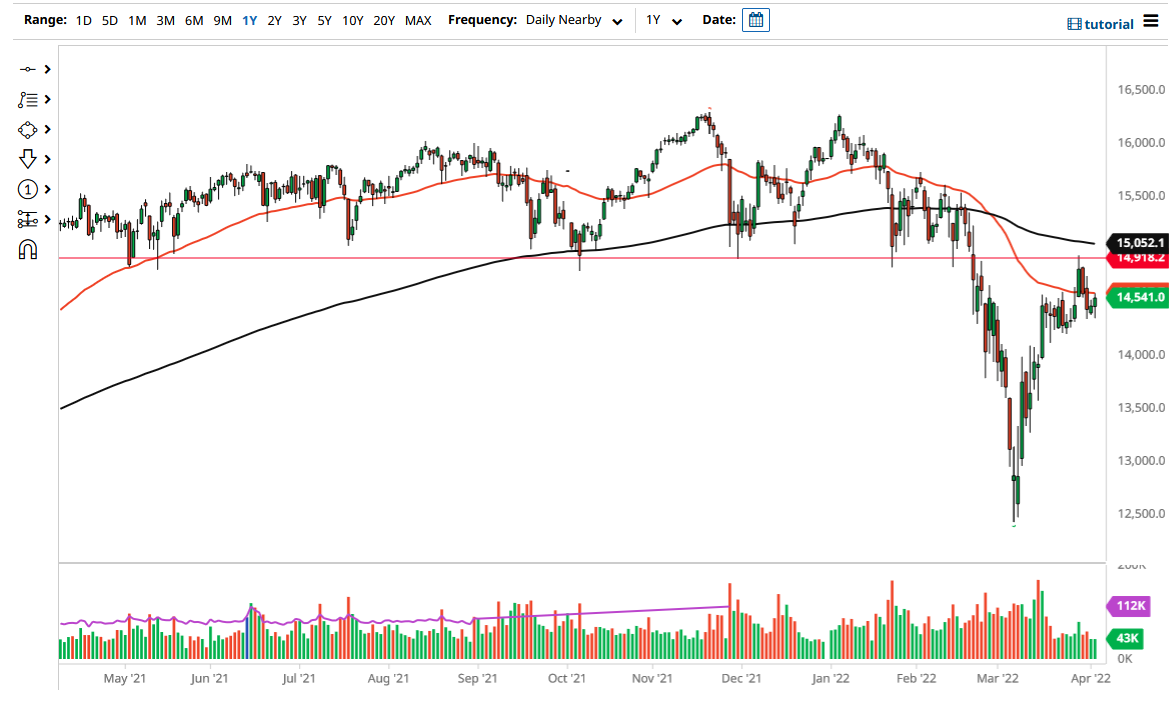

The German index initially fell a bit during the trading session on Monday, but then turned around to show signs of strength again. At this point, the market then approached the 50 Day EMA, before pulling back ever so slightly. The candlestick for the trading session is a bit of a hammer, but it does not necessarily mean that we have to go higher.

If we can break above the 50 Day EMA, then it is possible that we could go looking towards the 14,900 level after that. The market has been bullish for quite some time but recently has found a little bit of trouble. A lot of this is going to come down to the idea of whether or not we continue to see more “risk-on behavior”, or if we start to see traders run to safety assets going forward. If they do, it is very likely that the DAX, along with most other major indices, will start to fall.

That would send this market down to the 14,000 level, perhaps even the 13,500 level. Any rally at this point is more than likely going to be a selling opportunity as soon as we see any signs of exhaustion, unless of course, we break above the high that was made last week and perhaps even the 200 Day EMA which sits just above the 15,000 handle. Anything above there would be extraordinarily bullish, as it would complete a major “V bottom” that we have been forming.

The market will continue to be very noisy, as we have started to wonder whether or not a recession is a major threat in Germany, especially now that the Germans are refusing to pay the Russians in rubles for natural gas. That has had gas shut off heading into the country, so this will almost certainly cause issues for the German economy. This is a market that I think is starting to run out of momentum, but that does not necessarily mean that we cannot go sideways and then build up the necessary momentum. As you can see on the chart, we are essentially in the consolidation area around the 50 Day EMA, so it is possible that we see a bigger move sooner or later, but there is more likely than not resistance above that will be much more stringent than the support underneath.