My last signal from 13th April was not triggered, as none of the key support and resistance levels which I had identified were reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken prior to 5pm Tokyo time Thursday.

Short Trade Ideas

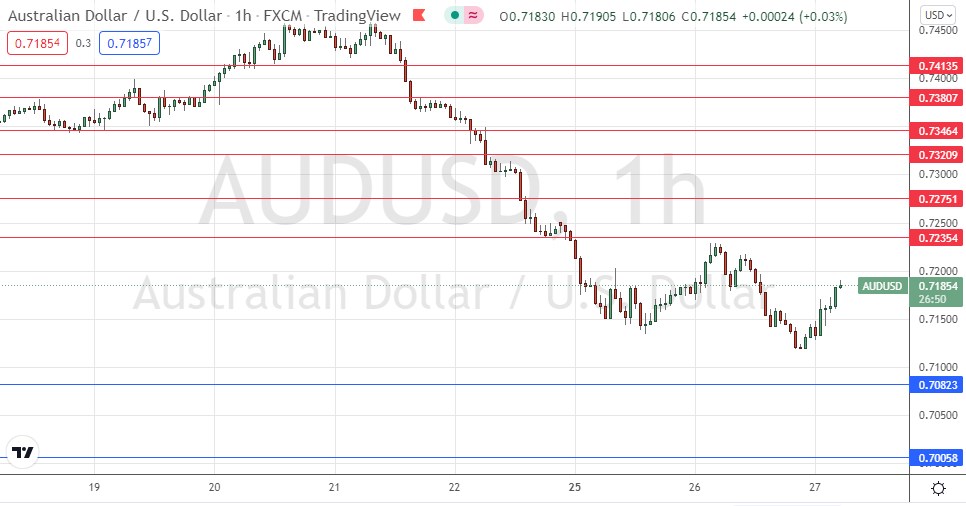

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7235, 0.7275, or 0.7321.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go short following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7082 or 0.7006.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous piece on this currency pair on 13th April that the price looked weakly bearish while consolidating below the resistance level confluent with the big round number at 0.7500.

I thought that if the price made new lows below 0.7400, it could plunge quickly as low as the next support level at 0.7321. The band of several resistance levels not far above the current price then suggested the line of least resistance would be downwards.

This was an OK call as I was correct about 0.7400 being pivotal. It held the low of that day as support.

The picture now has changed, with the price making quite strong falls last week as the US Dollar’s bullish trend continued to advance. However, the Australian Dollar has made a couple of strong bounces this week, which can give bulls some hope, yet it is still making lower lows and lower highs, which suggests the medium-term bearish trend is still in force.

Commodities in general have weakened over recent days, and a few hours ago Australian CPI data was released which showed inflation running at 5.1% and exceeding expectations. This has not yet had a negative effect on the Aussie but should logically support further downside movement.

I think the only interesting set up that we might see today in this currency pair would be a bearish reversal at 0.7235, which would present an attractive short trade entry point.

There is nothing of high importance due today concerning either the USD or the AUD.