putting a stop loss slightly further away compared to the numerical ‘tick difference’ of a take profit may prove advantageous. This tactic can give a speculator more breathing room to let USDT/USD trade while a targeted value to profit is waited on.

Speculators, who want to pursue USDT/USD and believe nervous sentiment will continue in the broad cryptocurrency market near term, may believe Tether may incrementally see its value lower also. Traders are strongly advised not to be overly ambitious while trading USDT/USD, and understand the nature of its trading is incremental and must be dealt with by carefully choosing all risk management parameters in order to potentially profit.

Current Resistance: 1.0004100

Current Support: 1.00029000

High Target: 1.00049000

Low Target: 0.99900000