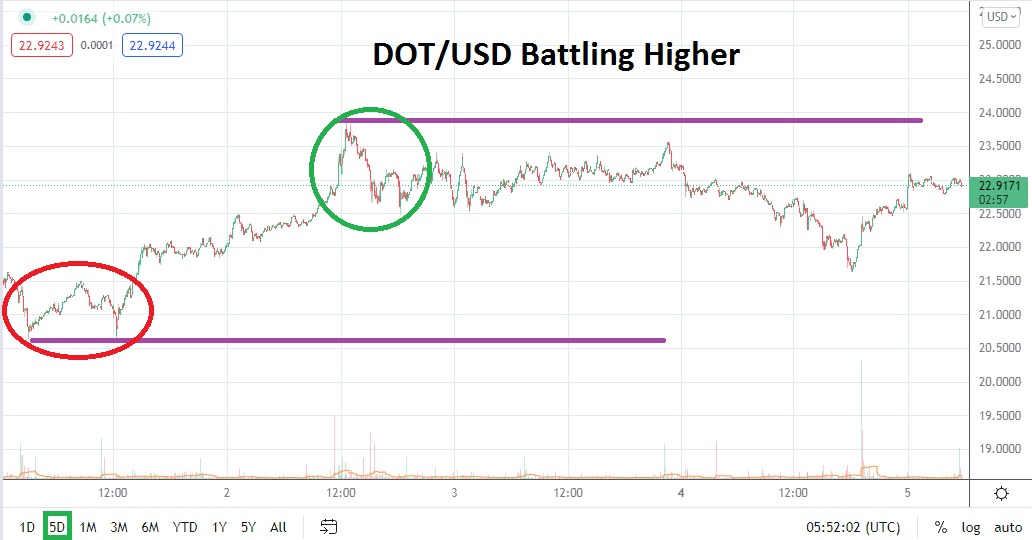

DOT/USD is trading below the 23.0000 juncture as of this writing, but its current value may attract the attention of optimistic speculators. After battling to a mid-term high on the 2nd of April when DOT/USD came within sight of the 23.8000 mark, the cryptocurrency then reversed lower, but again yesterday another attempt upwards was seen only to be pushed down again. However, in early morning trading Polkadot continues to incrementally gain and is within sight of important short term resistance.

The ability of DOT/USD to challenge the 23.8000 level a couple of days ago is intriguing, because it firmly put the cryptocurrency within touching distance of prices that have not been demonstrated since the middle of January. Since stumbling to a low near 13.7500 on the 24th of February, DOT/USD has incrementally been able to produce gains. While the high of nearly 55.5500 seen on the 4th of November 2021 may feel like miles away, price action produced the past month in DOT/USD has been positive.

The broad cryptocurrency market continues to show a change of sentiment may be underway. Yes, there are fresh memories of downward trends and the bearish trajectory to lows seen over the past six months should not be forgotten. However the recent ability of DOT/USD to march in step with the turnaround also being displayed by the major counterparts of Polkadot is enticing.

If DOT/USD can maintain its current stance which has shown strength as it battles in a price range slightly below values seen in the middle of January, this could be taken as a positive indicator. Conservative traders may want to wait for slight downturns in DOT/USD before igniting their long positions, but current price levels do look inviting and stop loss ratios can be constructed near rather close by support around the 22.5500 to 22.4500 levels. Leverage as always should be well defined and used cautiously.

DOT/USD is within sight of important resistance. If Polkadot can muster enough firepower to begin a real test of the 23.0000 juncture and surpass it and begin to touch the 23.25000 mark and sustain buying momentum, traders cannot be blamed for believing January values near the 24.0000 junctures up above are viable near term goals.

Polkadot Short Term Outlook:

Current Resistance: 23.2500

Current Support: 22.3900

High Target: 24.8000

Low Target: 21.5900