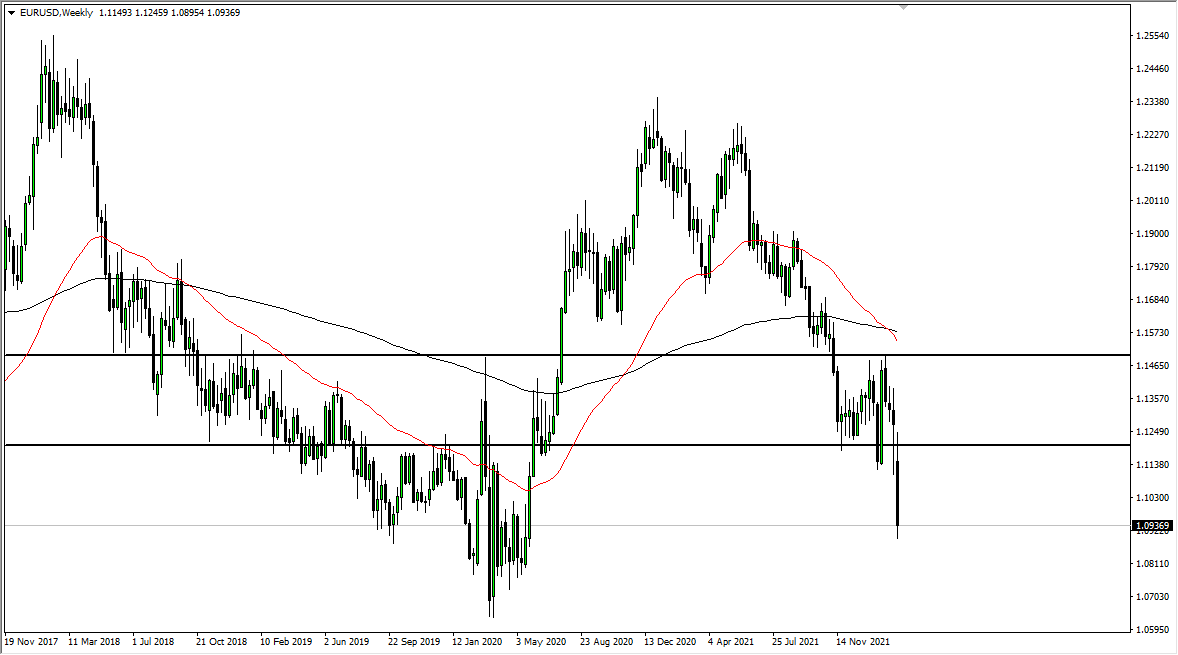

EUR/USD

The euro gapped lower at the open for the week, before turning around to fill the gap. Now that we have filled the gap, the euro has proceeded to fall rather significantly. Because of this, we have now cleared any doubts as to which direction we are going, and now it looks as if any time we rally, traders will be looking for an excuse to start shorting. I do not like the idea of buying the euro until we can clear the 1.13 level.

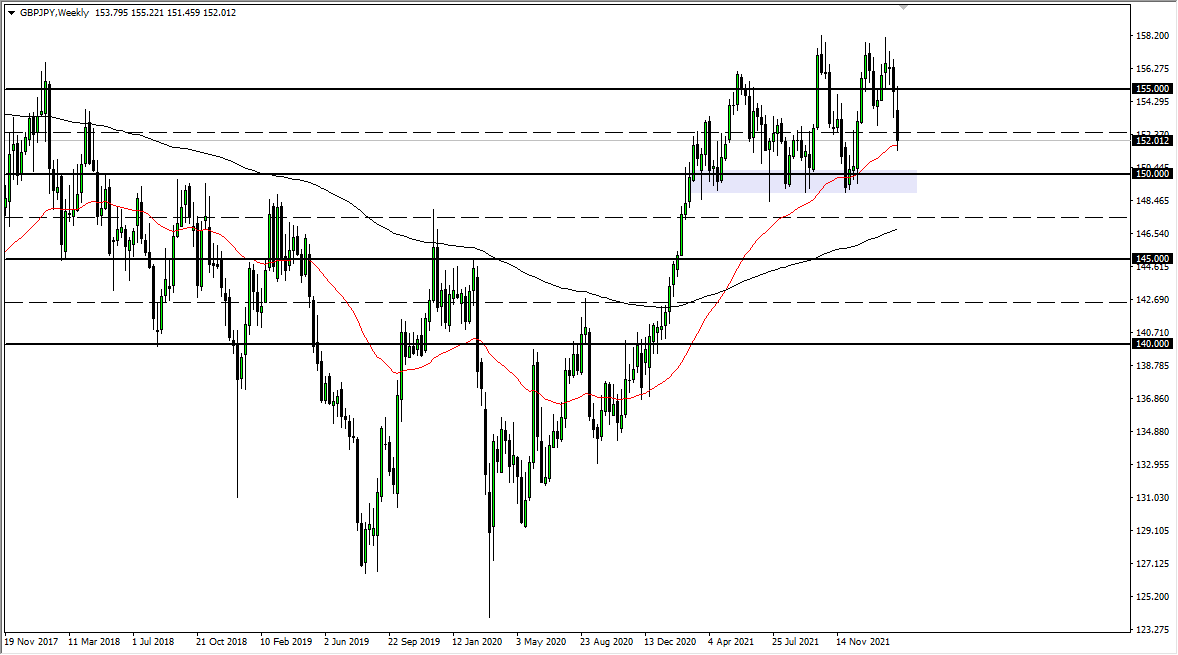

GBP/JPY

The British pound gapped lower to kick off the trading week, showing signs of risk aversion. The market turned around to fill that gap and then fell apart later on. We continue to see a lot of concern around the world for multiple reasons, not the least of which is the war in Ukraine. The market touched the 50 week EMA during the trading session on Friday, but I believe that the only reason the market did not fall towards the ¥150 level is that we closed for the weekend. At this point, it is not going to take much in the way of bad news to have rallies sold into.

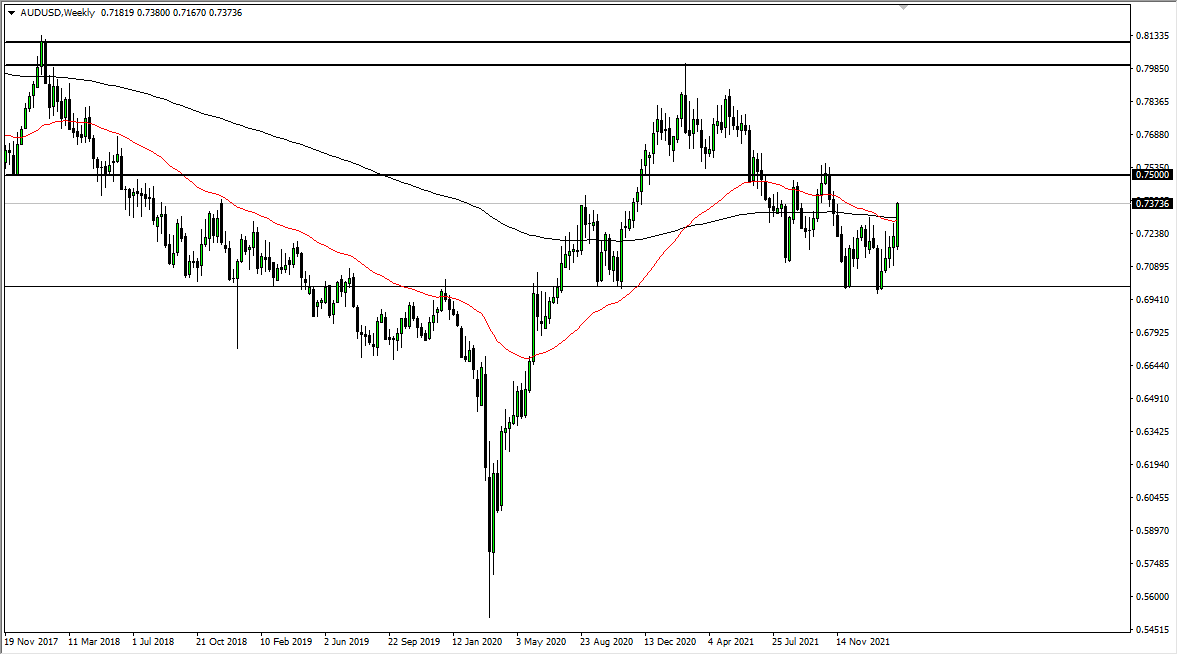

AUD/USD

The Australian dollar has been a bit of an outlier during the course of the week, as it continues to strengthen against the US dollar. Perhaps this is an indication that the market is looking for the RBA to raise interest rates, as the New Zealand central bank did. That being said, the 0.75 level could be targeted, and you should also keep in mind that it is perhaps possible that the Aussie is getting a little bit of a boost from the gold market, which has been nothing short of astonishingly bullish.

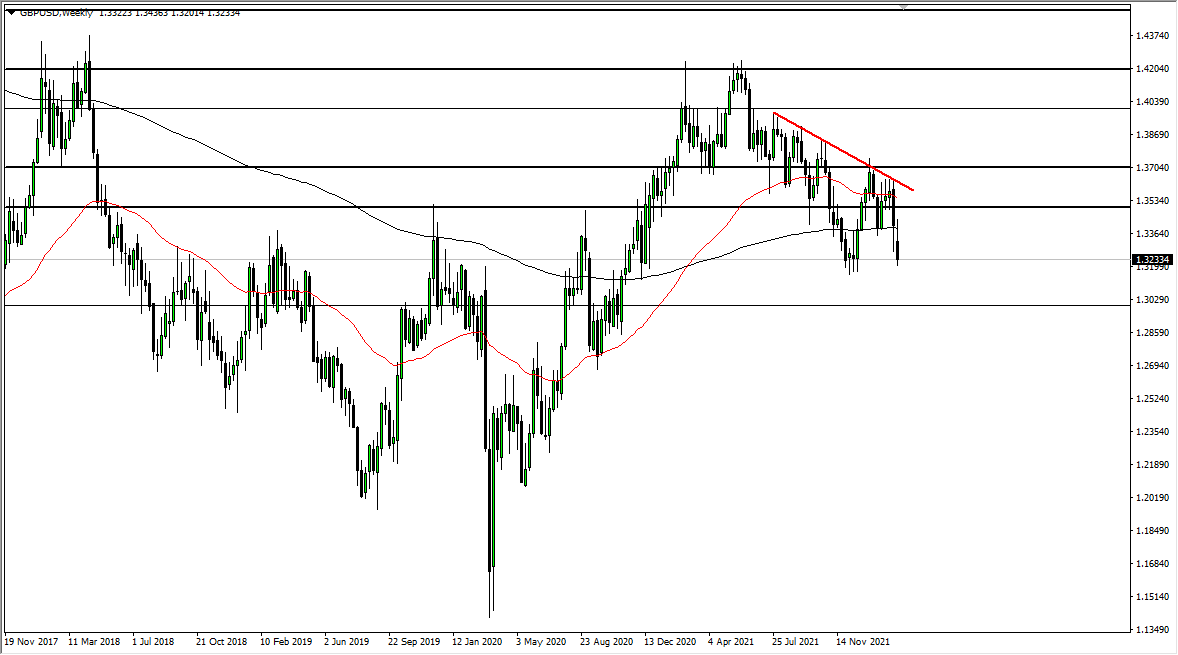

GBP/USD

The British pound gapped lower to kick off the week against the US dollar, only to turn around and fill the gap. Ultimately, we have seen enough selling pressure that the market turned right back around, closing just a bit above the 1.32 handle. The market breaking down below the 1.32 area would open up the possibility of a move down to the 1.30 handle, which is a large, round, psychologically significant figure that will cause a lot of headline noise. There probably will be a certain amount of support in that area, but breaking down below there could send the British pound plunging.