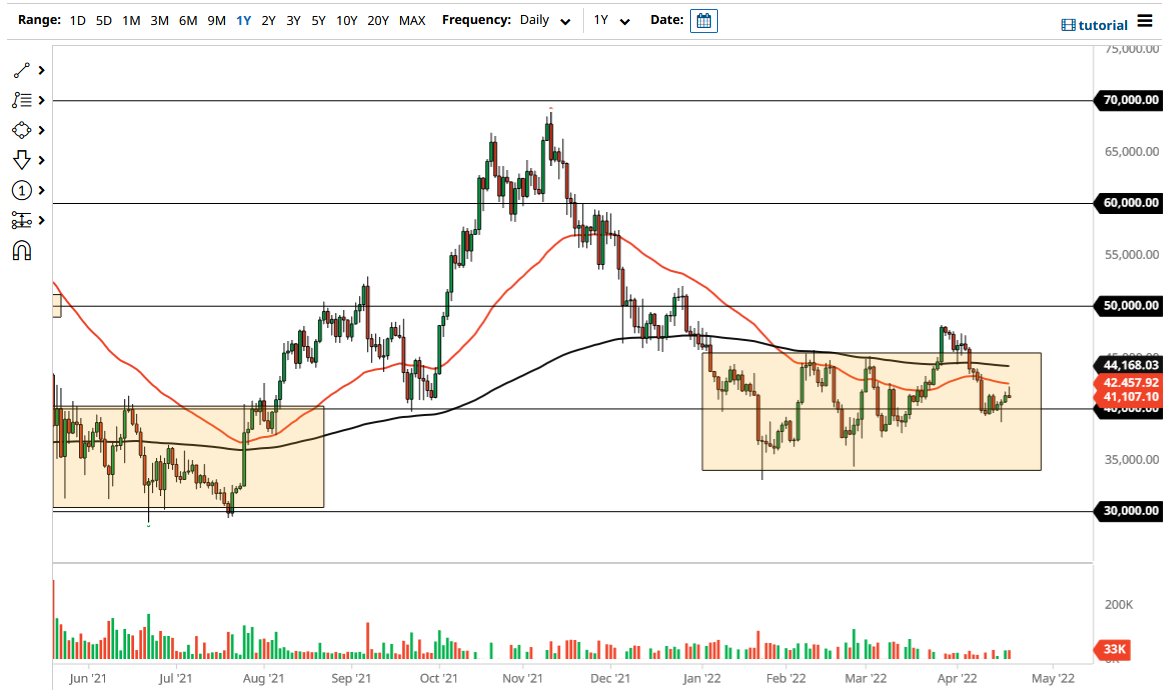

The Bitcoin market continues to see a lot of confusion as the Wednesday session has shown a turnaround at the 50 Day EMA. In other words, it looks as if there are just as many sellers as there are buyers. Over the last several days, it looks like Bitcoin was finding a lot of support at the $40,000 level, so it did not take a lot of imagination to suggest that perhaps we were going to rally. The market did ever so slightly, but then gave back gains during the last 24 hours.

It is worth noting that we cannot take out the 50 Day EMA, so at this point, I think we are simply hanging around and trying to figure out what we are going to do next. The hammer that formed on Monday was pivotal because as long as we can stay above there, I would anticipate that people will be willing to step into the Bitcoin market and try to lift it again. However, if we break down below that hammer, then it is possible that we could drop to the $37,500 level, and then possibly even down to the $35,000 level, an area that has been supported more than once. Anything below that level has me worried about Bitcoin because quite frankly I think it would show real weakness, and perhaps strongly. In that scenario, we could even go into “crypto winter.”

On the other hand, if we were to turn around a break above the 50 Day EMA, then the market is likely to go looking to reach the 200 Day EMA, which is a long-term trend indicator that a lot of people follow. It is sitting just below the $45,000 level, an area that has a certain amount of psychology attached to it. Breaking above that then will allow the Bitcoin market to start to think about the $50,000 level.

What I think we have ahead of us is probably more choppiness than anything else. After all, you can see we have gone back and forth quite erratically over the last couple of months, but at the same time, you have been rising in value ever so slightly. It is going to be difficult to deal with this type of volatility, so if you do choose to hold on to Bitcoin, it is probably best to ignore the market for a while.