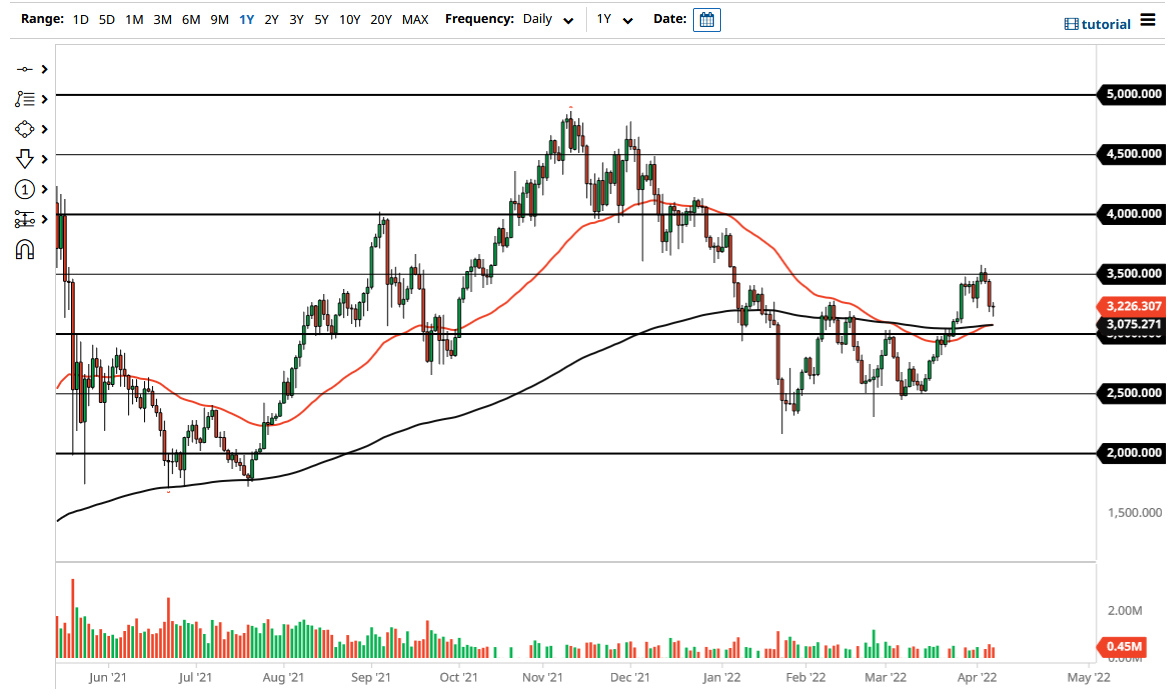

Ethereum has pulled back a bit during the trading session on Thursday but has found buyers by the end of the day to turn things around and form a bit of a hammer. By forming a hammer, this suggests that Ethereum is going to rally from here, perhaps trying to recapture the uptrend. Furthermore, the 50 Day EMA is reaching above the 200 Day EMA, forming a “golden cross.”

Looking at this chart, if we can break above the top of the hammer, one would anticipate that a move to the $3500 level would be possible. The $3500 level has been a significant resistance barrier recently, and it is of course a large, round, psychologically significant figure that will attract quite a bit of headline noise, and perhaps even institutional money. Breaking above that level then opens up the possibility of a move to the $4000 level, which has even more resistance built into it as that is where we had fallen from previously.

On the downside, if we were to break through the moving averages, that could have this market looking to take out the $3000 level underneath, which has been important multiple times. Giving that up would then open up a move down to the $2500 level which had been so significant in its support, as we had formed the “double bottom” at that level.

Keep in mind that Ethereum is also going through the process of validating the next move in blockchain technology, and as the merge continues, it is very bullish for Ethereum. As it works from proof of work to proof of stake, that will also add more users to the network, thereby driving up the value of a coin. More developers were jumping on to the Ethereum network these days, and that has been a bullish driver as well. As long as there is risk appetite out there, and an overall bullish sentiment when it comes to crypto, is very likely that Ethereum will do fairly well over the long term. This is not to say that there will be the occasional vicious pullback, but that is the nature of crypto in general.

In the short term, it looks like the buyers are trying to make a stand, so I am more bullish than bearish, and recognize that we may have a short-term blast higher just waiting to happen.