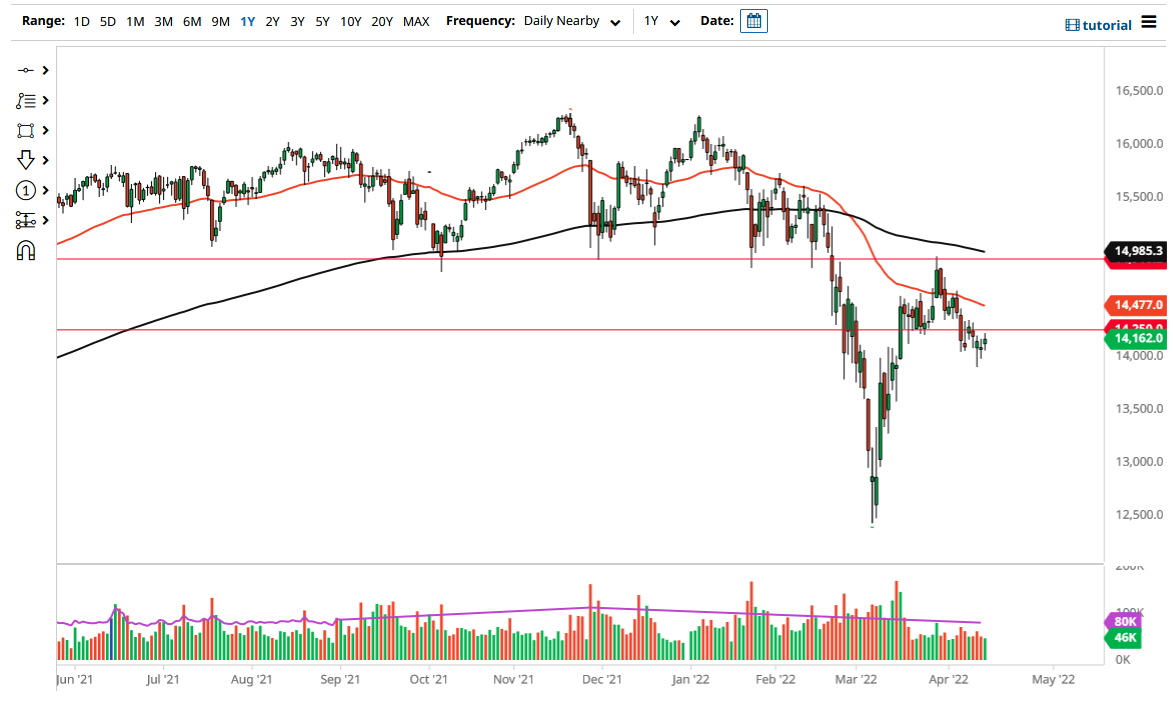

The German index has gone back and forth during the trading session on Thursday, as we continue to dance around just above the €14,000 level, in fact, it appears that we are stuck between the €14,000 level on the bottom, and the €14,250 level on the top. With these last couple of sessions being back and forth, it suggests that we are going to continue to see a lot of noisy behavior, and therefore it is going to be very difficult to trade this market with any type of certainty.

In the meantime, if you are a short-term range-bound trader, you can use those two levels as a bit of a guideline as to where to go long or short. That being said, if we do break out above the resistance barrier, the next resistance barrier will be the 50 Day EMA which is currently at the €14,476 level. On the downside, if we were to break down below the lows from a couple of candlesticks ago, then the market could start to drop again.

When you look at the chart, you can see that we have obviously bounced rather significantly, and then pulled back. The question is whether or not the recent pullback has been a simple pullback in a potential longer-term uptrend, or the downtrend is going to continue? When you look at the fundamental outlook for the European Union, one would have to think that it is very difficult to believe that the energy crisis that is almost imminent will not be factored into this picture.

If we do break down below the hammer from a couple of sessions previous, then I think it is very likely we go looking to target the €13,500 level, perhaps even down to the €13,000 level. Furthermore, the 50 Day EMA is negative sloping, and therefore when you look at it from a trend following perspective, it is very possibly still looking bleak. The one thing that looks possible as far as bullish trading is concerned is that we could be forming a “falling wedge”, but it would need to break higher to kick that trade signal. As things stand right now, a breakout from the 250-point range is necessary before a bigger trade can be remotely close to being triggered anytime down the road.