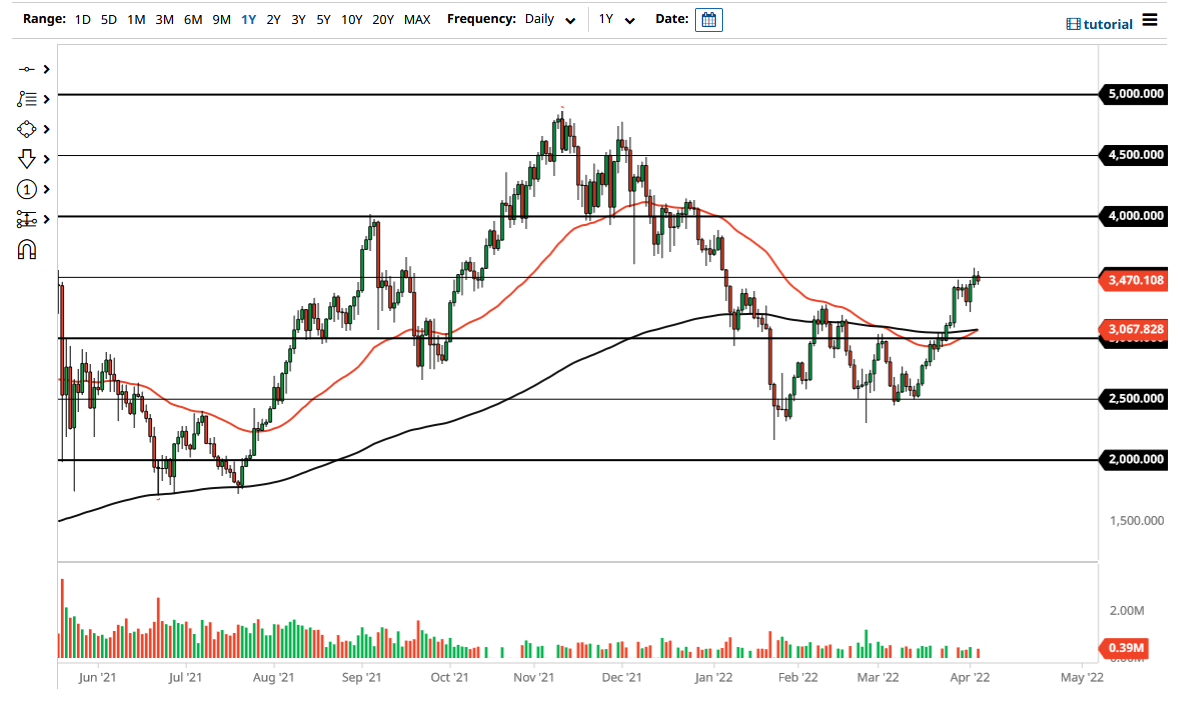

Ethereum went back and forth on Tuesday as we continue to struggle with the idea of the $3500 level. This is an area that has a certain amount of psychology attached to it, as well as previous market action. The fact that we continue to pierce this area is a good sign, as is the fact that the pullbacks have been very shallow over the last couple of days. Nonetheless, we have not broken out cleanly, so we need to wait and see whether or not we can get some type of follow-through.

Ethereum is a market that will have a major influence on several other coins, and it is worth noting that the 50-day EMA in Ethereum has started to rally a bit, and it is getting ready to cross above the 200 Day EMA, showing a potential “golden cross” in this market. If we do break above there, the market is likely to go much higher, perhaps reaching even higher levels such as $4000, maybe even the $4500 level. Furthermore, we have also broken out of a major W pattern, which has a measured move of $4500 or so as well.

We have recently seen the merge in the Ethereum blockchain start to make headway, and it is likely that we will continue to see adoption pick up, so Ethereum should rally. There is at least some type of fundamental news to drive Ethereum higher, unlike many other coins. That being said, as blockchain operations continue to expand, Ethereum should be one of the longer-term winners, and this is a bet on decentralized applications. That has not changed, even though we recently had a major pullback. Now that we are messing around with the $3500 level, I believe it is only a matter of time before we get an impulsive daily candlestick to see a continuation of the momentum and a market that could continue much higher.

On the downside, if we were to break down below the lows of last week, that could open up the possibility of a move to the $3000 level, but that seems to be a lot less likely based on the action that we have seen recently. The market has been very bullish over the last couple of months, and I have not seen that change.