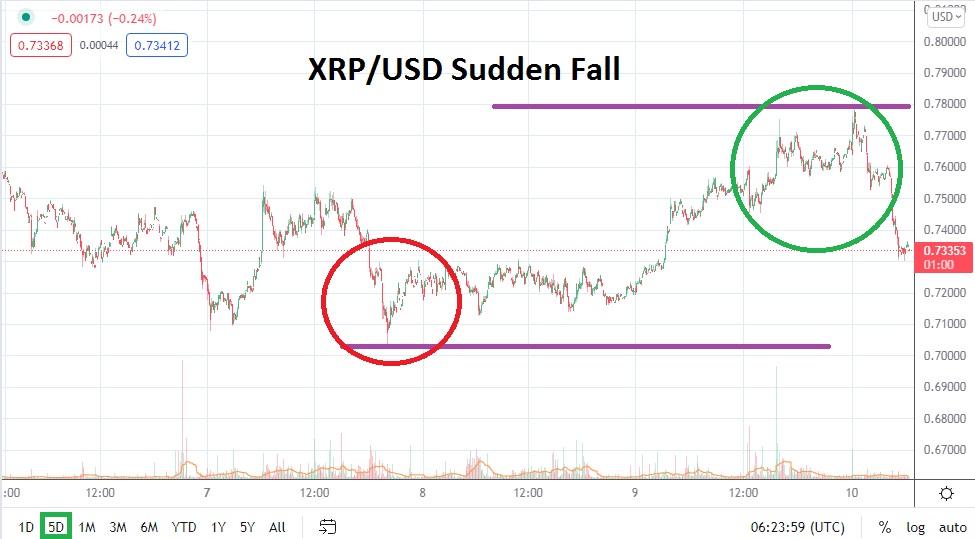

In late trading last night XRP/USD nearly touched the 78 cents level, but in the past handful of hours Ripple has suffered a sharp reversal lower and is within sight of crucial support levels. Like the broad cryptocurrency market, XRP/USD has produced choppy trading and the upward results displayed the past day have quickly vanished as nervous sentiment continues to trigger volatile swings in price.

As of this writing XRP/USD is at nearly 73 and half cents as its hovers in a rather intriguing range that could ignite additional quick trading, particularly if support levels are broken. If the 73 cents mark is penetrated lower and the 72 and half cents ratio begins to be flirted with speculators who were skeptical about the rise in value demonstrated the past day and a half may begin to increase their bearish selling.

If the broad cryptocurrency continues to show that headwinds are building again, XRP/USD could see a retest of depths it has tested rather consistently the past month. On the 7th of March, Ripple was trading near the 70 cents juncture and this level has acted as rather consistent support since late February. Traders may be tempted to target this lower value, but they should not be overly ambitious with their price goals if they are using a large amount of leverage.

Cryptocurrencies have found it difficult to maintain a steady pace upwards and many of the major digital assets remain within price ranges that are testing their lower depths when six month technical charts are used. The bearish trend in XRP/USD has been rather consistent too and until XRP/USD can break above the 80 cents mark and sustain values, many traders may continue to use rises in value as technical junctures to launch their selling orders.

The short term has demonstrated strong volatility, but the trend the past handful of hours has been negative and speculators may want to wager on this downward price action. Speculative wagers looking for nearby support as take price targets may prove logical. Aiming for 73 and a quarter cents, and then the 73 cents level may prove worthwhile. Traders are politely reminded to use stop losses, and brace themselves for choppy conditions to prevail near term.

Ripple Short Term Outlook:

Current Resistance: 0.73900

Current Support: 0.73030

High Target: 0.75680

Low Target: 0.70650