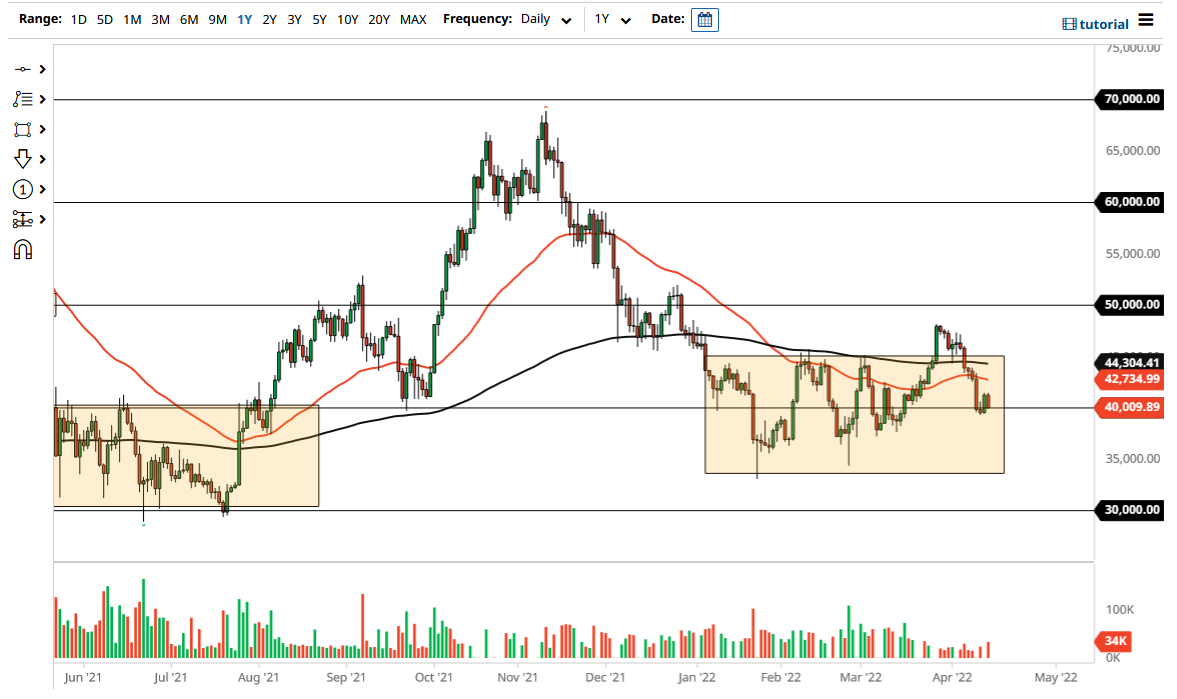

Bitcoin has pulled back a bit during the trading session on Thursday to reach the $40,000 level again. At this point, the $40,000 level appears to be a bit of a magnet for price, and perhaps more importantly over the last couple of days, a bit of support. As long as we can stay above there, it is likely that we will continue to see the market try to recover and go higher. That being said, the market looks very likely to be noisy to say the least.

If we were to break down below the inverted hammer from the Tuesday session, that could kick off a bit of selling pressure, perhaps reaching as low as $37,500. That is an area that has been supported multiple times, and therefore people will be looking at that level as the next potential buying opportunity. If we break down below there, I do not necessarily believe that the $35,000 level is going to hold this time, and I would anticipate a bigger breakdown at that point.

Remember, above all things Bitcoin is a risk asset. This is how institutions tend to look at it, and that is what matters. It is not retail that drives this market as much anymore, but the very people that this market was supposed to take out of the mix. Institutional money brings a bit of stability to the market, but it also brings the same type of attitude that you see in other things like the stock market. Quite frankly if the large institutions do not want to take a lot of risk in the markets, they will be bothered with buying Bitcoin.

That being said, if we were to break down below the $35,000 level, I suspect that we will do all the announce the upcoming “crypto winter.” On the other side of the coin, if we were to turn around a break above the 200 Day EMA, we will more than likely make a move to reach the $50,000 level, but I think it is going to take quite a bit of “risk-on behavior” around the world to make that happen right now. There are a lot of concerns currently, and therefore it is difficult to see markets like crypto take off. This is not just the Bitcoin problem, this is a risk appetite problem.