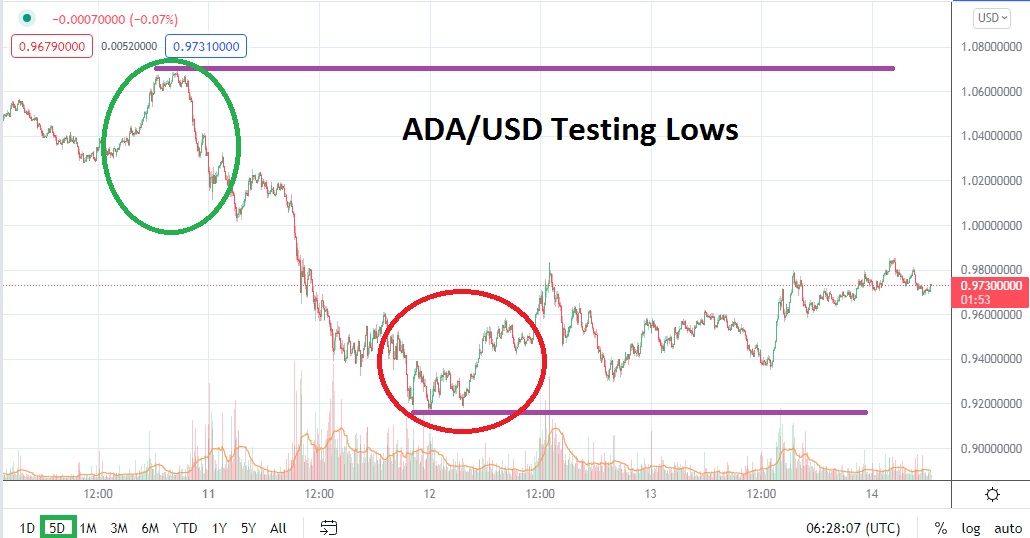

ADA/USD has put in a polite gain in early trading today and is near the 0.97000000 level, this after touching a low of 0.96810000 approximately late last night. Interestingly, from a technical viewpoint is the perception that ADA/USD has seen an incremental rise in support levels the past three days. On the 12th of April Cardano did trade near the 0.91600000 level, before showing ability to reverse higher.

ADA/USD has remained rather choppy the past few days, this as it mirrors the results from the broad cryptocurrency market. However, ADA/USD has also been able to achieve a high yesterday near the 0.9802000 ratio, and in early trading today touched the 0.98580000 mark. The ability to climb upwards after hitting lows may continue to attract day traders who want to pursue momentum which they believe can be ignited when support levels are triggered.

On the 4th of April ADA/USD did traverse near the 1.24500000 level, this retested highs seen only a few days before. The problem for bullish traders who have been pursuing additional climbs since the 4th of April is that price action incrementally lowered until hitting a depth of nearly 0.91480000 on the 11th of April. Having been battered by a long term bearish trajectory, bullish traders who wagered on upside momentum the past month and have perhaps taken some costly hits the past ten days may feel hesitant to wager in the short term.

ADA/USD is near important support levels, if the current value of 0.97000000 can be sustained and support levels near 0.96870000 prove to be durable, this could spark an outlook that upside price action short term is a capable result. The broad cryptocurrency market appears to remain rather nervous, results yesterday and early today have shown some buyers stepping into the trading landscape, but can they maintain their strength?

Near term ADA/USD is likely to continue to produce choppy results. Speculators may want to look for quick hitting trades that take advantage of current support and resistance levels, by using entry orders and working take profit targets. Looking for upside momentum on downturns towards support levels that look strong may prove to be a worthwhile wager, but traders should not be overly ambitious when selecting their price targets. Cashing out quick winners near term may prove to be a solid choice for traders.

Cardano Short-Term Outlook

Current Resistance: 0.97690000

Current Support: 0.96870000

High Target: 1.13520000

Low Target: 0.98920000